Why the Singapore property market will be different in 2026 - and it's not just about prices

As we write this article on the first day of the new year, 2026 is shaping up to not look exciting for Singapore's property market. At this point, I think most of you will consider that a definite upside.

After the steep uptick in property prices during the post-Covid-19 pandemic recovery, a re-alignment in purchasing priority among some buyers from $PSF to absolute prices, and an uncharacteristic "why is everything in the Core Central Region (CCR)" trend, things may be finally going back to normal. Or at least, a semblance of normalcy, as some of the changes we saw in 2025 are likely here to stay.

As an upside, there's even more completed properties entering the market and interest rates look set to moderate this year too, so buyers may finally catch the break they need. Here's a rundown of the trends to expect:

There was a larger than normal proportion of new launches in the CCR in 2025, which accounted for close to a quarter (about 23 per cent) of new projects last year. This year, we're seeing a return to the heartlands.

An estimated 65 per cent of new launches this year will be in the Outside Central Region (OCR). Some of the locations that will see new launches will include Tengah (we'll see the first private condo for this area at Tengah Garden Avenue), Tampines, and Bayshore. Narra Residences, at Dairy Farm Walk in District 23, is also one of these launches and we'll be reviewing it shortly.

For more details, you can also check out this list of 10 known sites for the first half of 2026.

For the primary market, this pivot back to the OCR will be important for two reasons. While most assume it's an issue of cost, this isn't entirely the case. While the average $PSF rose significantly in 2024/25, developers tried to keep the overall quantum within the affordable budget of most upgraders:

Volume by market segment in 2024 vs 2025 (non-landed homes excluding EC)

