5 steps to spot high-quality companies during the Covid-19 crash

By now, we're all keenly aware that we're in the midst of a health crisis that that has sent the stock market and economy into a tailspin. The Covid-19 pandemic is an event the global community has not faced since the 1918 flu pandemic.

But while our nations are on lockdown, we know that in the depths of economic distress lie a once-in-a-decade opportunity to own some of the best companies in the world for your stock portfolio.

"Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it's imperative that we rush outdoors carrying washtubs, not teaspoons. And that we will do." - Warren Buffett

Before you invest during this Covid-19 crash, it's imperative that you take some time to understand your own investment goals and risk profile, and how to build a stock portfolio that suits your needs.

You also want to make sure that you have your financial parachutes ready, and that you only invest with money you can afford to set aside. (And never borrow to invest in the stock market!)

So once you're ready to invest, the question becomes: What do I invest in? How do I know which stocks are 'good' to own right now?

In other words, how do I identify high-quality companies that are able to ride through this crisis, remain competitive, and emerge even stronger after it's over?

Here are five things you need to look out for:

Note: This is neither a recommendation to purchase or sell any of the shares mentioned in this article, and the information here is for educational purposes and/or for study or research only.

An economic moat is a sustainable competitive advantage that a company has that allows it to outperform its competitors over the long term. Not only that, an economic moat should be able to endure during a crisis like the one we're having now. All the best companies in the world today have wide and enduring economic moats.

For example, Facebook's economic moat is its network effect - you use Facebook.com and Instagram to share your opinions and photos because everyone else is on these social networks. It's extremely hard for a new social network to lure users over when Facebook already has 2.5 billion active users today. Even Google tried and it failed.

[[nid:477174]]

Another economic moat is high switching cost where it's extremely tough for a customer to switch to a competitive product. Adobe, the makers of Photoshop, is a great example of this.

Since its release in 1990, Photoshop has quickly become the industry standard for image editing software. Because of this, it's extremely hard for a creative professional to switch to a competing software when so many companies use Photoshop within their organisation.

Other examples of moats include intangible assets (intellectual property, brands, patents, licenses), economies of scale, and cost advantages.

The idea of an economic moat means that a company's products and services are essentially entrenched among its users which allow these companies to protect/gain market share and earn profit over the long run.

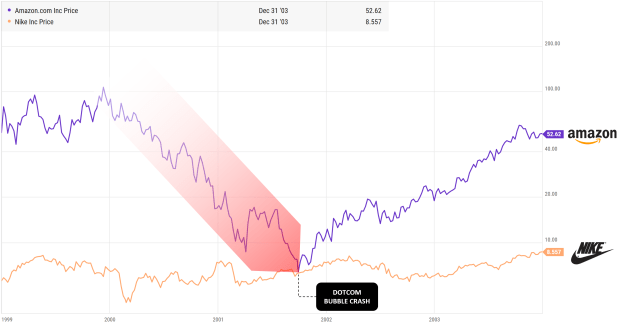

Although all high-quality companies have wide economic moats, they all have different business models which are affected to different extents by different crises. The 2000 dotcom bubble impacted internet-related stocks like Amazon more than it did traditional companies like Nike for example.

In this case, Covid-19 is a health crisis which has forced our cities into lockdown. Which means sectors like travel, retail, food service, and manufacturing will bear the full brunt of the crisis.

When the epidemic first emerged in Wuhan in January, Starbucks was forced to close half its stores in China. Now that the epicentre has moved to the West, Starbucks has had to close almost all its stores in the US and Canada.

[[nid:480321]]

Similarly, Disney recently closed its theme parks in Anaheim, Orlando, and Paris, while its theme parks in Tokyo, Shanghai, and Hong Kong also remain shut. Although Disney has diversified revenue streams, the theme park segment contributed around 38 per cent of total revenue in FY2019.

So although Starbucks and Disney are quality companies with economic moats, their business models place them on their frontlines against the coronavirus. Because of this, I'd prefer to adopt a wait-and-see approach and demand a higher margin of safety before I invest in either of them.

On the other hand, companies like Alphabet (Google) or Mastercard have business models which are relatively less impacted by the crisis - we continue to search on Google, binge-watch YouTube videos, and make (online) payments using our credit cards during a lockdown.

Although their short-term performance will still be affected due to lower overall economic activity, they should emerge fairly unscathed once the crisis blows over.

The growth runways of high-quality companies can also differ. For instance, The Coca-Cola Company is an established corporation that's been around since 1892. Its economic moats include a universally recognisable brand and a global distribution network that allows it to sell 1.9 billion drinks daily.

But its growth is limited - net revenues have grown from US$30.9 billion (S$44 billion) in 2009 to US$37.3 billion in 2019. That's a compound annual growth rate of just 1.87 per cent over ten years!

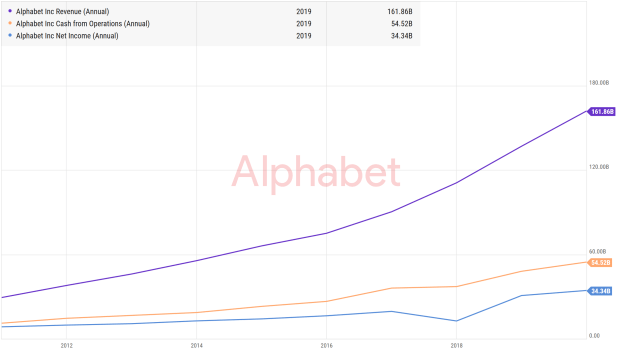

In comparison, Alphabet's revenue has grown from US$23.7 billion to US$161.9 billion over the same period (21.19 per cent CAGR). This is largely because Alphabet operates in an industry which still has a long growth runway.

The Internet is projected to grow to 5.3 billion users and the size of the digital advertising industry is expected to hit US$517.5 billion worldwide by 2023.

So look for high-quality companies that still have room to stretch and grow. A company with strong growth drivers has more potential to generate higher revenue and profit, and drive its stock price higher.

A high-quality company will almost always have a multi-year track record of exceptional financial performance. But it's always good to check and see for yourself.

A successful company should see its revenues and net profit grow consistently every year. Just as important, the company's operating cash flow should be rising consistently as well.

Positive cash flow is vital because a company needs cash to continue operating its business. A profitable company can go bankrupt if it manages its cash flow badly and runs out of cash.

Check also if the company is able to maintain a good level of gross and net profit margins. Eroding margins might signal that competition is intensifying or a company's business fundamentals are deteriorating.

They say cash is king, and even more so during a crisis when sales and revenue are hit. A company must have enough cash to last the adversity or it may not even have a chance to recover when the crisis ends.

It's also during a crisis or recession where companies with too much debt end up on the scrap heap. If a company is unable to repay loans that are due or meet its debt obligations, then it may be forced to file for bankruptcy or rely on a bailout from the government to survive.

So check if a company has small or manageable amounts of debt, and generates ample cash flow to cover its interest payments.

This checklist is obviously not meant to be exhaustive and you need to do your due diligence before you invest in any stock. Every company also has its own set of unique risks and threats to its business model, so make sure you take the time to understand them as well.

Knowing this, it makes sense to do your research on companies that fall within your circle of competence.

Finally, when you've identified a high-quality company, remember that just because its stock price has fallen 20-30 per cent (or more) from its peak, it doesn't necessarily mean that the stock is undervalued. Check to make sure it's trading below its intrinsic value before you invest.

This article was first published in The Fifth Person. All content is displayed for general information purposes only and does not constitute professional financial advice.