6 credit cards you should use as your ez-link card

Earn cashback, miles and rebates with an all-in-one credit card that can also double up as your ez-link/public transport card on trains and buses.

Commuters can now tap any MasterCard/Visa credit card to pay for public transport under LTA's SimplyGo scheme. No need to carry or even top up your EZ link card anymore! Even better, if the Visa or Mastercard credit card is stored on your smartphone, you can even leave the credit card at home.

To do this, simply:

This also means you now have a brand new way to earn air miles/cashback on public transport. Check out this article on the best cards to use to earn miles on bus and MRT rides.

Now that you have an all-in-one credit card that also doubles up as an ez-link card, you can even leave your wallet at home. But which cards give you the most cashback and rebate with every tap on public trains or buses?

The following credit cards also come with an automatic top-up option when your ez-link balance is low, which is again charged to the credit card.

Since 2018, ez-link cards can also be used at hawker stalls accepting NETS FlashPay transactions. Yep, your ez-link enabled credit card can now double up as your transport and lunch card! Here are five credit cards you can use on public transport that give you the most generous rewards.

BEST CREDIT CARDS FOR EZ-LINK/PUBLIC TRANSPORT TRANSACTIONS

| Credit Card | Cashback/Reward | Other benefits |

| SCB Unlimited Cashback Credit Card | 1.5% cashback on eligible spend, no cap, no minimum spend | Increase cashback to 5% with paired with Standard Chartered Unlimited$aver account |

| Citi SMRT Card | Earn 0.3% SMRT$ (10 SMRT$ = $10 cash rebate) on EZ-Reload top-up | Up to 5% savings at major supermarkets, fast food, movies, coffee and online shopping |

| DBS Live Fresh Card | Up to 5% cashback on public transport rides (includes Grab, GoJek) | Up to 5% cashback on online and Visa contactless spend Earn 1.85% p.a when paired with DBS Multiplier account |

| POSB Everyday Card | 0.3% EZ-Link rebate | Up to 15% rebate on dining (inc. online food delivery) Up to 20.1% fuel savings at SPC 5% rebate at Sheng Siong, 3% rebate at Watson’s 1% rebate on recurring bills from selected electricity providers |

| DBS Altitude Visa | 1.2 miles per dollar (Trains, bus and taxi rides and Singapore Airlines tickets purchased on DBS Travel MarketPlace.) | No expiry date for air miles conversion Complimentary travel accident insurance of up to $1,000,000 when you charge the full travel fare to your card 3 miles per dollar spend on selected online flight and hotel transactions |

| UOB Lady’s Card | Earn 10x UNI$ (20 miles) per $5 spend | Earn 4 miles per dollar when you choose from 7 categories: Beauty/wellness, Fashion, Dining, Family, Travel, Transport and Entertainment. |

1. STANDARD CHARTERED UNLIMITED CASHBACK CREDIT CARD

At the top of this list is the Standard Chartered Unlimited Cashback Credit Card, among the newest cash rebate card to hit Singapore. It comes with the EZ-Reload by Card service, which automatically tops up your card when the balance runs low.

[[nid:468802]]

The default auto top-up amount is set at $50.25, with $0.25 being the convenience fee charged by ez-link. You can change the auto top-up amount any time, but Standard Chartered cannot waive the convenience fee. To avoid this pesky fee, reduce the number of top-ups you make.

On the bright side, your EZ-Reload top-ups are counted as retail spend. This means you earn 1.5 per cent cash back every time you top up your ez-link card.

Want an uncomplicated cashback card. The Unlimited Cashback Credit Card is one of the easiest-to-use cash rebate cards in Singapore. Earn 1.5 per cent on all local retail spend.

What sets this cash back card apart is that there's no minimum spend required and there are no limits to the total rebate amount. Perfect for those who don't want separate rebate cards for certain types of spend.

Want to earn easy rebates from EZ-Reload. Other ez-link credit cards may provide rebates for EZ-Reload top-ups (see below) but they come with conditions like minimum spend or maximum rebate amounts.

With the Unlimited Cashback Credit Card, earning the 1.5 per cent rebate is as simple as letting the EZ-Reload function do its thing. Do note that after 3 Dec 2019, all newly issued Unlimited Cashback Credit Cards will no longer come with the ez-link facility. So don't wait too long to hit the apply now button below!