| 2024 | 2025 | |||||

| Region | New Sale | Resale | Sub Sale | New Sale | Resale | Sub Sale |

| CCR | 377 | 2291 | 50 | 200 | 657 | 30 |

| OCR | 3199 | 6209 | 756 | 4320 | 6002 | 405 |

| RCR | 2664 | 3868 | 476 | 6091 | 5402 | 452 |

Data from URA as of 28 Dec 28, 2025

Price movement by region (average $PSF) – non-landed homes excluding EC

| 2024 | 2025 | |||||

| Region | New Sale | Resale | Sub Sale | New Sale | Resale | Sub Sale |

| CCR | $3,111 | $2,192 | $2,846 | $2,883 | $2,120 | $2,973 |

| OCR | $2,246 | $1,460 | $1,871 | $2,263 | $1,532 | $1,965 |

| RCR | $2,645 | $1,820 | $2,205 | $2,867 | $2,011 | $2,356 |

Data from URA as of 28 Dec 2025

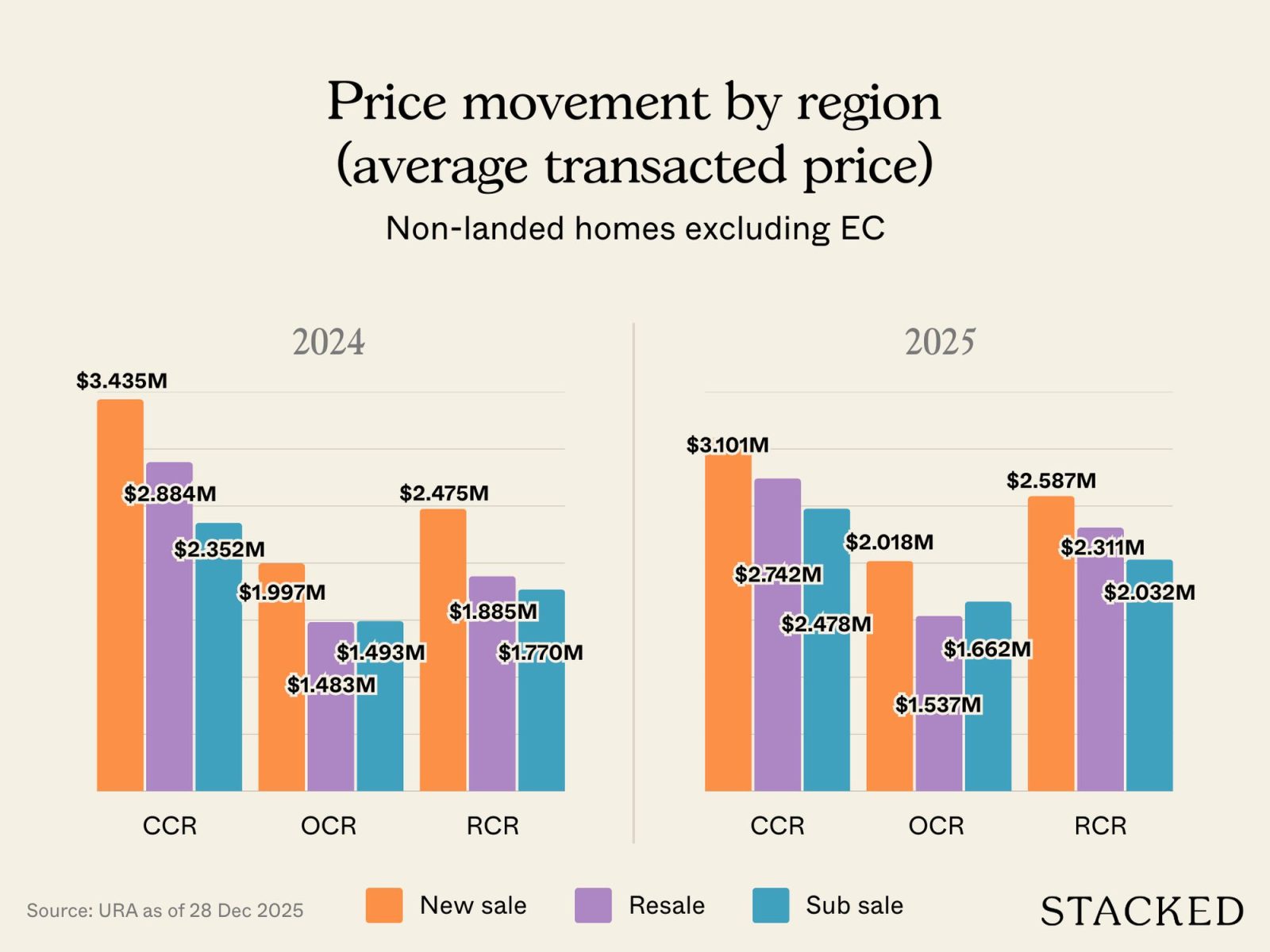

Price movement by region (average transacted price) – non-landed homes excluding EC

