My parents stay with me and rent out their 5-room HDB flat. Should they sell to buy a private property or continue to collect rent?

Hi there,

Background:

My ageing parents own a 28 year old five-room HDB in Yishun, location is pretty good, right next to Junction Nine and within walking distance to Northpoint.

My parents are staying with me and we had been renting out the Yishun unit for many years. So the condition of the unit is less than optimum.

I have our own HDB. So I cannot inherit the unit should anything happens to my parents.

We had an idea of selling off the Yishun unit and buy a private unit for investment of not more than $1.3 million. We have sufficient cash and sales proceeds from the unit to do so.

In this way, I can inherit the private unit. I suppose we do not need to pay for ABSD for inheritances. My parents are agreeable to this arrangement.

Here is the dilemma:

I was targeting $650,000 for the Yishun 134 square metre unit, so far the offers did not reach my target. Rental had been going up and most likely to sustain at a high level at least for the next couple of years, easily $30,000 of annual revenue (~five per cent rental yield).

Not sure if buying a private unit now is the right move given the price is sky-high. Was looking at projects near Ang Mo Kio where we stay, so we can drop by to use the facilities as well, but the price of Lentor Modern and Amo just shocked me with the $2k+ psf.

Should I just hold on and reap the rental return from the Yishun unit till my parents pass away or sell off the unit now and get a one to two bedroom private unit.

Not sure if I missed out any other consideration.

Hope you can share your opinion with me thanks.

Best Regards

Hi there,

Thank you for writing to us about your situation, it's great to hear that you are able to continue generating rental income while being able to accommodate your parents – it's a pretty good position to be in due to the cash flow generated through your parent's home while having your own HDB to stay in!

Understandably with the current high resale HDB prices, and the declining age of the Yishun HDB, it may seem like the right time to let go of the property.

Plus, if you have considerations over inheriting another property, it does make sense to consider owning a private property instead.

From what you wrote, your end goal seems to revolve around being able to generate rental income while also having the ease of inheriting a private property since you currently own an HDB.

To do this, we'll structure our response as follows:

Now let's move on to tackling the pointers above.

First, it's important to understand your finances before even thinking about what to purchase. For this, we'll need to consider the financial outcome of selling the 28-year-old HDB which would form the basis for the investment property.

From the information that you've given to us, it's likely that the unit is at block 309, 310, 314 or 330 Yishun Ring Road, which is located right next to Junction Nine and was completed in 1995 and is turning 28 years old.

We can see from the graph above that the prices of these four specific blocks are mostly moving in line with the overall market. However, their prices are lower than the average HDB prices in Yishun and this is likely due to the age of the blocks.

In the past year, there have only been two five-room transactions in these four blocks, both at $580,000.

These blocks in the same cluster are seven years older and were transacting from $516,000 to $588,000. The valuation of the unit at block 308 that was sold at $588,000 in July this year was actually $560,000, so the buyer paid a Cash-over-Valuation (COV) of $28,000.

These blocks are located on the other side of Junction Nine and are currently seven years old. There were 30 units transacted in the past year at prices ranging from $598,000 to $668,000.

Looking at the recent transactions in the vicinity, asking for a price of $650,000 may not be the most realistic given your parents' unit is 28 years old and as you've mentioned, its condition is less than optimum after years of renting it out.

Although the unit is bigger in size and there are buyers who appreciate that, finding someone who is willing to pay a considerable amount of COV for a unit where they will have to do extensive renovation is definitely going to be a challenge – especially with the current high cost of materials and labour.

[[nid:603939]]

For the same price, most buyers would typically opt for a unit that is younger albeit smaller, plus there will be potentially fewer costs required for renovations.

So while prices are at a high right now, we do have to be aware that with the recent cooling measures, and announcement of bigger upcoming BTO sites, this high might not persist over the next few months as well.

According to HDB's rental statistics (based on the transactions in the second quarter of 2022) the average rent for a five-room unit in Yishun is $2,400.

Assuming the valuation of the unit is $580,000, that would mean a rental yield of 4.97 per cent. It goes without saying that HDBs naturally have a higher rental yield as compared to private properties due to the lower quantum/purchase price.

