Best credits cards for your grocery runs in Singapore

Now that we should only be leaving our homes to get the essentials.

The weekly grocery run has become a luxury that allows me and the wife to stretch our legs and breathe some fresh air (from behind our masks).

And while I haven't had that much time to do grocery shopping or cooking before.

I now find that I've got plenty of time on my hands to do both.

And if you know me…

Then you know that I would have taken some time to figure out what're the best grocery credit cards to use.

And by best, I mean those that give us cashback or rebates.

You're welcome.

For this comparison, I'll be looking at the more popular supermarket chains like Cold Storage, Giant, NTUC, and Sheng Shiong.

| Supermarket Chain | Best Cashback Credit Card for Groceries | How Much Cashback? |

|---|---|---|

| All Supermarkets | Citibank Cash Back Card | 8% |

| Maybank Family and Friends Card | 8% | |

| DBS Live Fresh Card | 5% | |

| HSBC Visa Platinum Credit Card | 5% | |

| Cold Storage | UOB Delight Card | 8% |

| Giant | UOB Delight Card | 8% |

| Citibank SMRT Card | 5% | |

| NTUC Fairprice | OCBC Plus! Visa Credit Card | 7% (12% for NTUC Union members) |

| Citibank SMRT Card | 5% | |

| Sheng Shiong | BOC Sheng Shiong Card | 6% (12% if you spend $600 outside of Sheng Shiong) |

| POSB Everyday Card (5%) | 5% |

There're so many credit cards in the market right now.

So how do you choose the best one for grocery shopping?

It's a no-brainer, really.

[[nid:485699]]

If you find yourself heading to the NTUC Fairprice on your way back from work because it's right next to the MRT station or bus stop you get off at.

Then it's only logical to get a credit card that allows you to get the most cashback or rebates from NTUC Fairprice.

Even if Sheng Shiong or Giant has the best deals, you wouldn't want to take a 20-minute detour after work JUST to go get groceries right…

Unless, like me, you find yourself in an area that has almost all the options available within walking distance.

But even then, you'll probably just want to stick with one go-to supermarket because it doesn't make sense to get bread from Sheng Shiong and then walk over to Giant for peanut butter because it's cheaper.

Some credit cards need you to meet a minimum monthly spend in order to enjoy the cashback or rebate.

So if you have a sense of how much you spend a month, including groceries.

You'll be able to make sure that you can qualify for the maximum amount of rebate which you should be getting with our card.

On the same note, you'll want to find a credit card that gives you a rebate on other monthly expenses like transport, dining, and petrol.

Some cards also offer additional or tier-ed rebates if you can meet more than one category of spending.

Want to stretch your dollar?

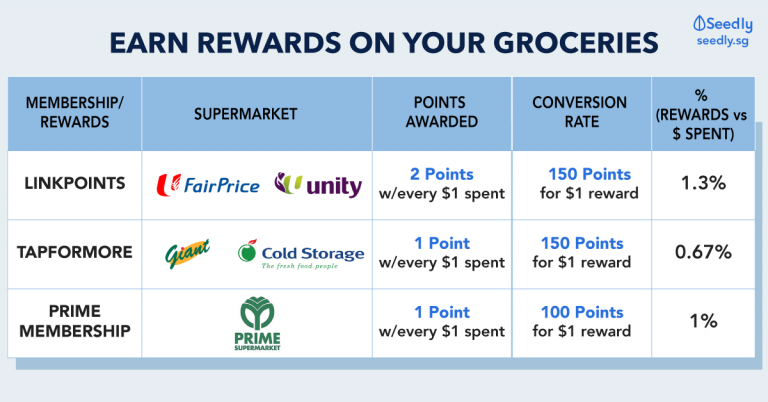

Then you might want to consider pairing your grocery credit card with your go-to supermarket's rewards programme like NTUC Plus! LinkPoints and PAssion Card TapForMore points.