2. CITI SMRT CARD

The Citi SMRT Card is the only credit card in Singapore that partners with one of Singapore's major transport companies. Simply activate the card at TransitLink office to use it as your ez-link card.

At 2 per cent rebate for any EZ-Reload transactions over $30, you'll save quite a bit after a year. The rebates are rewarded in SMRT$, which can be redeemed for vouchers or free rides.

1 SMRT$ is equal to S$1 worth of vouchers, which means that you can earn $40 worth of SMRT vouchers with the SMRT$48 you accumulate in a year (SMRT vouchers come in denominations of 10).

[[nid:476954]]

But the 2 per cent rebate comes with strings attached: you need to spend a minimum of $300 per month, failing which you only qualify for a 0.3 per cent rebate. You can also only earn up to 600 SMRT$ in a year.

Each EZ-Reload transaction must also be over $30; anything below earns 1 per cent SMRT$. Fortunately, the default EZ-Reload amount is set at $30, which can be changed at any time.

The great thing about this card is there are no convenience fees for EZ-Reload top-ups, usually charged at $0.25 per transaction. And if you can meet the minimum spend, you save quite a bit on your train rides when redeemed for vouchers.

Want to earn rebates and free train rides with your rebates. In addition to the 2 per cent rebate from EZ-Reload transactions, you can also earn up to 5 per cent rebate at groceries, 5 per cent rebate on coffee and fast food, and 1 per cent rebate on recurring bills.

Want extra household savings or Grab discounts. You also save more on groceries, shopping or Grab rides if you apply for the Citi SMRT Card.

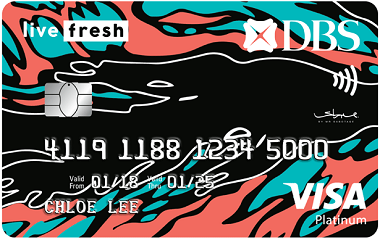

3. DBS LIVE FRESH CARD

Enjoy up to 5 per cent cashback on your everyday rides for the first 180 days from your card approval Date before 31 March 2020 and spend a minimum of $600 in a calendar month. Note that cashback is capped at $20 on Online spend, $20 on Visa contactless spend and $20 on all other spend for each calendar month.

Have a DBS Multiplier account. On top of using this credit card for public transport rides, you can also link your card to your DBS Multiplier accpunt and earn up to 1.85 per cent interest per annum.

Also love online shopping. Cardmembers get 5 per cent cash back when you shop online or use mobile payments (Apple Pay, Android Pay, Samsung Pay).

4. POSB EVERYDAY CARD

The POSB Everyday Card only offers 0.3 per cent rebate for EZ-Reload transactions - which is to say, not much. But it's better than nothing at all.

Activating the ez-link function on the POSB Everyday Card is also convenient: you will receive an activation code within 10 days of applying for the card which you can then use at a ticketing machine.

Note that the default EZ-Reload amount is set at $50, and the $0.25 convenience fees are also waived.

Want to save on food delivery. With up to 20 per cent savings on online food delivery, enjoy more of your favourite meals for less.

Are looking for an easy everyday cashback card. With cashback at Sheng Siong, Watson's, StarHub and utility bills, this handy card helps you cut costs on daily spend.

5. DBS ALTITUDE VISA

The DBS Altitude Visa offers 1.5 miles per dollar on all public transport rides paid using SimplyGo, capped at a total spend of $1,200.

Plan to spend on flights and hotels: Enjoy 3 miles per dollar on selected online flight and hotel transactions.

Want complimentary travel accident insurance of up to $1,000,000 when you charge the full travel fare to your card.

6. UOB LADY'S CARD

Earn 10x UNI$ (20 miles) per S$5 spend when you choose from 7 categories: Beauty and wellness, Fashion, Dining, Family, Travel, Transport and Entertainment.

Get This Card If You…

[[nid:477291]]

Spend regularly on one of seven categories: Enjoy 4 miles per dollar on beauty and wellness, fashion, dining, family, travel, transport and entertainment. You'll have to choose one category to enjoy the 4 miles per dollar earn rate.

Intend to splash out on a new luxury shoe or handbag: With the Lady's LuxePay Plan, put your new luxury purchase (shoes and bags) worth S$500 or more (local, online or overseas) on a 6 or 12-month instalment payment plan, absolutely free.

If you'd love to go on a year-end shopping spree, you might want to consider applying through SingSaver to get up to $180 cashback.

This article was first published in SingSaver.com.sg.