So for the sake of being conservative, let's assume that the selling price if you were to sell today is $580,000.

Let's do a 10-year projection in the event you guys decide to continue holding on to the HDB and renting it out.

The number of years used is arbitrary here since there's no clear progression beyond this since the idea is to earn rental income for as long as your parents are around, thus it could be more or less, but 10 years is used as a sort of medium-term horizon.

Let's take a look at the growth of your HDB over the next 10 years. To do this, we'll assume the growth rate of HDBs in the past 10 years:

From 2012-Q4 till 2022-Q3, the resale price index grew by 14.58per cent - a 1.46 per cent growth on average per year.From 2012-Q4 till 2022-Q3, the resale price index grew by 14.58 per cent – a 1.46 per cent growth on average per year.

| Description | Amount |

|---|---|

| Assuming a 14.6 per cent growth over 10 years | $664,564 |

| Current valuation | $580,000 |

| Interest costs (We are assuming the house has been fully paid) | $0 |

| Town council S&C fees (Based on $79/month) | $9,480 |

| Rental income (Assuming $2400 for 11 months/year) | $264,000 |

| Agency fees should you engage an agent (Based on $1200/year) | $12,000 |

| Estimated gains | $327,084 |

Do note that these projected gains are merely on paper estimates to act as a guide and will vary depending on future market conditions.

As you can see, most of the gains are really based on the rental income you'll earn. While the 1.46 per cent growth per year does lead to some profit, we see this as a minimum hedge against inflation which really isn't much in this era.

Overall, here are the pros and cons of holding on to your HDB:

| Pros | Cons |

|---|---|

| Passive rental income which is great for your ageing parents as retirement income | Difficult to sell due to the limited buyer pool owing to the age of the flat |

| Will not have to top up any cash assuming the unit is already fully paid | Prices may stagnate or decline as the HDB ages further |

| Unable to inherit in the future since you own an HDB |

Now before we consider purchasing an investment property, let's look at what the conditions of inheriting a property are.

As you've rightly pointed out, owning an HDB today means you will not be able to inherit your parents' HDB when they pass on – no one is allowed to own two HDBs.

If you were to sell off the Yishun HDB and purchase a private property, you will be able to inherit that as long as your HDB has obtained its MOP.

[[nid:537878]]

One important consideration to take into account is whether there would be an outstanding loan on the private property.

So if your parents did not get full insurance coverage on the mortgage loan (if they are able to take on one), you will have to take over the loan and make monthly repayments in the future.

And in the event you are unable to afford this and are forced to sell the property, SSD will be applicable if the property is sold within three years of acquiring it.

However, from your question, it seems that the property would be paid in full especially since you cannot be the one purchasing the property (since that'll incur ABSD, which would not make it a very viable option) and your parents are likely unable to take on a loan.

As such, we'll assume that a significant amount of cash and sales proceeds would be used to pay for the $1.3 million dollar property.

Since you prefer to stay in the Ang Mo Kio area, we'll consider developments in that area that are currently on the market. We have also included their average rent and rental yield:

| Project | Estate | Tenure | Completion year | Unit type | Size (sqft) | Asking price | Average rent (last 12 months) | Rental yield (Based on asking price) |

|---|---|---|---|---|---|---|---|---|

| Thomson Impressions | Upper Thomson | 99 years | 2019 | One-bedder | 463 | $855,000 | $2,460 | 3.45 per cent |

| The Panorama | Ang Mo Kio | 99 years | 2019 | Two-bedder | 700 | $1,288,000 | $2,976 | 2.77 per cent |

| Sky Vue | Bishan | 99 years | 2017 | One-bedder | 495 | $948,000 | $2,818 | 3.57 per cent |

| Three 11 | Upper Thomson | Freehold | 2016 | One-bedder | 581 | $1,150,000 | $2,425 | 2.53 per cent |

| Thomson V Two | Upper Thomson | Freehold | 2012 | One-bedder | 474 | $818,000 | $2,357 | 3.46 per cent |

| Source: PropertyGuru, Edgeprop | ||||||||

We picked out these developments based on your requirements but they may or may not be suitable for you. So as with any big financial decision, we suggest that you consult an agent for further in-depth analysis.