| Membership and rewards programme | Applicable for which supermarket? | How are Points awarded? | Conversion rate of rewards | Percentage of rewards to amount spent |

|---|---|---|---|---|

| NTUC LinkPoints | NTUC FairPrice, Unity Pharmacy | 2 LinkPoints for every $1 spent | 150 Points for $1 worth of rewards | 1.3% |

| TapForMore (PAssion Card) |

Giants, Cold Storage, Guardian, Market Place, Jasons | 1 TapForMore Points for every $1 spent | 150 Points for $1 worth of rewards | 0.67% |

| Prime Supermarket Membership | Prime Supermarkets | 1 Fresh Points for every $1 spent | 100 Points for $1 worth of rewards | 1% |

If you're like me and don't have a particular supermarket chain that you frequent.

P.S. I just go to whichever has the best deals for the day.

Then these are the cards for you:

| Cashback Cards | Cold Storage | Giant | NTUC | Sheng Shiong | Rebate In The Form Of? | Minimum Monthly Spend | Monthly Cashback Cap |

|---|---|---|---|---|---|---|---|

| Citi Cash Back Card | 0.25% | Cash Rebate | Less than $888 | No cap | |||

| 8.0% | $888 | $25 | |||||

| DBS Live Fresh Card | 0.3% (online & contactless payment) |

Cash Rebate | Less than $600 | $20 (online payment) $20 (contactless payment) |

|||

| 5.0% (online & contactless payment) |

$600 | ||||||

| Maybank Family & Friends | 0.3% | Cash Rebate | Less than $499 | $80 | |||

| 5.0% | $500 - $799 | ||||||

| 8.0% | $800 | ||||||

| HSBC Visa Platinum Credit Card | 5.0% | Cash Rebate | $600 (for all 3 months in a quarter) |

$250 (in a quarter) |

|||

The Citibank Cash Back Card gives you 8 per cent cashback on grocery spend across Cold Storage, Giant, NTUC, and Sheng Shiong.

But you'll need to clock $888 minimum monthly spend.

And there's a $25 cashback cap per category.

This means that for groceries, you'll want to keep your spending to $312.

For the Maybank Family and Friends Card, you'll also get 8 per cent cashback on grocery spend at all four supermarket chains.

What's nice is that the $800 minimum monthly spend is slightly lower than the Citibank Cash Back Card.

Even if you dropped to $500 to $799 minimum monthly spend, you'll still earn a respectable 5 per cent cashback.

It's also nice that the $80 cashback cap is higher than Citibank's offering.

The thing about the abovementioned cards is that they all have pretty high minimum monthly spending.

Alternatively, you can use DBS Live Fresh Card which gives you a respectable 5 per cent cashback, at all supermarket chains.

And it only has a $600 minimum monthly spend.

Similar to the DBS option, HSBC Visa Platinum Credit Card also gives a 5 per cent cashback at all supermarket chains.

And it also only has a $600 minimum monthly spend.

The only additional caveat is that you'll need to clock that minimum spend for ALL three months in a quarter to be able to qualify for the rebate which is capped at $250 for the quarter.

| Cashback Cards | Cold Storage | Giant | NTUC | Sheng Shiong | Rebate In The Form Of? | Minimum Monthly Spend | Monthly Cashback Cap |

|---|---|---|---|---|---|---|---|

| UOB Delight Card | 0.3% | - | SMART$ (1 SMART$ = $1) |

Less than $400 | $50 | ||

| 3.0% | $400 - $799 | ||||||

| 8.0% | $800 | ||||||

If you only get your groceries from Cold Storage, then the UOB Delight Card is your go-to card as it gives you an 8 per cent cashback.

With an $800 minimum monthly spend.

But if you're shopping at Cold Storage, then I don't think this is really your concern… (read: high SES)

Even if you only manage to hit $400 to $799 minimum monthly spend, you'll still get 3 per cent cashback.

