Why you should top up $1 to your Supplementary Retirement Scheme (SRS) account today

You’ve probably read or heard this piece of advice many times in the SeedlyCommunity or among your savvier circle of friends.

“Top up $1 to your Supplementary Retirement Scheme (SRS) account to lock-in your retirement age!”

Wondering why you should do that?

I promise that when you get to the end of this article, you will understand what this is all about (hint: it’s to do with retirement planning and taxes).

And I’ll even show you a step-by-step guide on how to make a top-up to your SRS account .

Whether you’re a fresh grad who just entered the workforce.

Or a seasoned professional who’s been working for a while.

You’ll eventually start earning more and might want to look for ways to reduce your taxable income .

One of the ways which you can do so is via the Supplementary Retirement Scheme (SRS) which allows you to save for retirement.

While reducing your taxable income by $15,300 every year.

Best of all, if you choose to invest your SRS monies, the investment returns are accumulated tax-free.

The SRS tax relief is also more than what you get if you performed CPF Special Account (CPF SA) top-ups.

If you’ve already maxed out your CPF SA top-ups, you might want to consider SRS top-ups too.

Since government policies are updated so often…

Who knows when the government will eventually decide to raise the statutory retirement age from 62 years old to higher?

One workaround is to open an SRS account and deposit $1 to “lock-in” your retirement age first.

Note: don’t put more than that if you’re not really sure how you will use your SRS account to help you in retirement planning yet

Why?

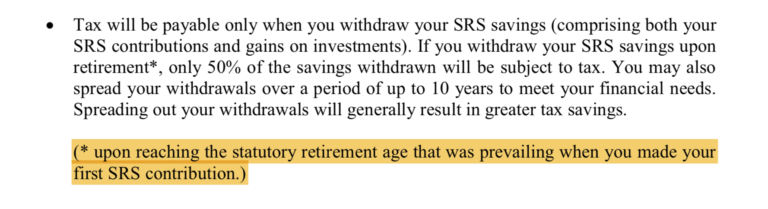

Well… it’s all thanks to this particular paragraph which I found in a 29-page PDF put up by the Ministry of Finance:

Interested?

You can make use of these SRS Account Opening Promotions for 2020:

SRS Account opening promo 2020 |

New SRS Account Opening Promo | Gift | Invest with new SRS account promo | Additional gift | Valid till |

|---|---|---|---|---|---|

| DBS/POSB SRS Promo | Open new SRS Account via digibank (online) & contribute min $10,000

|

$50 cash gift | Purchase Unit Trusts and/or Insurance with new SRS Account funds via digibank or at any DBS/POSB Branch

|

$30 cash gift ($1,000 to $5,000) |

Dec 6, 2020 |

| $40 cash gift ($5,001 to $10,000) |

|||||

| $50 cash gift (more than $10,000) |

|||||

| OCBC SRS Promo | Open new SRS Account & contribute min $10,000 within 7 days of account opening

|

$50 FairPrice e-voucher | - | Dec 31, 2020 | |

| UOB SRS Promo | Not announced yet (hopefully), will update if they do release details | ||||

The Supplementary Retirement Scheme was started in 2001 and is part of the Singapore government’s multi-pronged strategy to address the financial needs of a greying population.

It’s basically a way to help Singaporeans to save more for their old age.

Over and on top of their Central Provident Fund (CPF) monies, of course.

Think of the SRS as an extra savings and investment account for retirement planning.

It is a purely voluntary scheme, unlike our CPF, where you can contribute any amount subject to a cap of $15,300 yearly.

You can choose to open your SRS account with any of the following banks in the private sector: DBS, OCBC, or UOB.

Where you will earn the standard 0.05 per cent p.a. return as you would with a regular bank savings account.

But if you want to, you can also use your SRS monies to invest in various financial instruments and products to increase your returns.

