Buy-now, pay-later plans: Are they really worth it?

In Singapore, over 1.1 million people have used a Buy-Now, Pay-Later (BNPL) solution when buying something online or in stores. These plans allow you to purchase things immediately and pay off the bill in smaller, monthly instalments.

While it's tempting to get something you really want without having to pay for all of it at once, there are still risks associated with paying off a purchase in increments. You may wonder if these plans are actually worth it.

Below, we've listed some pros and cons you should take into consideration when deciding whether or not to use a BNPL plan.

BNPL plans are primarily popular with online shoppers because you don't have to pay the full price upfront.

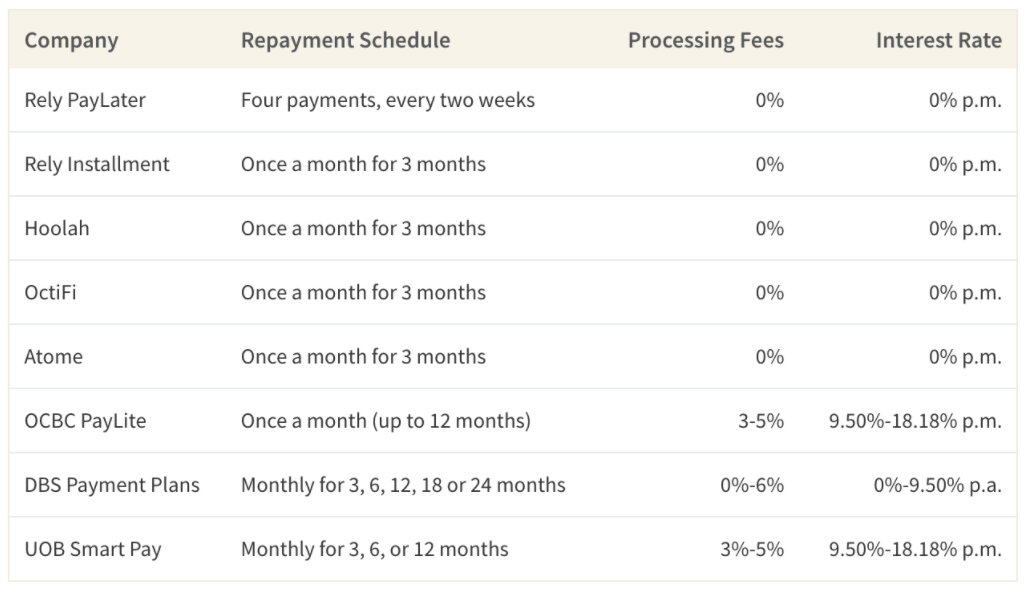

This way, you avoid postponing your purchase until you've saved up enough cash (which can take weeks or even months). Furthermore, BNPL plans are also alluring because they charge little-to-no interest and processing fees, and have near-instant approval, allowing for a seamless shopping experience.

Some companies, like Rely, even offer cashback promotions if you make your payments on time.

BNPL plans are a legitimate way to pay for something if you don't have the funds right away. For instance, you can buy a kitchen appliance, like a refrigerator, or a computer for work or school, without hurting your bank account.

As is common with other loans, failing to make payments on time results in late fees.

For instance, Hoolah charges between $5 to $15 in late payment charges, depending on how much you borrowed. While this may not seem like much initially, it's an additional charge that you would not have to pay if you waited to buy the item in full.

Besides extra fees, late payments could result in account termination. If you do decide to shop via BNPL, you should make sure to set aside funds that are devoted to paying off the monthly payments. You should also avoid becoming too dependent on BNPL plans to the point where you are unable to afford all the monthly payments.

Unfortunately, BNPL has become so tempting for shoppers that the Monetary Authority of Singapore has started investigating the role of BNPL schemes contributing to growing debt. In fact, according to a recent survey by Finder, 27 per cent of Singaporeans who reported using a Buy Now Play Later scheme believed they were financially worse off because of it.

The allure of these types of payment options resulted in people buying more things on impulse and overstretching their budget. Since you are breaking down your purchases into smaller monthly payments, it's harder to see how much you actually spent, which can result in mismanaged finances.

If you find yourself in a position where making your monthly installments is difficult, you should discuss these concerns with a representative of the BNPL company.