In general, we can see that the price movement of private condominiums in District 20 is parallel to that of the overall market in Singapore.

Having said that, with a budget of $1.3 million, your options in District 20 are pretty limited and most of the units that fall under this price are one-bedder units.

One thing to note about a one-bedder unit is that the buyer pool is typically smaller than that of a two or three-bedder as it caters more to investors, singles or couples, so depending on the development offloading the unit for a good price in the future could pose a challenge.

[[nid:584631]]

We have previously written on whether one-bedder units are a good investment and you can read more on that here.

You've mentioned that the reason for purchasing a unit in District 20 nearby was so that it'll be close to where you're staying and you guys can pop by occasionally to use the facilities.

Just to be clear, not every condo would allow this since you are technically not a resident of the condo once you rent out the entire unit. However, it's not easily enforceable and it is not in our position to base one's property purchase decision on this either.

Perhaps the above is worth keeping in mind, if that's the major reason why you are restricting the location of the investment property. So while we can understand the convenience of staying in the neighbourhood, it will naturally restrict your options.

Seeing that it's an investment property, we believe the priority should be selecting a development with greater potential for appreciation or one which has a higher rental yield, whichever is more important for you.

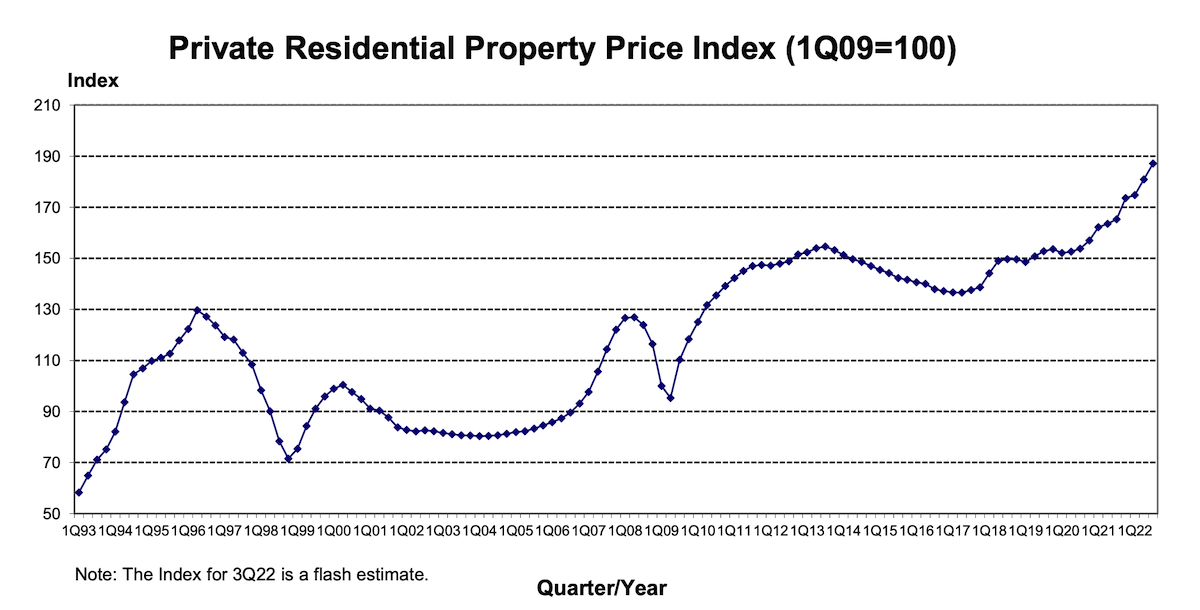

We'll also do a 10-year projection should you decide to buy a condominium for investment just so that we can make a better comparison to holding on to the HDB. For our growth rate, we'll look at how the private property index has fared in the past 10 years:

| Year | Property price index |

|---|---|

| 2012 | 151.5 |

| 2013 | 153.2 |

| 2014 | 147 |

| 2015 | 141.6 |

| 2016 | 137.2 |

| 2017 | 138.7 |

| 2018 | 149.6 |

| 2019 | 153.6 |

| 2020 | 157 |

| 2021 | 173.6 |

| 2022Q3 | 187.1 |

Based on the PPI, property prices grow 23.4 per cent from 2012 to 2022Q3

Let’s assume you purchase The Panorama at $1.28 million:

