'Took 3 years of planning': Couple outlines how they bought a condo at 26

PUBLISHED ONApril 12, 2023 10:40 AMByVenkat Gunasellan

PUBLISHED ONApril 12, 2023 10:40 AMByVenkat Gunasellan Owning a house is the Singaporean dream for many millennials and Gen-Zs.

But to get one these days is no easy feat, from skyrocketing prices to long waiting times for build-to-order (BTO) flats, the whole experience can be daunting.

For one couple, they decided to buy a two-bedroom condo instead for their first home. And no, their parents didn't help out to pay for it.

In a post they shared on social media app Lemon8 in February, the couple went into great detail about how they managed to buy a $1.2 million condominium.

[embed]https://www.tiktok.com/@heidingfromyou/video/7101277366814625025?is_from_webapp=1&sender_device=pc&web_id=7210247996235138562[/embed]

In the video caption, the couple shared how the toughest part for them was the down payment of 25 per cent, which they said came up to around $300,000 to $350,000.

"Not to mention there is still the BSD [buyer's stamp duty]," the couple mentioned in the post.

They noted that the monthly mortgage payment wasn't the hard part, at around $4,000 to $4,500. They managed to cover this fee with their CPF monies and forked out less than $1,000 in cash every month.

But of course, all these involved a proper financial plan, which the couple shared took "three years of careful planning".

They diligently saved, with each of them contributing $2,000 monthly.

As with a lot of home or property purchases, loans may come into play. In this regard, the couple stated that they borrowed $100,000 for their downpayment, which they are paying back in instalments. It was not stated though whether it was a bank loan.

While it might seem like a pricey route to take, they had their reasons.

Firstly, they noted that BTO flats were not an option due to the "crazy waiting time of five years".

Secondly, the equally high prices of resale flats made it less of an appealing option for them compared to a condo.

"We [were] looking at the Bishan area as it is more convenient for both of us," they shared in the caption. "The housing price [in] this area is around $1 million."

In addition, resale flats "will be very difficult to sell" at a later time when looking to upgrade, they said.

Making the purchase is just one part of the couple's housing journey.

In a separate post, they wrote about how they managed their finances, sharing that their bank balances were down to zero.

And apart from their housing expenses, they were also planning for a wedding. So they needed to build their savings back up quickly.

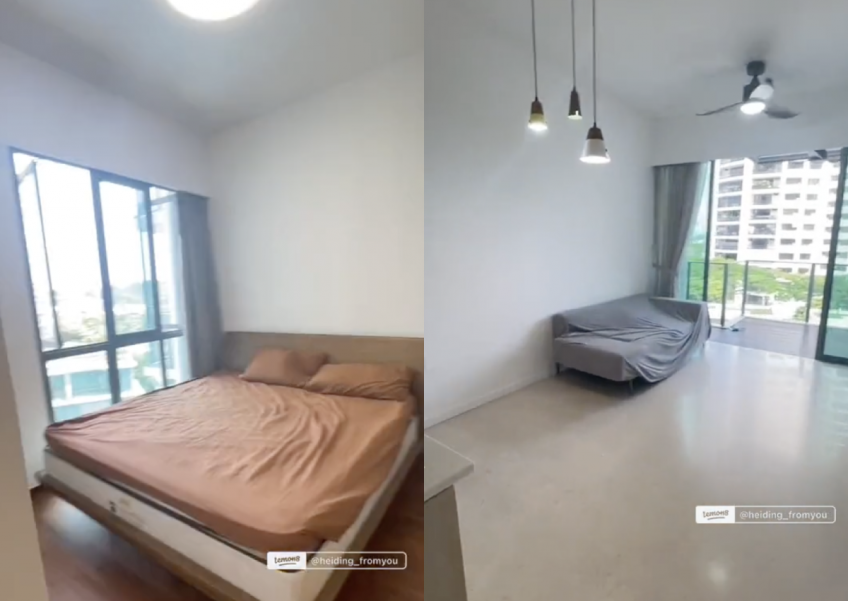

They decided to rent out their newly purchased condo at $3,000. In addition to that, they put $1,000 in their joint account every month.

In total, they managed to save $48,000 after a year.

They also highlighted a few tips for people wanting to buy a condo.

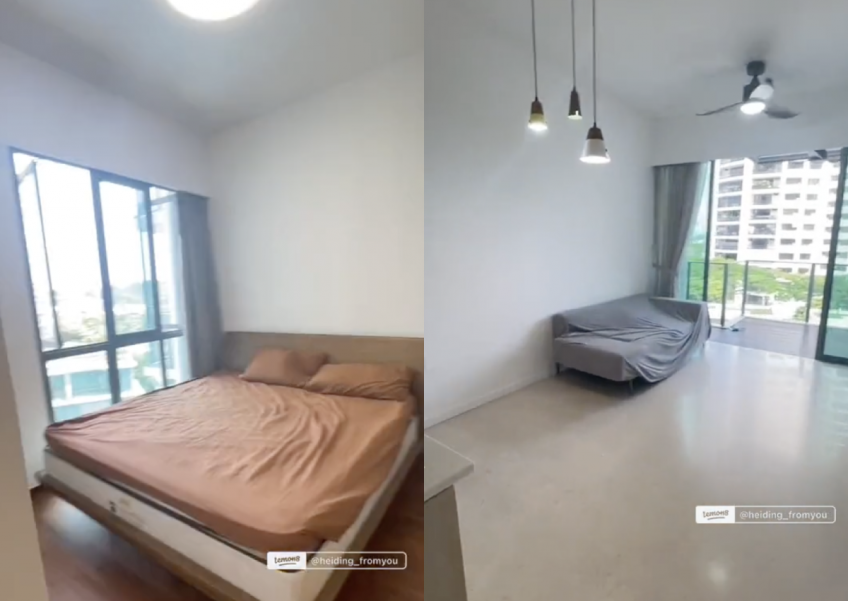

Keep renovation works to a minimum, they advised. They added that they picked a unit that was "well maintained" so that it would look "decent even with minimal renovation".

Also, be disciplined in saving. It helps to create a sense of accountability if you open a joint savings account with your partner, they said.

In addition, it's also wise to build up your emergency funds. They suggested setting aside $2,000 every month.

Lastly, they advised to find other sources of income.

Just last week, entrepreneur and content creator Nicole Chen, better known as Nicole Liel, shared valuable tips after she bought her first BTO flat.

The first tip the 25-year-old had for potential homeowners was to be willing to compromise.

Her initial demands ranged from wanting a unit on the top floor, unblocked views and a block that was near the expressway.

However, she soon realised that wanting the perfect home would likely delay the time it takes to own one.

The next tip is all about saving your money.

Although Nicole has two income streams, she makes it a point to make sure she bases her expenditure on one while saving the other.

Over time, the savings would accumulate, and this would ease the burden when paying off the loan payments for the house.

Even if you don't have dual income, it's all about putting aside a set amount of money monthly and having a lot of discipline.

Last but not least, she advised not to make the down payment in cash.

ALSO READ: First-timers, select your BTO flat when invited by HDB or lose priority for a year

No part of this story or photos can be reproduced without permission from AsiaOne.