Car insurance in Singapore: All you need to know to get the cheapest rate (2022)

"Woo hoo! It's time to renew my car insurance, I'm so excited," said no one ever. Yes, we may love our cars - but the main reason we buy car insurance is that it's compulsory in Singapore.

Unlike almost everything else in the world (including cars!) where it's pretty easy to comparison-shop for the cheapest prices, car insurance is a tricky one because prices for premiums are quoted on a case-by-case basis. On top of that, not every insurer will reveal their prices easily or quote you a price online.

So if you're looking to renew or buy car insurance, it makes total sense to use a free tool like MoneySmart's Car Insurance Comparison Tool to help you find the best price on the market.

Of course, that doesn't mean you should slack off. You should take charge of your car insurance policy, because ultimately you have to know what you paid for, in the event that you have to file a claim. Touch wood.

We've made it easy for you to know all about the essentials of car insurance in Singapore with this comprehensive guide.

Two words: Too much. You can expect to pay anything from $700 to $1,000 - or more! - for a year's coverage.

Your car insurance annual premium is calculated on a case-by-case basis. Basically, insurers try to work out how likely it is you'll end up in an accident and how expensive it will be to foot the bill (i.e., the risk they bear) by looking at the following factors:

| Factor | Rule of thumb |

| Age | Generally, you can get the cheapest premium from age 30 to 65. Below 30, the younger you are, the more expensive car insurance will be. |

| Gender | Some insurers think women are safer drivers and charge less if the named driver is a woman. |

| Marital status | Married people are seen as more responsible drivers, and can sometimes get cheaper premiums. |

| Occupation | An “indoors” job in an office can get you cheaper premiums. Outdoor or sales-driven jobs suggest heavy car usage, therefore more costly to insure. |

| Driving experience | The longer you have been driving (ideally four years or more), the cheaper the premium. |

| Claims history | The fewer car insurance claims made in the past, the cheaper the premium. |

| No Claim Discount (NCD) | For every year that you’ve driven and didn’t have to make a claim, you get a 10 per cent discount. You can accumulate your No Claim Discount (NCD) up to 50 per cent off, i.e. after five claim-free years. |

| Certificate of Merit (COM) discount | If you did not get any demerit points in the past three years, you can get a 5 per cenr discount off your car insurance (after deducting NCD) from selected insurers. |

| Make & model of car | The more basic the car is, the cheaper the premium. You have to pay more to insure continental cars, luxury cars and SUVs as their parts are more costly to replace. Expect to pay higher premiums for large engine capacities and/or car modifications. |

| Age of car | The older the car, the cheaper the premium — up to about 10 years old. Subsequently, premiums will go up as your car starts disintegrating. |

| Car usage | The less you drive, the cheaper the premium, since you lower the likelihood of accidents by not using the car. |

You can't change your age, driving experience, claims history or car. But you can shop around and see who will give you the best price for your profile and car. Start by getting quotes from at least five or six car insurance companies.

However, don't just pick the cheapest car insurance you see. If you aren't properly covered, cheap insurance is worse than no insurance because you're just flushing money down the drain.

Cheap premiums sometimes go hand-in-hand with high excess (the amount you have to pay upfront before the insurer will start paying for the rest) and/or horrible terms & conditions (i.e. you can't claim shit because everything is excluded). Read the policy wording to make sure you'll actually get the coverage you want.

If you have decided on a likely contender, check if your plan can be customised, which insurers like AXA and AIG allow. You may be able to tweak some elements of your plan to get cheaper car insurance premiums:

| Factor | Rule of thumb |

| Excess | Choose a higher excess for cheaper premiums. But be warned that you will have to pay more up front if you get into an accident! See below for more. |

| Choice of workshops | If you don’t mind being restricted to a list of authorised workshops, you can get a cheaper rate. |

| Named driver(s) | You can add other drivers (e.g. your kids or spouse) but it will cost more. |

| Age of driver(s) | If you don’t need to cover a younger driver, you can increase the age limit (e.g. 30/35/40 years old and above) for lower premiums. |

| Car rental | To get a cheaper rate, forgo loss of use benefits like rental cars or transport allowance (in the event that your car is stuck at the workshop). But if not having a vehicle will badly affect your livelihood or lifestyle, you might want to add on this option. |

| Personal accident insurance | If you’re covered by a separate PA insurance plan, some insurers allow you to skip PA insurance for a cheaper rate. |

| Overseas coverage | Some insurers offer an overseas coverage add-on. Unless you drive up to Malaysia a lot, it’s safe to skip this one. |

| NCD protector | If you don’t mind forfeiting your NCD, you can skip this add-on to save money. But we recommend adding it if you have achieved a fairly high NCD, otherwise, that’s four or five years of safe driving flushed down the toilet. |

"Excess" refers to the amount you have to pay out of your pocket before the insurance company pays for the rest.

For example, Ryan is coasting down the freeway, headbanging to a Linkin Park album when a tree jumps in his path. He slams into it, and the cost to fix his car is $2,000. His excess is $600 (for a pretty comprehensive plan). So he just pays $600, and the insurer forks out the remaining $1,400.

Excess is inversely related to the cost of the car insurance plan. In plain English, this means…

Low excess = expensive insurance premium. If an accident happens, you'll be very glad you need to fork out only $600, especially since you might already be stressing out over medical bills and having a rough time in general. But you will feel very broke when you pay for your annual car insurance premium. If you're looking for a low excess of $300 to $400 or so, you can expect to pay $3,000 upwards for your annual premiums.