Oh, and by the way, the card comes with a $50 cashback cap.

| Cashback Cards | Cold Storage | Giant | NTUC | Sheng Shiong | Rebate In The Form Of? | Minimum Monthly Spend | Monthly Cash Rebate Cap |

|---|---|---|---|---|---|---|---|

| Citibank SMRT Card | - | 4.7% | SMRT$ (1 SMRT$ = $1) |

Less than $300 | $50 ($600 annually) |

||

| 5.0% | More than $300 | ||||||

| UOB Delight Card | 0.3% | - | SMART$ (1 SMART$ = $1) |

Less than $400 | $50 | ||

| 3.0% | $400 - $799 | ||||||

| 8.0% | $800 | ||||||

If your favourite place to get groceries is Giant, the UOB Delight Card gives you a pretty sweet 8 per cent cashback.

However, it has an $800 minimum monthly spend.

Plus you only get 3 per cent cashback if you only hit $400 to $799 minimum monthly spend.

If you can't meet the $800 minimum monthly spend for the UOB Delight Card, then the Citibank SMRT Card is an alternative option with a $300 minimum monthly spend.

This is probably more attainable, and the 5 per cent cashback is still quite respectable.

But what's really nice about this card is that the 5 per cent savings is also applicable at NTUC and Sheng Shiong as well!

| Cashback Cards | Cold Storage | Giant | NTUC | Sheng Shiong | Rebate In The Form Of? | Minimum Monthly Spend | Monthly Cashback Cap |

|---|---|---|---|---|---|---|---|

| OCBC Plus! Visa Card | - | - | 7% | - | LinkPoints (150 LinkPoints = $1) |

$500 outside of NTUC to qualify for rebate | No cap |

| 12% (only for NTUC Union members) |

$400 outside of NTUC to qualify for rebate | ||||||

| Citibank SMRT Card | - | 4.7% | SMRT$ (1 SMRT$ = $1) |

Less than $300 | $50 ($600 annually) |

||

| 5.0% | More than $300 | ||||||

The OCBC Plus! Visa Credit Card gives you 7 per cent cashback as long as you spend $500 minimum monthly spend OUTSIDE of NTUC.

If you happen to be an NTUC Union member (FYI: it costs $117 a year), you can push that up to 12 per cent cashback as long as you spend $400 minimum monthly spend OUTSIDE of NTUC.

Don't want to jump through so many hoops?

Don't spend that much every month?

Then you might want to consider the Citibank SMRT Card which only has a $300 minimum monthly spend.

But still gives you 5 per cent cashback - not too shabby for a no-frills option.

| Cashback Cards | Cold Storage | Giant | NTUC | Sheng Shiong | Rebate In The Form Of? | Minimum Monthly Spend | Monthly Cash Rebate Cap |

|---|---|---|---|---|---|---|---|

| BOC Sheng Shiong Card | - | 6.0% | Cash Rebate | No min spend requirement | $45 | ||

| 12.0% (only if spend outside of Sheng Shiong) |

$600 outside of Sheng Shiong to qualify for rebate | $70 | |||||

| Citibank SMRT Card | - | 4.7% | SMRT$ (1 SMRT$ = $1) |

Less than $300 | $50 ($600 annually) |

||

| 5.0% | More than $300 | ||||||

| POSB Everyday Card | - | 5.0% | Daily$ (Daily$ = $1) |

No min spend requirement | $50 | ||

If you shop at Sheng Shiong exclusively, then you should always do so with the BOC Sheng Shiong Card.

Why?

There's no minimum monthly spend required in order to get the 6 per cent cashback, but it does come with a $45 cashback cap.

And if you're already going to spend $600 outside of Sheng Shiong anyways…

Then you'll qualify for the upsized 12 per cent cashback instead, which comes with a $70 cashback cap.

If you don't have the BOC Sheng Shiong Card, you could use the POSB Everyday Card (no minimum monthly spend and 5 per cent cashback) instead.

Most of us started with POSB/DBS accounts, so we'll probably have this card somewhere.

You can consider the Citibank SMRT Card too which gives a 5 per cent cashback.

But unlike the other 2 options, there's a $300 minimum monthly spend.

This article was first published in Seedly.