3 undervalued companies with company buyback activities in October

For a start, undervalued companies are deemed to be trading in the open market at a price presumed to be below the companies' true intrinsic value. Moreover, an undervalued stock is also believed to be priced too low based on metrics such as Price-Earning (“PE”) ratio and Price to Book Ratio.

However, actions tend to speak louder than words or numbers. The best possible way is to keep a look out for those undervalued companies that are engaging in Share Buyback. Share Buyback is a transaction whereby a company buys back its own shares from the open market.

Companies tend to buy back its shares when the management consider the current share price does not reflect the true value of the company.

In this article, we will be looking at 3 undervalued companies - Hong Fok Corporation Limited, OUE Limited and Yangzijiang Shipbuilding Holdings Limited, that engages in share buyback in the month of October.

Hong Fok Corporation Limited (“Hong Fok”) is a Singapore-based investment holding company. The company operates through three segments:

The Company's investment properties include International Building at Orchard Road, Singapore; YOTEL Singapore Orchard Road at Orchard Road/ Claymore Hill, Singapore; The Concourse at Beach Road, Singapore, and Concourse Skyline at Beach Road, Singapore.

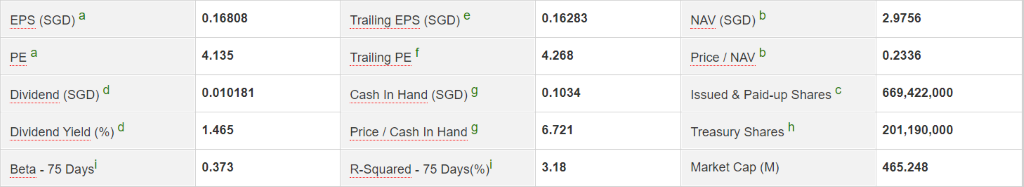

Hong Fok is currently trading at a PE ratio of only 4.13 times. Its trailing 12 month’s PE is slightly higher at 4.26 times. The average PE ratio of Singapore’s real estate development industry stands at 10.4 times. This means that its PE ratio is trading below the industry average.

Hong Fok is also trading at a low Price to Book ratio of 0.23 times as compared to the industry average’s Price to Book ratio of 0.44 times.

Hong Fok’s 75 Days Beta stands at only 0.37 times. As the beta value is less than 1.0, the company’s share price is theoretically less volatile than the broader market.

In the month of October, Hong Fok’s management has been actively purchasing its share back from the open market. The first purchase was on 7th October, where the management bought back 93,000 shares at a price between 63 and 64 cents.

Till date, Hong Fok has bought back a total of 913,000 shares, with an estimated transaction value of S$618,000.

OUE Limited ("OUE") is a diversified real estate developer and operator with a real estate portfolio located in Asia. OUE has consistently grows its business by leveraging its brands and expertise in developing and managing landmark assets across the commercial, hospitality, retail and residential sectors.

In March 2017, OUE expanded its portfolio into the healthcare sector with the acquisition of OUE Lippo Healthcare Limited, a listed integrated healthcare services and facilities provider.

This was followed by the acquisition of First REIT Management Limited (formerly known as Bowsprit Capital Corporation Limited), the manager of First REIT, Singapore’s first healthcare real estate investment trust, in October 2018. In 2019, OUE expanded into the consumer sector with OUE Restaurants.

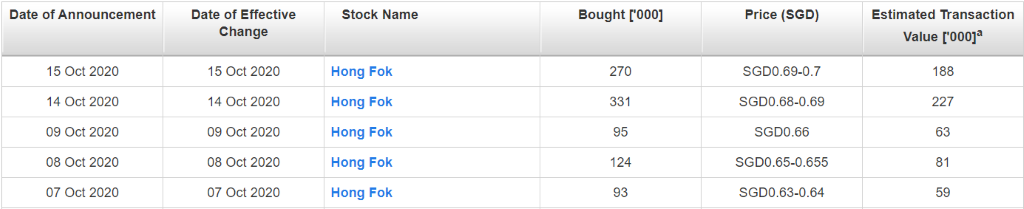

With an Earning Per Share of $0.28, OUE’s PE ratio stands at 4.16 times. This is significantly lower than the industry average PE ratio of 10.4 times.