| 2024 | 2025 | |||||

| Region | New Sale | Resale | Sub Sale | New Sale | Resale | Sub Sale |

| CCR | $3,435,178 | $2,884,646 | $2,352,293 | $3,101,137 | $2,742,292 | $2,478,452 |

| OCR | $1,997,824 | $1,483,195 | $1,493,226 | $2,018,931 | $1,537,162 | $1,662,537 |

| RCR | $2,475,892 | $1,885,941 | $1,770,085 | $2,587,569 | $2,311,380 | $2,032,230 |

Data from URA as of 28 Dec 2025

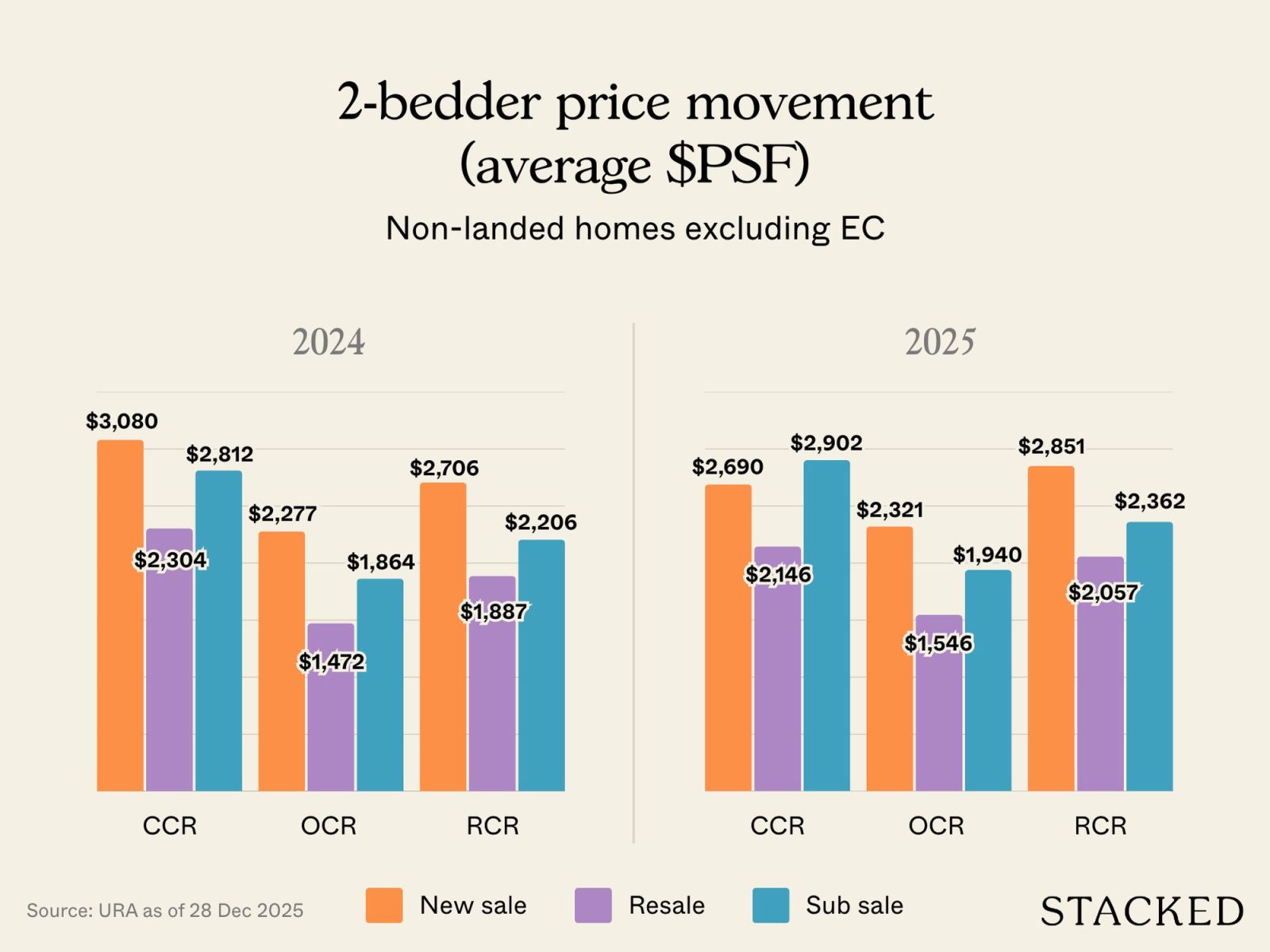

2-bedder price movement (average $PSF) – non-landed homes excluding EC

