Why HDB and private home prices are still projected to rise in 2021

“Crisis is opportunity”, we’ve heard time and again about Covid-19, the Global Financial Crisis, etc. For those eyeing the Singapore private property market, however, the saying over the past year has been “Where is the opportunity?”

Despite the pandemic, not many people can say that there have been a ton of discounts . Even the biggest known fire sale of 2020 – at 38 Jervois – had little to do with Covid-19; it was more about the Additional Buyers Stamp Duty (ABSD).

Recent news by analysts are going to disappoint opportunity-seekers even further. It may not be a “buyers’ market” in 2021 after all, with private home prices rising at their fastest pace since 2018 , and HDB resale prices at a nine-year peak . Here’s why the momentum might be continuing:

We have a full report on the past year in this earlier article . In addition, recent flash estimates by the URA (see above for links) suggest the property price index for Q4 2020 will see a 2.1 per cent rise.

This is the sharpest pick-up since Q2 2018, when prices had risen so high that the government imposed new cooling measures. Returning to these previous levels indicates how well the market has adapted to the new taxes.

Analysts predicted a rise of one to four per cent in private home prices this year, and two to five per cent for new launch projects.

At the same time, flash estimates for HDB resale flats suggest a rise of 2.9 per cent for Q4 2020 (the best quarter in close to a decade), and a total increase of 4.8 per cent for the entire year.

By contrast, resale flat prices had risen only 0.1 per cent the year before – and had been in steady decline for around seven years. Analysts have predicted prices to rise another two to five per cent by the time the year is out.

Why is it likely that prices will keep rising in 2021?

Government Land Sales (GLS) were reduced by almost a quarter , in the second half of 2020. The private home supply was at 1,775 units in 1H 2020 (three confirmed list sites), but just 1,370 units in H2 2020 (also three confirmed list sites).

As this was due to the Covid-19 situation, it was expected that 1H 2021 would make up for the reduction. However, the government instead continued to moderate the supply .

To date, the confirmed list only shows four private residential sites (and only one Executive Condominium site), which can yield about 1,605 new homes (excluding the EC site). This is not a substantial increase over what we saw last year.

Besides this, unsold inventory was around 26,600 in Q3 2020, and predicted to dip below 20,000 units by the end of Q1 this year – this is thanks to the unexpectedly strong sales despite Covid-19. For reference, the last en-bloc fever (2017) had its beginnings in mid-2016, when unsold inventory was at around 23,000+ units.

As such, developers may have to look outside of the limited GLS offerings this year; and they may have the confidence to do that, now that 2020 has proven the overall resilience of the property market.

Despite the Circuit Breaker, Singapore continues to rank as one of the safest-places in South East Asia – in fact the fourth safest in the world – when it comes to Covid-19.

On a regional basis, there are few alternatives for residential property investment right now. Hong Kong, the closest contender, is in a state of political turmoil, and also has its own version of stamp duties for foreigners.

Australia’s property market has fared almost as well throughout Covid-19; but restrictions on foreign buyers (e.g. a requirement to sell back to locals), plus political tensions with China, are likely to make Chinese investors focus more on Singapore and Hong Kong (and see above, about Hong Kong).

Note that even during the Circuit Breaker period, Marina One Residences saw around $20 million worth of sales, with Chinese buyers purchasing sight unseen. In May 2020, with pandemic controls at their height, Chinese buyers were still a main pillar of the luxury housing market.

This is likely to continue in 2021, as the situation is unchanged.