OUE is also trading at a huge discount to its Net Asset Value (“NAV”). The Price to Book ratio for OUE is at only 0.27 times and is below the industry average of 0.44 times.

OUE’s 75 Days beta is at 0.18 times, and that is much lower than Hong Fok’s 75 Days beta of 0.37 times. This shows that OUE’s share price movement is less volatile as compared to the broader market.

Since the start of October, OUE has been actively engaging in share buyback. The first purchase began on Oct 6, 2020, where OUE purchased 400,000 shares at an average price of $1.19.

Subsequently, there were 6 more purchases at a price range between $1.19 and $1.20. The cumulative purchase stands at 901,000 shares and the estimated total transaction value is at $1.07 million.

Established in 1956, Yangzijiang Shipbuilding Limited (“Yangzijiang”) is one of the largest private shipbuilding companies in China. The Group is listed on SGX Mainboard since April 2007.

With four shipyards in Jiangsu Province, China along the Yangtze River, the Group produces a broad range of commercial vessels including large containerships, bulk carriers and LNG carriers, serving the orders from a well-established customer network covering Northern America, Europe and other parts of the world.

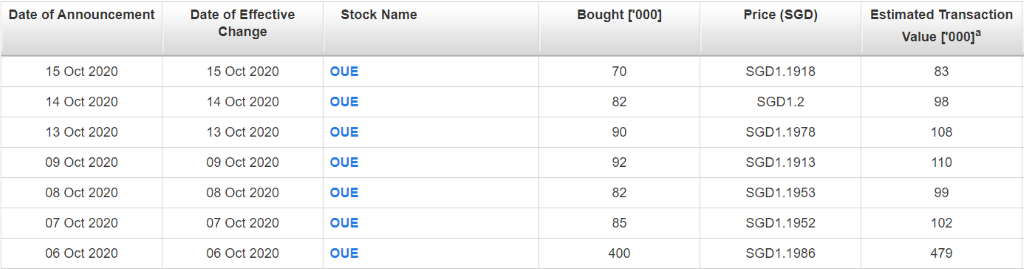

Yangzijiang’s PE ratio currently stands at 6.28 times and that is lower than the average PE ratio in the shipbuilding industry of 11.78 times. Yangzijiang’s trailing PE ratio of 7.78 times is also lower than the industry’s average PE ratio.

With an NAV of $1.58, Yangzijiang’s Price to Book ratio stands at 0.60 times and this is lower than the industry’s average Price to Book of 0.72. Both metrics signifies that Yangzijiang is currently undervalued.

Finally, with a 75 Day beta of 1.09 times, this indicates that Yangzijiang’s share price is strongly correlated to the broader market. Any movement on the overall market will have an impact on Yangzijiang's share price movement.

Yangzijiang’s management continue with their share buyback action in the month of October despite purchasing more than 17 million shares in September at a price range between $0.92 and $0.985.

In October till date, Yangzijiang has purchased more than 8.9 million shares at a price range between $0.955 and $0.99. The cumulative transaction value amounts to $8.7 million.

With the aggressive buyback, this shows that the management sees that the current share price does not reflect the true value of Yangzijiang.

Companies engaging in share buyback is one of the positive indications seen from the management, especially when the current share price is not reflecting the intrinsic value of the company.

However, investors should also take note that share buyback will not ensure that the share price will rise.

Investors should keep a lookout for individual companies’ financial performance and the management’s plan on the growth of the company in the long run. These will determine on the future movement of the individual companies’ share price.

This article was first published in Investor-One. All content is displayed for general information purposes only and does not constitute professional financial advice.