| 2024 | 2025 | |||||

| Region | New Sale | Resale | Sub Sale | New Sale | Resale | Sub Sale |

| CCR | $3,080 | $2,304 | $2,812 | $2,690 | $2,146 | $2,902 |

| OCR | $2,277 | $1,472 | $1,864 | $2,321 | $1,546 | $1,940 |

| RCR | $2,706 | $1,887 | $2,206 | $2,851 | $2,057 | $2,362 |

Data from URA as of 28 Dec 2025

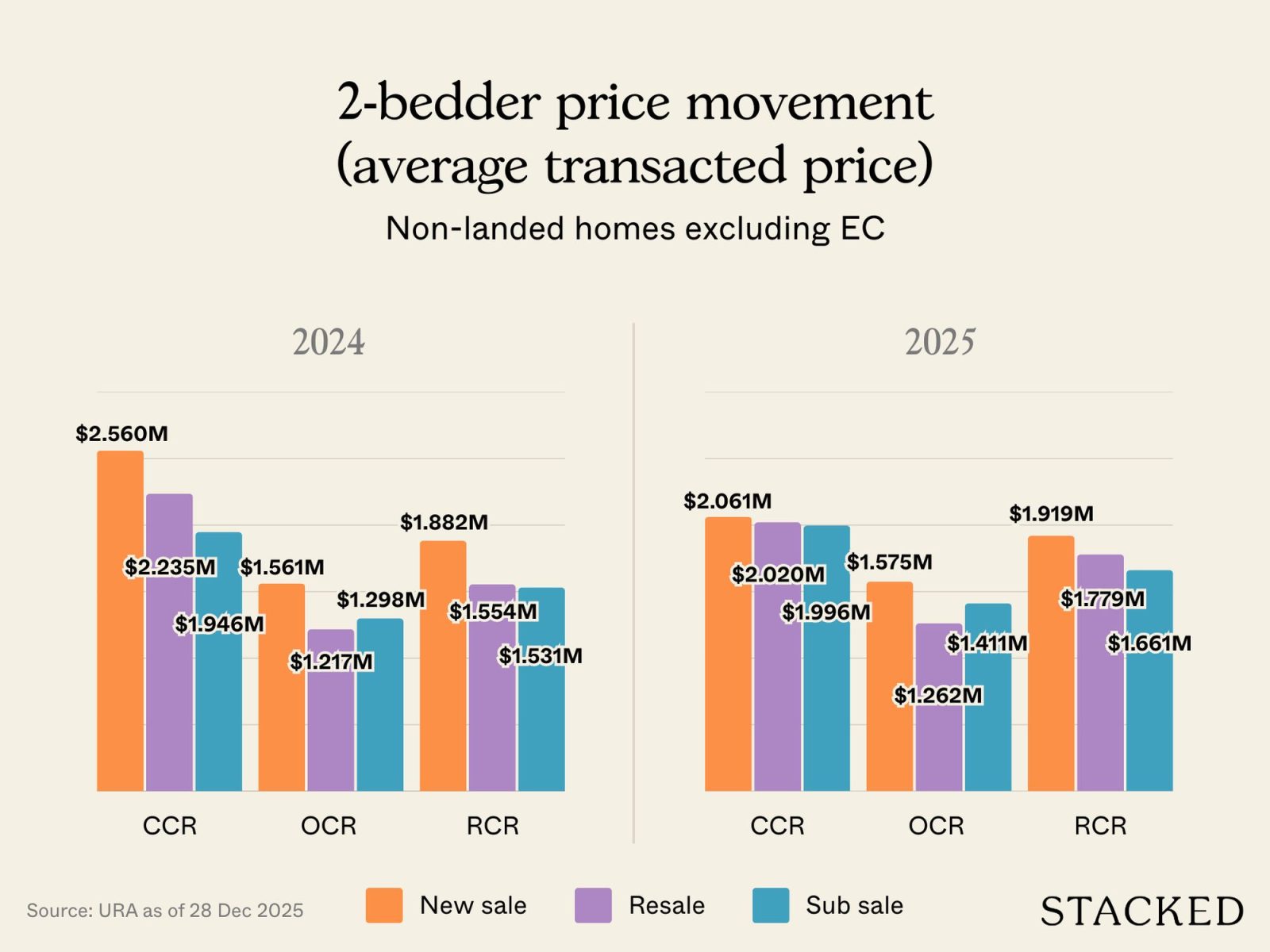

2-bedder price movement (average transacted price) – non-landed homes excluding EC

