Will the stock market crash again with a second wave of Covid-19 outbreaks?

As countries are opening up after months of Covid-19 lockdown, cases of infection started to rise again. As of 22 July 2020, there are 15 million cases as compared to 7.5 million one month ago.

This wave of infection is worsened by the carefree attitudes of many people in the US and UK partying in crowded bars and beaches. It is a foregone conclusion that a second wave of infection will hit many parts of the world.

Many investors are worried that the second wave of infection could crash the stock market severely. Many of us would have frightening flashbacks of news footages of congested hospitals, overloaded ICUs, and countless body bags and coffins.

Governments could be forced to lockdown economies again, which have painful economic consequences from increased unemployment and bankruptcy of companies.

In May 2019, Loo had successfully predicted the market crash of 2020, and one year later, in May 2020, Loo again predicted the recent stock market bull run . We believed that as investors, we should not panic and be overly worried about the stock market impact of the current wave of Covid-19. Here are our reasons.

The Covid-19 lockdowns across the world between March to June 2020 had hit many communities and businesses badly.

Since then, many businesses have implemented business continuity measures to work around the virus. To name a few, employees are required to wear masks in working environments, close contact and handshakes are avoided, and companies have found new ways to sell to customers.

Business transformation from offline to online means has been rapid. Business and social activities are now replaced by online meetings on social platforms such as Zoom, Google Hangouts, Microsoft Teams and even Facebook and Instagram Live.

Thus, even if the world is hit with a second wave of infection, the majority of businesses have already found ways to survive, thus the impact would be less severe impact to the economy and stock market.

There is now a global race for a Covid-19 vaccine and at least 22 pharmaceutical companies are now conducting clinical trials. I am in the opinion that the vaccine will be developed soon for two main reasons.

[[nid:495490]]

National Pride: It is a matter of national pride among the big three countries, namely United States, United Kingdom and China, to first develop the vaccine. Large amounts of public and private funds have been channeled into vaccine development.

Governments have even eliminated regulatory hurdles to facilitate the speedy development of the vaccine. This has greatly increased the chances of a successful vaccine sooner rather than later.

US biotech firm Moderna and British-Swedish Pharmaceutical form AstraZeneca are inching very close to successfully completing the final phase of human trials for their vaccine.

Huge Monetary Rewards: Huge monetary rewards awaits the successful vaccine developer. With just the news of their vaccine entering into human trials, share prices of Moderna, Gilead Sciences, Sinovac Biotech, AstraZeneca and AbbVie have all shot up significantly.

For instance, in February 2020, the stock price of Moderna averaged at USD $20 (S$28) and has shot up to hit USD $81 as of July 23, 2020. The prospect of massive monetary reward will likely speed up the discovery of a vaccine and diminish the likelihood of a stock market taking a pounding from a second wave of outbreaks.

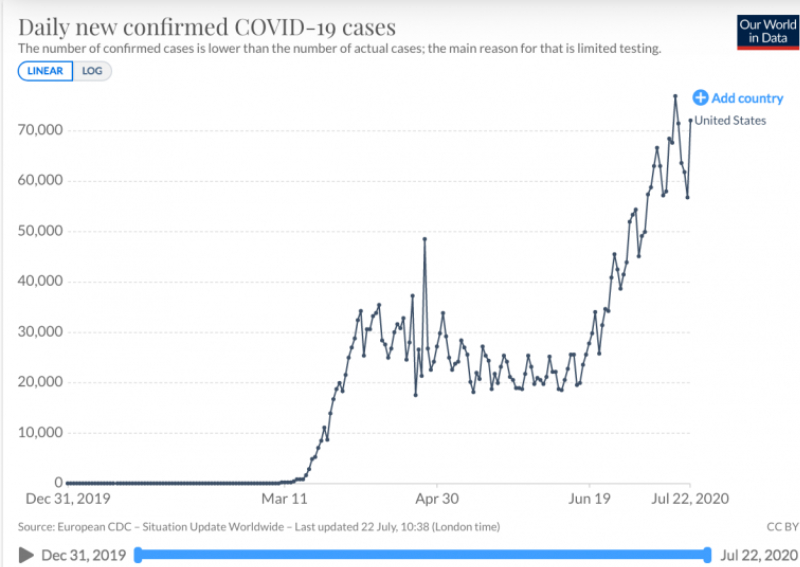

Just a quick glance at these graphs dated July 22 will give you a clear picture. From the first graph, you can see that daily infection count in the US declined marginally during the lockdown period of April 2020 to June 2020, but with the lifting of the lockdown, the infection count spiked up again. In short, infection in the United States has always been high, and is climbing higher by the day.

Despite the increasing daily infection count, the Covid-19 daily death count in the US has been declining significantly and distinctly. While there could be a lag effect, and it is possible the death count will rise again, there is a clear trend of falling mortality rates and these are the likely reasons.

[[nid:494512]]

Better medical know-how in treating Covid-19 patients: In the early phase of the global outbreak, the mortality rate was very high as medical institutions and doctors were unfamiliar with the right treatment options and vaccines.

This was worsened by a global shortage of personal protection equipment (PPE), face masks, and ventilators, as well as inadequate care facilities. Fortunately, most clinics and hospitals are now better equipped and more familiar with handling Covid-19 patients, allowing them to administer faster and more effective treatment.

Better Covid-19 treatment drugs: Through trial and error, the medical world has identified a number of drugs proven to be effective in treating the virus – such as Dexamethasone and Remdesivir. All these drugs are a few of an increasing number which have been found to be effective in treating severely ill Covid-19 patients and reducing its mortality rate.

Elderly and people at risk are more careful in avoiding the virus: It is widely-known that Covid-19 is more lethal to the elderly and those with weak immune systems.

With this knowledge, these vulnerable groups have been more careful to avoid the virus, by staying at home and avoiding crowds, which also explains the decreasing mortality rate. As long as infections involve largely the young and healthy segments of the population, there would be a lower mortality rate and a lesser impact to stock markets negatively.

Death and infection, while scary, do not hurt economies and faze the stock market as badly as government-imposed country-wide lockdowns, with most economic activities are forced to a standstill.

[[nid:495329]]

By now, most governments are aware that a total lockdown is ineffectual in completely wiping out the virus. Lockdowns have proven only to contain infection levels temporarily. Many countries across the world now are reeling from wide-spread infection again since the lifting of their lockdowns.

Moreover, lockdowns are extremely costly to governments, economies and employment. The US lockdowns have cost the Federal Reserve and the US government trillions of dollars and resulted in unemployment hitting a high of 14.4 per cent in April 2020.

In Singapore, almost $100 Billion had to be committed to help Singaporeans and businesses cope with the impact of Circuit Breaker and beyond.

Hence, even as we hear news of cities implementing partial lockdowns as the infection pick up again, governments would be very reluctant to implement full-scale lockdowns again given their sheer cost and futility. President Trump had outrightly declared that he will not close the country even if a second wave of infection were to occur.

Thus, I believe that stock markets are unlikely to suffer from a similarly drastic crash like what we saw in March 2020.

Finally, we have seen the power and resolve of the US Federal Reserve and the US government to cushion the impact of the Covid-19, and they will continue to “mother-hen” the US economy in the midst of this second wave of outbreak.

Given the scale and trauma towards Covid-19, we should not be surprised at spurious volatility in global stock markets, in the short- to mid-term.

However, I believe that this second wave of Covid-19 outbreak is unlikely to result in a massive March 2020-type of stock market crash again.

This article was first published in Dollar and Sense.