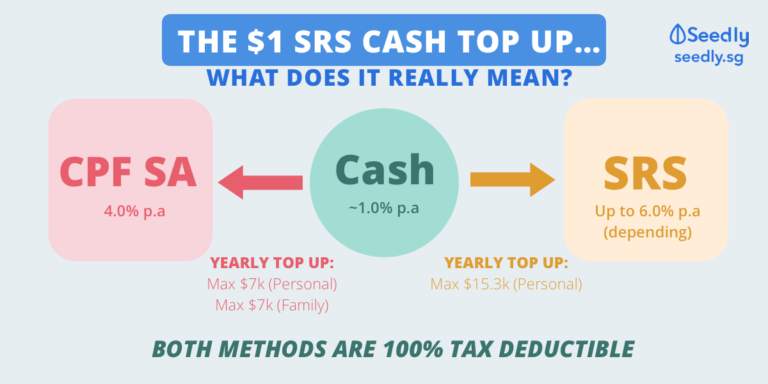

When it comes to retirement planning and tax savings, a lot of people are confused between topping up their SRS Account vs. their CPF SA.

To give you a better overview of what’s the difference and what’re the potential returns you can get, I’ve created a comparison table.

FYI: I’ve also included holding onto cash in your bank savings account as a point of reference too.

| SRS vs. CPF vs. Cash | Supplementary Retirement Scheme (SRS) | CPF Special Account (CPF SA) |

Cash (Savings Account) |

|---|---|---|---|

| Interest Rate | 0.05 per cent p.a. Note: returns can be higher depending on what you choose to invest in |

4 to 5 per cent p.a. | 0.05 to 2 per cent p.a. |

| Yearly Contribution Cap | $15,300 (Personal) |

$7,000 (Personal) $7,000 (Family member) |

No |

| Tax Deductible? | Yes | Yes | No |

| Withdrawal Conditions | At 62 years old (retirement age) Note: if withdraw before, subject to 5per cent fee |

At 65 years old (default) At 55 years old (if you have met Basic Retirement Sum) |

Anytime |

| How To Start | Open with DBS, OCBC, or UOB | Automatically enrolled for Citizens or PR | Open with any bank |

Regardless of what you do, don’t just leave your money in your regular bank savings account which only gives you a paltry 0.05per cent p.a.

At least put it into a high-interest savings account while you figure out if you want to do an SRS or CPF SA top-up.

Now that you have an overview, here’s a more in-depth look at the 3 various options I’ve presented to you.

It’s really simple.

I did it in less than 5 minutes via DBS/POSB’s digibank platform.

Disclaimer: we’re not sponsored, I just decided to open my SRS account with DBS since I have most of my money with them

Just follow the instructions and you should get it opened almost immediately.

Topping up your SRS account is almost like you’re transferring money from one savings account to another.

It’s really that easy!

And that’s it!

If you’re convinced that an SRS account is useful for your retirement planning and you want to lower your taxes.

Here are some SRS account opening promotions for new SRS account holders (sorry, existing SRS account holders):

SRS Account Opening Promo 2020 |

New SRS Account Opening Promo | Gift | Invest With New SRS Account Promo | Additional Gift | Valid Till |

|---|---|---|---|---|---|

| DBS/POSB SRS Promo | Open new SRS Account via digibank (online) & contribute min $10,000

|

$50 cash gift | Purchase Unit Trusts and/or Insurance with new SRS Account funds via digibank or at any DBS/POSB Branch

|

$30 cash gift ($1,000 to $5,000) |

Dec 6, 2020 |

| $40 cash gift ($5,001 to $10,000) |

|||||

| $50 cash gift (more than $10,000) |

|||||

| OCBC SRS Promo | Open new SRS Account & contribute min $10,000 within 7 days of account opening

|

$50 FairPrice e-voucher | - | Dec 31, 2020 | |

| UOB SRS Promo | Not announced yet (hopefully), will update if they do release details | ||||

So there you have it!

I hope this helps you to think about how an SRS account can help in your retirement planning.

While lowering your taxes!

This article was first published in Seedly