| 2024 | 2025 | |||||

| Region | New Sale | Resale | Sub Sale | New Sale | Resale | Sub Sale |

| CCR | $2,560,119 | $2,235,794 | $1,946,991 | $2,061,957 | $2,020,668 | $1,996,231 |

| OCR | $1,561,761 | $1,217,082 | $1,298,906 | $1,575,101 | $1,262,202 | $1,411,862 |

| RCR | $1,882,747 | $1,554,848 | $1,531,227 | $1,919,641 | $1,779,695 | $1,661,449 |

Data from URA as of 28 Dec 2025

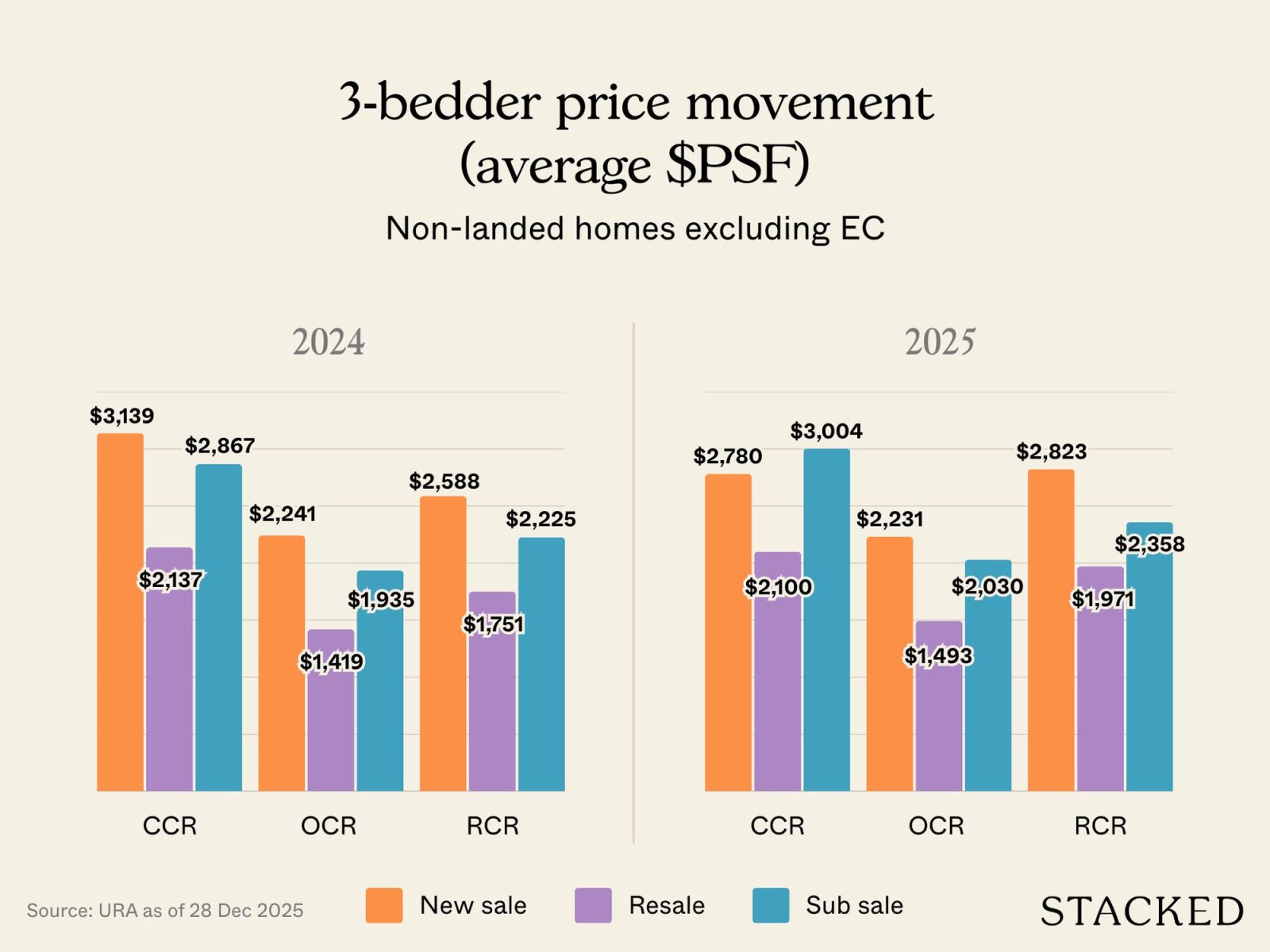

3-bedder price movement (average $PSF) – non-landed homes excluding EC

| 2024 | 2025 | |||||

| Region | New Sale | Resale | Sub Sale | New Sale | Resale | Sub Sale |

| CCR | $3,139 | $2,137 | $2,867 | $2,780 | $2,100 | $3,004 |

| OCR | $2,241 | $1,419 | $1,935 | $2,231 | $1,493 | $2,030 |

| RCR | $2,588 | $1,751 | $2,225 | $2,823 | $1,971 | $2,358 |

Data from URA as of 28 Dec 2025

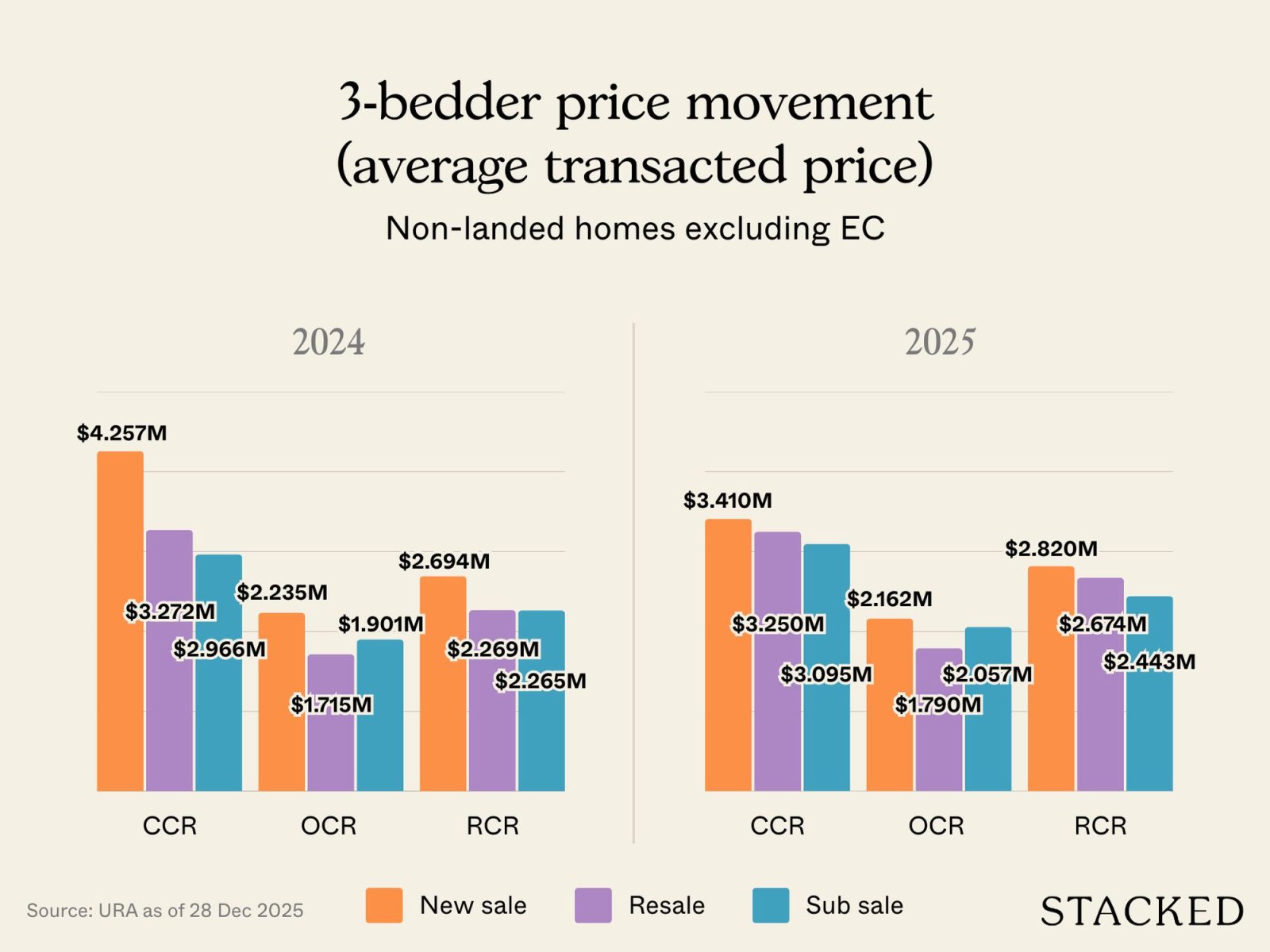

3-bedder price movement (average transacted price) – non-landed homes excluding EC

| 2024 | 2025 | |||||

| Region | New Sale | Resale | Sub Sale | New Sale | Resale | Sub Sale |

| CCR | $4,257,826 | $3,272,562 | $2,966,538 | $3,410,334 | $3,250,620 | $3,095,808 |

| OCR | $2,235,108 | $1,715,893 | $1,901,291 | $2,162,495 | $1,790,867 | $2,057,764 |

| RCR | $2,694,105 | $2,269,114 | $2,265,425 | $2,820,386 | $2,674,180 | $2,443,437 |

Data from URA as of 28 Dec 2025

Even so, the practical realities of rising land costs mean that the "sweet spot" for upgraders — around $1.8 million to $2 million — tended to result in two-bedders or compact three-bedders (e.g., 2+Study units) being the only real options for some buyers.

With a pivot back to the OCR however, there's a greater chance of finding family-sized three-bedders at the same price range. Back in 2025, for instance, we saw that Canberra Crescent Residences in Sembawang (District 27) managed to keep three-bedders in the price range of $1.6 million to $1.9 million. We also saw that the pricing strategy of Springleaf Residence (District 26) kept close to the affordability sweet spot: around $1.9 million to $2.1 million for a three-bedder unit.

Assuming OCR projects in 2026 don't depart too far from this price range, "true" family-sized units are a greater possibility.

The second reason is that CCR locations don't appeal to every homebuyer

The definition of having enough amenities can differ among various buyer profiles, from singles and young couples, versus families. The CCR, for all its retail and entertainment splendour, often lacks the green spaces and high density of schools that families prioritise.