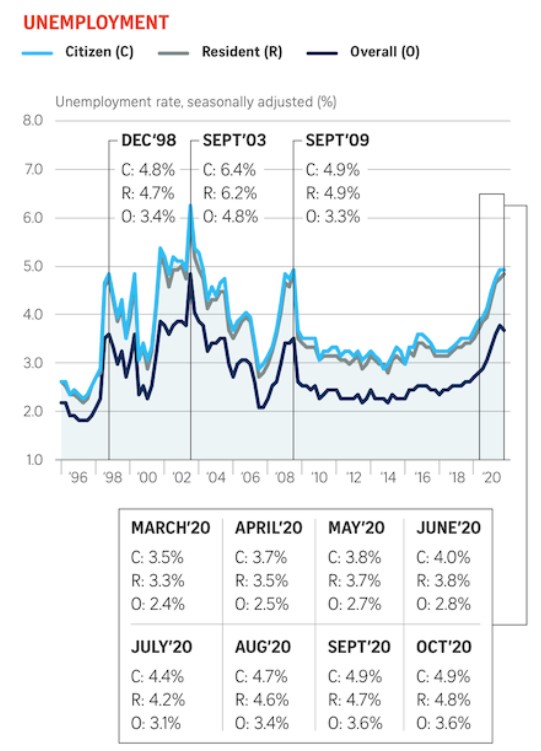

The spike in unemployment, up to 3.6 per cent , was a serious concern in 2020, as this reflects on our ability to service home loans; in Q3 unemployment was at the highest in 16 years .

But employment rates have reboundedAs of 2021, however, employment levels among Singaporeans and Permanent Residents have begun to rebound ; although full recovery is unlikely until 2022. This is likely to result to have two effects:

First, we could see sustained momentum in the HDB resale flat market, as those facing lower paying jobs, retrenchments, etc. downgrade from private to HDB flats, or opt for bigger resale flats instead of upgrading to a condo.

Second, we didn’t see many mortgagee sales or fire sales even in Q3 2020, when unemployment was at its peak; nor did we see big price drops for the whole of 2020. As the situation is now improving rather than getting worse, the idea of a buyer’s market with steep discounts is growing dimmer for 2021.

As we’ve mentioned before, there’s a huge bumper crop of resale flats reaching their Minimum Occupation Period (MOP). But besides that, you may have noticed something about BTO flat launches of late:

There have been a lot of launches in highly desirable mature areas, in 2020 and 2021. Chief among these are places like Bishan and Toa Payoh (Bidadari), where oversubscription is all but guaranteed.

The former means we could see a lot of very new, five-year old resale flats on the market; where lease decay is still a non-issue.

The latter means a lot of frustrated applicants, who may turn to resale offerings in the desired areas instead of waiting further (e.g. if you’ve balloted for Bidadari twice in a row and failed).

It certainly doesn’t help that Covid-19 raises the risk of construction delays – another factor that makes ready-to-move-in resale flats attractive.

Note that going into 2021, this is an issue that’s far from resolved: most construction supplies for our prefabricated housing come from abroad, so even if Singapore has the virus under control, suppliers abroad may still be shut down.

As such, it’s hard to disagree with forecasts of rising prices for resale flats, going into 2021.

What we said in 2020 continues to apply in 2021. The United States is committed to keeping interest rates near zero, to stimulate recovery.

This will continue to keep interest rates low for some home loans in Singapore as well; at present, rates as low as 1.3 per cent are possible. If you’re paying much more than this, do contact us so we can help you find a cheaper loan.

Low interest rates equate to better gains, better rental yields, and lower monthly repayments; all of which help to support the home prices (public and private, as you can opt to use a bank loan for HDB flats as well).

The US intends to keep rates low till 2022, but that means the rates are likely to stay long for many years after that as well.

Bear in mind the last time this happened was around 2009; and the interest rate still hadn’t normalised by the time Covid-19 came around. HDB loans have now been more expensive than bank home loans for around 11 years.

We have a longer explanation of this in an earlier article, where we pointed out that resale condos may be in the spotlight for 2021.

The lower number of new launches could slow the pace of rising prices; this is because new launches are always priced higher than existing condos, and have a knock-on effect, raising prices of surrounding resale properties.

As such, a large number of new launches in a given year may see substantial price rises – such as in 2019 and 2020.

However, the lower number of new launches could be more than compensated for, if we see new en-bloc stirrings and resale demand. Overall, it doesn’t look like sellers are flinching despite Covid-19.

If anything, 2021 is shaping up to be even less of a buyers’ market than last year. Great if you own a home right now, but disappointing if you’ve been taking the “wait and see” approach.

This article was first published in Stackedhomes.