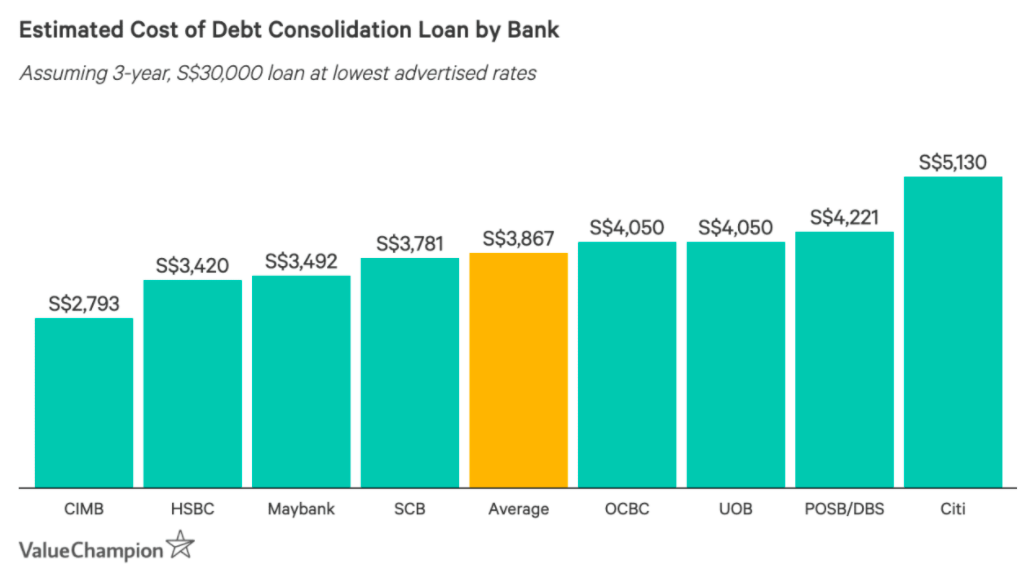

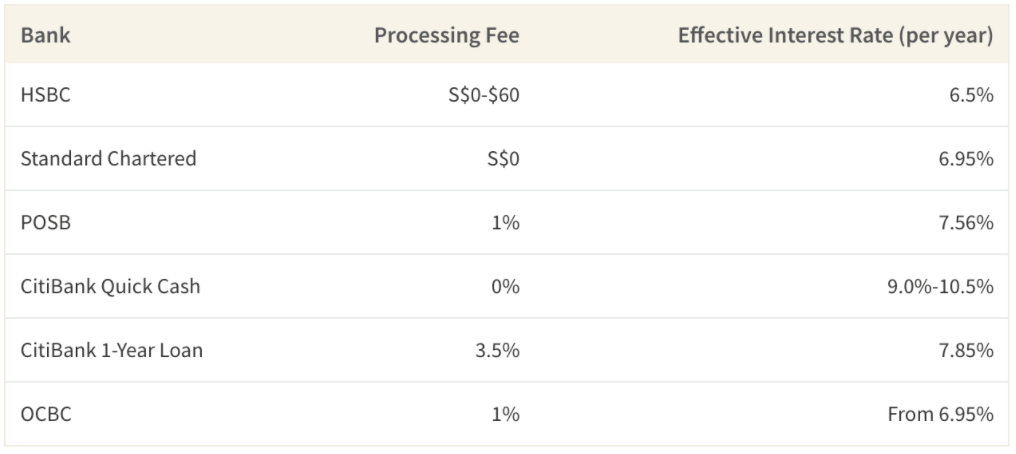

Some companies, like Atome, may allow you to push back your repayment date.If your debt is unmanageable, however, you might want to look into a debt consolidation plan, which amalgamates all existing debt into one loan for you to pay back. These typically charge interest rates of 2.77 per cent to 5.75 per cent per annum and last up to 10 years.

You may be wondering how a BNPL plan compares to other forms of credit, like credit cards.

At its core, credit cards and BNPL both allow you to pay in advance for things, though credit cards will give you a higher spending limit. Moreover, credit cards will typically charge you a monthly installment based on how much you spend overall (ie, $50 minimum or 3 per cent) of your statement.

On the other hand, BNPL plans are micro-loans for individual items you purchase. Additionally, BNPL payments are automatically withdrawn from your accounts. While you can set automatic withdrawals with a credit card, this is not the default.

Alternatively, personal loans are better for larger projects and expenditures, like wedding costs or a vacation.

This is since taking out a loan means you will only pay one monthly payment over years, rather than using multiple BNPL plans for several expenses and losing track of them. However, they usually have higher interest rates than BNPL plans. Additionally, to take out a personal loan in Singapore you must have a minimum annual income of $20,000 and borrow at least $1,000.

On the other hand, BNPL companies only require their users to have a Singaporean address, Singaporean-issued bank card, and be 21 or older.

If you need to buy an expensive item (like a work laptop) immediately but can't afford the full payment at checkout, then a BNPL plan could be a good option.

Since BNPL plans often charge little or no processing fees and provide an interest-free period, you can manage your purchase in smaller, more digestible payments. They're also good options if you have a steady cash flow but may be in a place where you want to reduce how much credit you're using in a particular month.

Alternatively, if you are looking to fund something large like a wedding or renovation, then it will be worthwhile to just take out a personal loan. This gives you a lump sum to pay back monthly.

That said, BNPLs are not good for people who are chronically low on cash. While it is tempting to shop and only pay a little bit for your purchases each month, you are still liable for paying back to the entire amount. Failure to do so can result in penalties and loan default.

Thus, for impulse purchases and items that are financially out of reach, the best financial decision is to wait until you can pay for what you want upfront. This way you won't be beholden to any additional monthly payments and won't risk getting into debt.

This article was first published in ValueChampion.