Are you making the most of your credit card points?

Here's something that may surprise you - contrary to popular belief, most miles card don't actually earn you miles.

Unless you're holding a cobrand card like the KrisFlyer UOB Credit Card, AMEX KrisFlyer Ascend or AMEX KrisFlyer Credit Card, you're technically earning bank points, which can subsequently be converted into miles.

This is an important distinction to make because every bank has its own points currency and rules regarding conversion rates, conversion fees, pooling and expiry. It pays to familiarise yourself with these rules when getting into the miles game!

So here's the bad news: there are no fewer than 12 different rewards currencies in Singapore, and some banks have more than one. This can be hopelessly confusing to a first-timer.

For example, consider how some popular rewards cards are marketed.

The OCBC Titanium Rewards advertises 10X OCBC$ per $1, but is that better than the DBS Woman's Card at 10X DBS Points per $5, or the UOB Lady's Card at 10X UNI$ per $5? Without an apples to apples comparison, it's easy to be overwhelmed.

The good news is we're going to explain all you need to know about credit card points in this article.

WHAT ARE THE DIFFERENT POINTS CURRENCIES ON THE MARKET?

There are currently 12 different points currencies in use by Singapore banks. Although most keep it simple by having only one, OCBC (3) and Citibank (2) offer different currencies depending on the card.

Here's the big picture overview of how each bank's policies measure up:

CONVERSION RATE AND MINIMUM CONVERSION

The most important factor to understand is the conversion rate because without this, you won't be able to do a like-for-like comparison of credit cards.

There are three main ratios in use - 5:2, 1:1 and 1:2 (all referring to points:miles). Why so many? Only the banks know. I wish we had a simpler system where 1 point=1 mile, but that's just the situation here.

5:2 Ratio |

1:1 Ratio | 1:2 Ratio | Other Ratios |

| OCBC$, Citi ThankYou points, SCB 360 Rewards Points (Visa Infinite), HSBC Rewards Points, Maybank TREATS | Citi Miles, OCBC Travel$, OCBC VOYAGE Miles | DBS Points, UOB UNI$ | AMEX Membership Rewards (450 points: 250 miles), BOC Points (3 points: 1 mile), SCB 360 Rewards Points (3,500 points :1,015 miles- non Visa Infinite cards) |

*The above ratio assumes you're transferring points to KrisFlyer. All banks offer the same conversion ratio to other partners (e.g. Asia Miles) except SCB

It's also important to consider what the minimum conversion amounts are. All things equal, it's better to have a smaller minimum conversion, because it gives you added flexibility. Moreover, it reduces the chances of orphan points or points, which are just short of the minimum conversion.

For example, if I have 4,800 DBS points, I will not be able to convert them into miles because I'm 200 points shy of the minimum.

| Minimum 10,000 miles | Minimum 5,000 miles | Minimum 1,000 miles or less |

| OCBC$, Citi ThankYou points, HSBC Rewards Points, Citi MilesBOC Points, DBS Points, UOB UNI$ | Maybank TREATS (KrisFlyer; Asia miles minimum 2,000) | OCBC Travel$, AMEX Membership Rewards, OCBC VOYAGE Miles, SCB 360 Rewards Points |

CONVERSION FEES

[[nid:468718]]

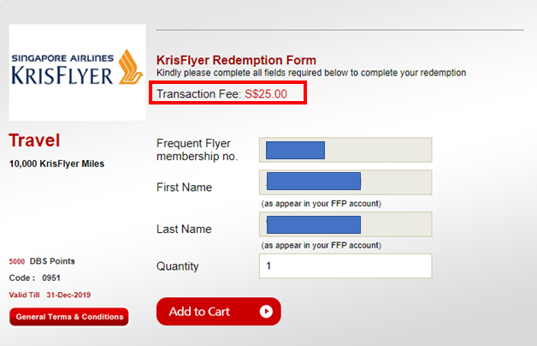

Remember that bank cards earn points, not miles. This means that you'll need to convert your points into miles, which usually attracts a fee of $25.

In general, banks waive the conversion fees on their premium cards. If you're an OCBC Voyage (income requirement: $120,000), UOB Reserve ($500,000) or AMEX Platinum ($50,000-$200,000, depending on the card) cardholder, you won't need to pay a conversion fee.

That said, OCBC also offers fee-free transfers for the OCBC 90N card, a mass market card launched earlier this year.

POINTS POOLING

If you have more than one card with a given bank, it helps if points are pooled together, as this avoids the need to pay multiple conversion fees.

For example, UOB pools points, so if I have 3,500 UNI$ on my UOB Preferred Platinum Visa and a further 1,500 UNI$ on my UOB Visa Signature, I can convert a total of 5,000 UNI$ to KrisFlyer, paying a single conversion fee.

In contrast, Citibank does not pool points, so if I have 20,000 ThankYou points on my Citi Prestige and a further 20,000 ThankYou points on my Citi Rewards Visa, I can't convert anything as I've not hit the minimum 25,000 points on either card. Also, when I do convert my points, I'll need to pay two separate fees.

POINTS VALIDITY

When you earn KrisFlyer miles on a cobrand card, they're deposited directly into your KrisFlyer account and the three year expiry countdown starts immediately. However, when you earn points on a bank card, you can choose when to start the countdown by transferring the points.

In other words, your points have 'two lifespans' - one on the side of the bank, and one on the side of the airline. Here's where it gets a bit confusing, because banks may apply different expiry policies depending on the card you hold.

For example, DBS Points expire after one year, but if they're earned on the DBS Altitude, they never expire. Likewise, Citi ThankYou points expire after five years, but if they're earned on the Citi Prestige, they never expire either.

| 5 years | 3 years | 2 years | 1 year | No expiry |

| Citi ThankYou points | HSBC Rewards Points, SCB 360 Rewards | UOB UNI$, OCBC$ | Maybank TREATS, DBS Points, BOC Points (12-24 months) | OCBC VOYAGE Miles, OCBC Travel$, Citi Miles, AMEX Membership Rewards |

So while the above table lays out the general rules, always be sure to check the T&Cs of your particular card.

TRANSFER PARTNERS

[[nid:469872]]

Not all banks are equal when it comes to transfer partners.

Although all banks offer KrisFlyer and most offer Asia Miles, if you'd like more exotic frequent flyer programs, you'll have to look at SCB, AMEX or Citibank.

It's beyond the scope of this article to explain why you'd want to earn anything other than KrisFlyer miles, but to summarise: certain frequent flyer programs may offer sweet spots to particular destinations.

This means that you'll require far fewer miles (and therefore credit card points) if you pick the right programme.

CONCLUSION

Although the sheer variety of bank points may seem intimidating, the good news is that most people will only need to be familiar with one or two. That said, the more schemes you know, the easier it will be to compare and evaluate different bank cards.

This article was first published on SingSaver.com.sg.