| Description | Amount |

|---|---|

| Assuming 23.4 growth over 10 years | $1,579,520 |

| Current valuation | $1,280,000 |

| Interest costs (We are assuming the house will be fully paid) | $0 |

| MCST (Assuming $300/month) | $36,000 |

| Rental income (Assuming $2,900 for 11 months/year) | $382,800 |

| Agency fees should you engage an agent (Based on $1,450/year) | $14,500 |

| Estimated gains | $631,820 |

The projected gain is $304,736 ($631,820 – $327,084) more if you were to purchase a condo and rent it out instead of holding on to the HDB and renting it out.

Given that the private condominium is much younger, there is possibly still some runway for appreciation as compared to the HDB which is already 28 years old.

Besides this, the main advantage of purchasing a private property now is the fact that you will be able to inherit this when the time comes and own two properties without having to pay ABSD.

Now let's look at the pros and cons of buying a private property for investment:

| Pros | Cons |

|---|---|

| Passive rental income | Will have to top up cash in order to purchase |

| Potential for growth as development is young | May be challenging to offload a 1 bedder down the road |

| Will be able to inherit | Monthly cash outflow is greater due to maintenance cost |

Next, let's tackle your final question:

We get it, property prices are high now, and it's probably the one question that everyone is thinking about.

But no matter the market situation, it's normal to always wonder about this.

In an upmarket, buyers are worried they're overpaying.

In a down market, buyers are wondering if prices will drop further (there are people who waited just when Covid hit and are still waiting today).

But as the saying goes, time in the market beats timing the market.

In the past 20 years, the property market movements have been such that the next peak is always higher than the last peak and the next trough is also higher than the last trough.

The benefit of being able to fully pay off the property is that you won't have to worry about being forced to sell it at a bad time because you're unable to finance it.

In the current market where buyers are concerned about interest rate hikes, you will not be affected either. So holding on to the property until you deem it's the right time to sell will not be a problem.