High excess = cheaper insurance premium. The good news is, you'll get a bargain on your car insurance. The bad news is, you'll be afraid to drive your car. This is a risk you might not want to bear unless you're the safest driver on earth and enjoy the protection of a prominent deity.

Note that if you add on a perceived "risky" driver - e.g. your kid (under 23 years old with less than two years of driving experience) who's just gotten her driver's license - your insurer might force you to accept an additional young and inexperienced driver excess without any discount on your premium.

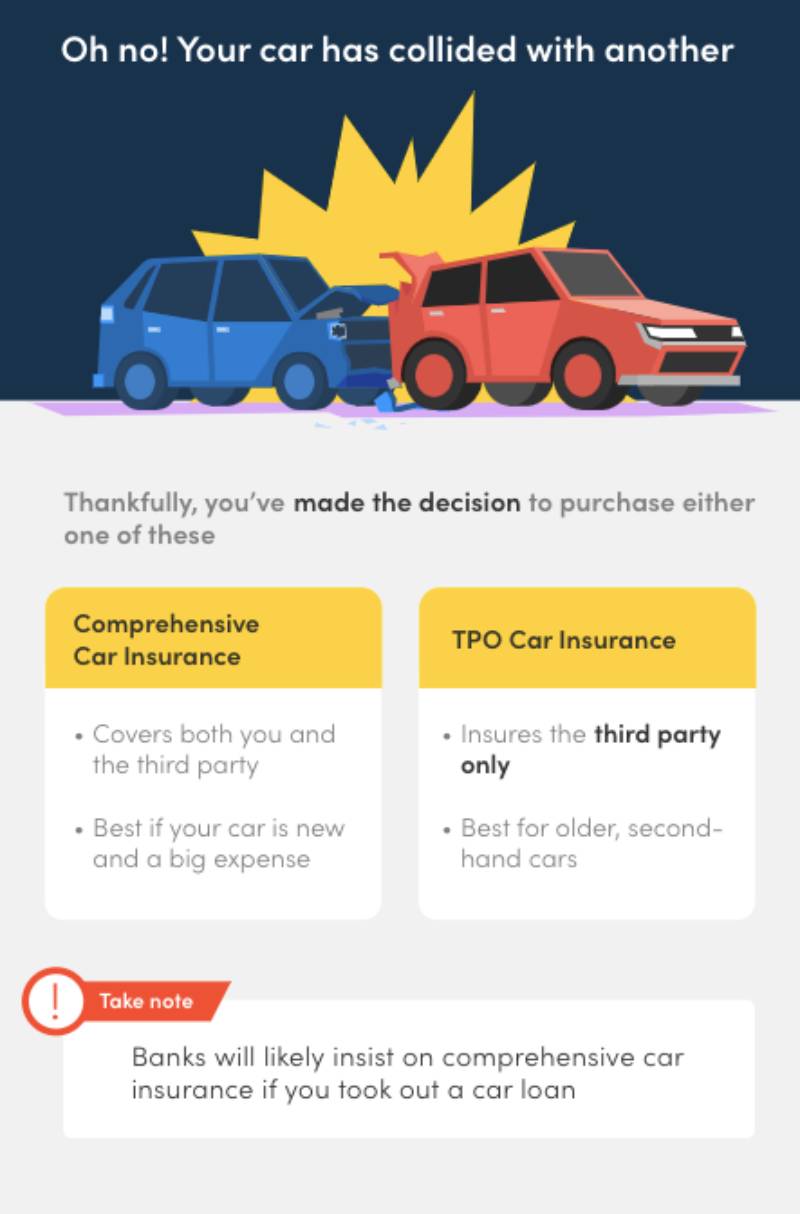

TPO car insurance is the minimum requirement in Singapore. It's cheaper and only covers damages to other people's cars. If you bump into someone's fender and he responds as though you had taken liberties with his wife, you can claim for the damage to his car to shut that loser up. But you can't claim any damage to your own car.

Comprehensive car insurance usually costs a few hundred bucks more but covers basically anything that might happen to your car plus any other parties involved. As the name suggests, this kind of car insurance policy has the widest coverage including things like flooding… which never happens in Singapore because we only experience "ponding" (see section 12).

Which one you choose depends mainly on the car's value and age.

Consider TPO if your car is at least ten years old and fully paid off, or if you have a cheap (ha, "cheap") second-hand car and it's already banged up anyway. If it's really badly damaged, you might choose to scrap the car.

If you saved for years for your brand-spanking new car, you'll definitely want to get comprehensive car insurance. Otherwise, you'll be in a world of pain when it inevitably gets damaged. The difference in price isn't huge anyway.

Oh, if you bought the car on a bank loan or if you're still paying the instalments, you might not have a choice. No bank wants to repossess a Subaru from a drain.

When you sign a car insurance contract, you are the default "named driver". In other words, figures like the excess pertain to you.

Those figures change if an unnamed driver wrecks your car. So you may pay an excess of $200 if you wreck the car, but if your brother removes a lamp post with it, the excess might be $1,200 instead.

Instead of letting that happen to you, consider adding other drivers. This used to incur higher premiums, but these days many insurers will allow you to add three to five named drivers for free, as long as they are at least 27 years old and have a minimum of two years' driving experience.

If your kid brother is always "borrowing" your car for his late-night prata runs, you might want to think twice before adding his name though. Some insurers will force a high excess upon you e.g. $3,000 if you add a young or inexperienced driver to your policy.

The NCD (No Claim Discount) or NCB (No Claim Bonus) is a discount applied to your premium if you've been good. You get this in increments of ten per cent when you don't file any car insurance claims for the year, and it accumulates for each year without a claim.