We have, for instance, pointed out the issue with a prime area like Marina Bay. As iconic as it is, it's more prestigious than family-oriented. There are simply less people who would visualise growing up in Marina Bay, have their parents staying there, or have any kind of grassroots connection to the place. Perhaps the only real CCR location that can also claim a "heartland vibe" may be Great World.

The government is actively transforming the CCR to turn them into more holistic neighbourhoods (i.e., not just offices and high-end malls). But until that day comes, the focus on the heartlands will probably be a relief to homebuyers.

Overall, we expect less excitement over novelties and luxury facilities, and a return to basics, like an interest in lower maintenance fees, whether there's a sheltered walk to the MRT, whether the side-gate makes sense.

Skyrocketing prices and lack of availability characterised the post-Covid-19 pandemic recovery period in 2022/23. However, it has slowed down over the intervening years and we may finally have reached the balance point between supply and demand.

As highlighted in our 2025 year-end review, private home completions are expected to rise from around 5,200 units in 2025 to approximately 7,000 units in 2026. Many projects that were launched during the post-pandemic surge are now reaching TOP.

At the same time, the number of new launches is set to dip next year, from 26 projects in 2025 to just 17 in 2026. Total new supply is also expected to drop by nearly 30 per cent, from about 11,400 units to roughly 8,100 units.

So in effect, fewer new projects are being launched, while more homes are actually being completed. Buyers who need to move in sooner will have a bigger range of options, and the increase in completed stock could soak up some demand from new launches (depending on how many buyers then decide to switch to resale instead)

This is also going to help moderate the pace at which prices rise. Unlike 2022/23, home buyers won't feel intense pressure to buy right now before prices go out of reach. We expect more gradual wait-and-negotiate attitudes to be the norm.

As an aside, this may also result in a softening rental market, as those who were awaiting the completion of their homes move in.

For buyers priced out of the private market, this provides an important rung on the ladder that 2025 lacked. Last year, we saw only two ECs: Aurelle of Tampines, and Otto Place. Both these ECs had family-sized three-bedders in the $1.4 million to $1.5 million range, which in reference to point 1, makes them far more affordable than fully private launches.

For 2026, we have at least five ECs, of which you can see the sites here. Coastal Cabana will be the first EC launch of 2026 in January, while Rivelle is likely to follow. We would expect these ECs to be among the first choices for upgraders on a budget.

It's almost inevitable that the ECs will sell out fast, as only Coastal Cabana is notably large at around 748 units. Other launch-ready ECs this year are expected to be mid-sized or relatively smaller such as the upcoming EC project at Senja Close which could comprise 295 units.

We expect a lot of excitement about EC launches this year, and buyers who need an EC should be looking over their financing options now.

As of December 2025, home loan rates were at a three-year low*. At the time of writing, it's possible to find sub-two per cent home loans, and this could substantially lower monthly loan repayments. This could encourage more confidence in the market, but with a caveat: a floor rate of four per cent still applies for the purposes of the Total Debt Servicing Ratio (TDSR).

For example: A loan of $1.5 million over a 25-year loan tenure, a 1.8 per cent interest loan means the borrower would pay about $6,200+ per month. However, the lender has to use the floor rate of four per cent; so for the purposes of TDSR calculations, the estimated monthly repayment rate is close to $8,000 per month.

Under the TDSR, your monthly home loan repayment — inclusive of other debts like car loans, personal loans, etc. — cannot exceed 55 per cent of your combined monthly incomes.

As such, the interest rate drop has made properties more affordable but it doesn't necessarily make financing easier to get. There may be a chance, however, that MAS will reduce the floor rate in light of the lower actual interest rates.

We expect a lot more consultations with mortgage brokers over this, and perhaps a bit of complaining. But that will be accompanied by increasing confidence in affordability.

*This is relevant to SORA-based home loans. Home loans that are based on the bank's internal board rate may not be affected.

Simply put: the market is moving towards what most observers would characterise as normalcy. And by that, we mean many buyers are going to see 2026 as a great year, because after the last few years, everyone could do with a little less excitement.

(Except maybe over more ECs.)

Supply is improving, urgency is easing, and buyers finally have breathing room. Perhaps most importantly, the days of "just get something first" behaviour are fading.

[[nid:726941]]

This article was first published in Stackedhomes.