Better Buy: Propnex vs. APAC Realty

Singaporeans have a long-standing love affair with owning property.

As the nation modernised over the past 55 years, the value of its real estate has followed suit.

This trend has made millionaires of those who invested in property during those early years.

That insatiable hunger to own an investment property has not diminished even when Covid-19 hit our shores.

Even as physical viewings of show flats and new condominiums ground to a halt, property agents conducted virtual tours of houses for interested buyers.

The two largest property brokerage firms in Singapore are Propnex Limited (SGX: OYY) and APAC Realty Ltd (SGX: CLN).

Propnex has over 8,500 sales professionals as of May 9, 2020 and is an integrated real estate services group that provides services such as real estate brokerage, training and consultancy.

APAC Realty is a leading real estate services group that holds the exclusive ERA regional master franchise rights for 17 countries in Asia-Pacific. The group has more than 17,300 salespeople across 651 offices.

With the property market looking lacklustre, both companies have also seen subdued demand for their services.

However, with Phase II of the post circuit breaker measures kicking in on 19 June, property viewings will be allowed.

Investors may wonder which of the two real estate services firms makes the better investment. Let's have a look at several aspects.

Investors should note that only Propnex had released a full set of financial statements for the first quarter of 2020, while APAC Realty only released a business update.

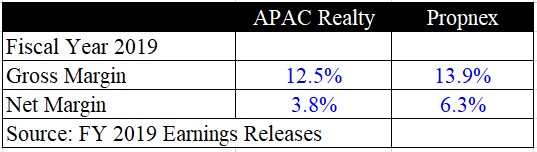

Hence, I will be using the fiscal year 2019 numbers to obtain a fair comparison of each business.

For 2019, Propnex chalked up a slightly higher gross profit margin compared to APAC Realty, while net margin was also higher at 6.3 per cent.

This fatter margin could indicate that Propnex has a more efficient cost structure compared to APAC Realty.

Winner: Propnex

Both real estate services firms pay out a regular dividend. Propnex started paying an interim dividend last year.

Investors should note that both companies had reduced their dividends on a year on year basis due to the implementation of the property cooling measures in July 2018.

The move had dampened demand for property and reduced overall property transaction volume and value.

However, APAC Realty still paid out a respectable level of dividends at S$0.02 last year, while Propnex paid out slightly more at $0.0275.

In terms of dividend yield, both companies are offering a roughly 5 per cent historical yield.

As Covid-19 has impacted property viewings in the second quarter of 2020, both companies may report weaker results and possibly lower interim dividends, too.

But based on last year's dividend level, Propnex is slightly ahead with a 5.1 per cent dividend yield.

Winner: Propnex

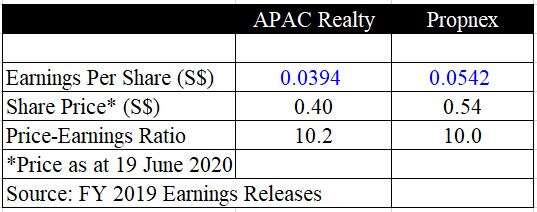

Finally, we take a look at which company is trading at a more attractive valuation.

Based on the earnings per share last year, APAC Realty is only slightly more expensive at 10.2 times earnings, versus 10 times earnings for Propnex.

Winner: Propnex

At this point, both companies are not able to quantify the exact financial impact due to COVID-19.

APAC Realty has mentioned that real estate transactions have taken longer to be completed and the collection period from developers will also be lengthened.

These negative effects will be felt only in the third quarter of 2020 due to a time lag.

[[nid:492856]]

Propex has stated that the private residential market could see a 27 per cent year on year contraction to an estimated 14,000 units, thereby impacting earnings in the short-term.

The HDB resale could see a drop of 7 per cent to 11 per cent in the volume of transactions due to the circuit breaker measures.

However, both firms have been proactively training their agents during this lull period to sharpen knowledge and ensure relevance.

Technological tools have also been employed to ensure some level of business continuity.

These include the use of telecommuting to connect with clients, virtual viewings to showcase the interior of properties, and consumer webinars to keep clients updated on what's going on.

The real estate services industry is going through a temporary tough period but should see a gradual but slow recovery as the circuit breaker measures have now been lifted.

Propnex has the better numbers of the two and investors could consider adding it to their watchlists.

For the latest updates on the coronavirus, visit here.

This article was first published in The Smart Investor.