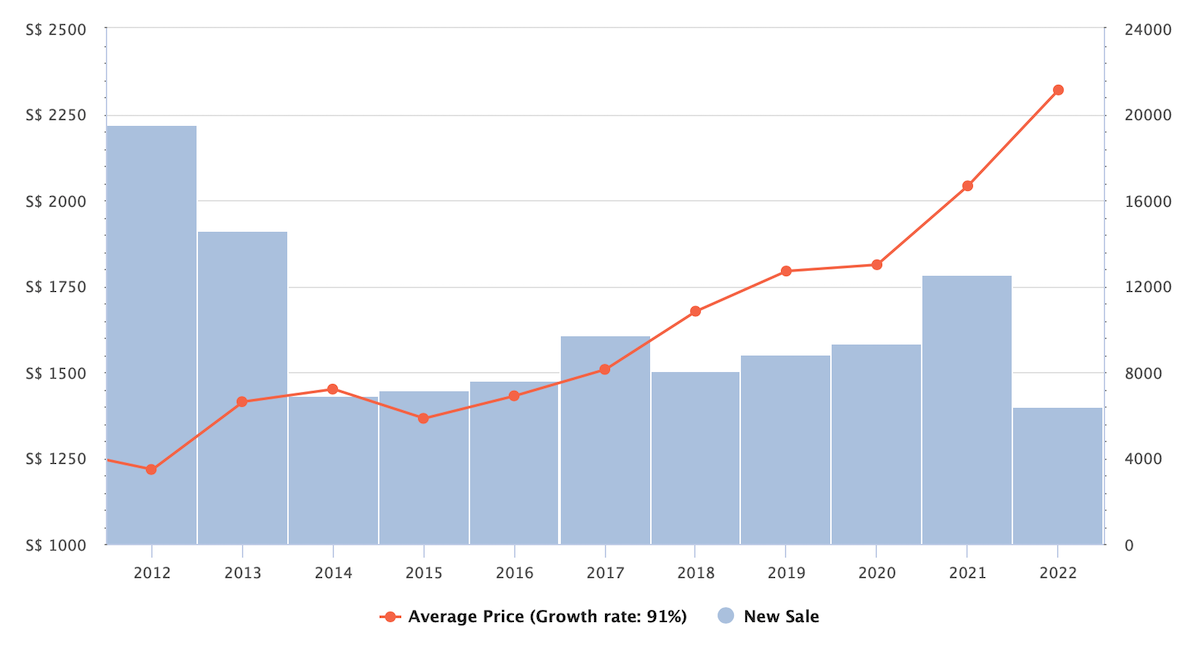

Since you mentioned how high Amo Residence and Lentor Modern are, here's a chart to put things into perspective:

From the graph above, we can see that new launch prices have been on the rise with the average PSF at $2,320 for the last 10 months of 2022.

With the increasing land and construction costs, and the revised Land Betterment Charge (LBC) that developers have to pay, it is likely that this uptrend will continue. We have also recently written about how the LBC may affect property prices.

It's not so much that prices are high now (even though they are), but it's what you believe of the future of property in Singapore that's the question.

For example, let's look at the prices of a Rolex Daytona over the past few years.

[[nid:595619]]

When it was launched in 2016, the second-hand market was already trading at a 50 per cent premium over the retail price.

The demand continued all the way until the pandemic, and at that point in Singapore, you could get it for around $30,000. Which to some people seemed totally crazy as you could buy a new one (if you could get it) for about $17,000.

But since the pandemic hit, demand soared through the roof and prices hit a high of $45,000 and up.

So, if you were into watches at that point were you able to see the trends that would point towards an appreciation in prices?

While even buying it at $30,000 may seem insane, it doesn't seem so crazy when you know that prices are still going to rise another 50 per cent.

Of course, the demand has tapered off since then, and prices are no longer as high as before, but the point remains. It isn't so much that prices may seem expensive at that point, it's how much potential and value you see ahead in the future.

To conclude, we are leaning towards selling the HDB and purchasing a private investment property that would see better capital appreciation in the longer term. This is because private property is still seen as a better hedge against inflation.

Public housing is meant to be affordable, so if there are any regulations to ensure this, it would likely hit HDB more than private housing.

Moreover, it does simplify matters when it comes to your inheritance.

[[nid:603249]]

So to be clear given your circumstances, it does make sense to sell to purchase a private property as that is the only route where you can inherit it.

The issue is the timing. It could be worth thinking about selling the HDB now at a high and waiting for a little to see how the market evolves over the next few months before making a move to buy anything. Since you aren't in a hurry (other than rental income), and are afraid of buying at a high, this may make some sense.

What you'd need to calculate is if the cost of losing out on rental income over a one to two period is worth waiting to time the market for a possible drop in property prices.

Given the market has a lot of cooling measures placed on it, the Government does have a lot of levers to play with to adjust for the market conditions. As such, they definitely will not allow for a situation where property prices plunge an unhealthy percentage.

However, we must accept that there is an opportunity cost to purchasing this private property. You'll need to fork out a large sum of cash to make that jump to a private property investment.

This cash could have been invested in the equities market to earn dividends and some capital appreciation, or some of it could be set aside to supplement your parent's income.

After all, the power of property investment is in leverage – and if you are paying it in cash, then perhaps you're losing out on what really makes property investment so lucrative.

[[nid:602342]]

Of course, the benefit to buying property is that it's not as volatile as equities, but considering a lack of a tight timeline here, you may be very comfortable holding onto a stock portfolio that's not in the black so long as you have holding power.

You may also want to consider what would happen if, for some reason, your parents would like to move out.

They might have to depend on the rental income earned from the private property to rent somewhere else, and if that doesn't work out and a lot of cash is tied up in the property, it could make things difficult.

A property is usually one of the biggest assets that a Singaporean owns and many downgrade or right-size in their older years to cash out and fund their retirement.

We believe your family has had thorough discussions about this move, but one concern we do have is that with old age, there may be accompanying ailments – so if your parents are adequately insured, then this move is no issue.

But in the event they are not, then perhaps tying up your liquid cash in an illiquid asset such as property may not be a good idea – even if it's a good hedge against inflation.

This article was first published in Stackedhomes.