DBS Live Fresh Card review 2021: Not just another pretty card

Singapore's go-to bank DBS must really want to change up their mundane, workaday image - just look at the snazzy DBS Live Fresh Card.

The cashback credit card got a huge makeover, thanks to sneaker artist Mr SBTG two years ago, to appeal to the millennial crowd.

I'd say it worked, because I've never really had any sort of impression of DBS and POSB credit cards.

Let's see if the DBS Live Fresh Card has the substance to match its style.

| DBS Live Fresh Card | |

| Annual fee & waiver | $192.60 (waived for one year) |

| Supplementary annual fee | $96.30 |

| Interest free period | 25 days |

| Annual interest rate | 26.80 per cent |

| Late payment fee | $100 |

| Minimum monthly repayment | three per cent or $50, whichever is higher |

| Foreign currency transaction fee | 3.25 per cent |

| Cash advance transaction fee | eight per cent or $15, whichever is higher |

| Overlimit fee | $40 |

| Minimum income | $30,000 (Singaporean/PR) / $45,000 (non-Singaporean) |

| Card association | Visa |

| Wireless payment |

Apple Pay, Samsung Pay, Google Pay |

The DBS Live Fresh Card is a basic cashback credit card, but it's not one my parents will appreciate.

There are absolutely no perks for necessities like grocery shopping, petrol or utilities. Instead, the card privileges are for fashion and dining, and the bonus rebates are for online shopping.

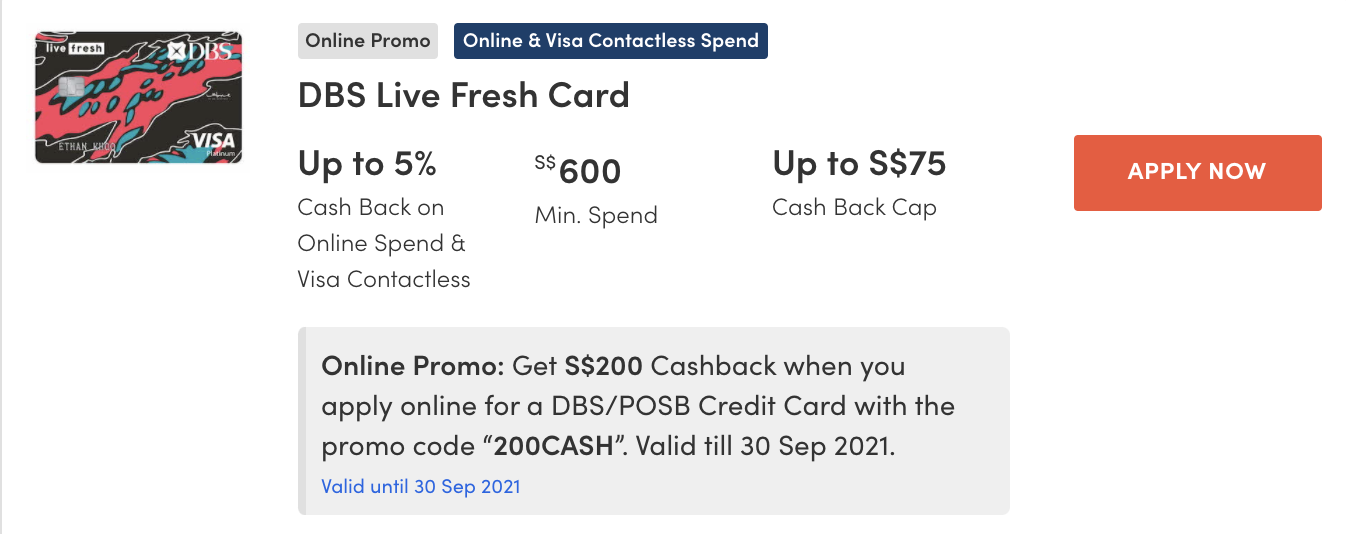

100 per cent targeted at millennials, the DBS Live Fresh Card offers up to five per cent cash rebate on Online and Visa Contactless Spend. Everything else earns 0.3 per cent - almost negligible in my opinion.

Total monthly cashback is capped at $75, which is quite low.

Adding to that, the cap is further split into three categories - $20 for Online Spend, $20 for Visa Contactless Spend and $20 for all other spend, plus $15 cashback on sustainable spend, if you can be bothered to game that.

It doesn't take a genius to realise that the cash rebates are a tad stingy, especially for a card with a $600 minimum spend requirement. So why is this card still popular?

If you haven't already guessed, the DBS Live Fresh Card belongs in the pockets of the hip millennials who rely on the internet to get stuff done.

There aren't any specific bonus rebates for key categories (like groceries, dining and the likes), but in this day and age, you can pay for everything with just a click or wave right?

If it can't be ordered online, cardholders can make use of the five per cent cashback on contactless payment methods to still earn some rebates when spending on those necessities. But bear in mind - cashback is capped at $20.

When the card was re-launched in 2017, the DBS Live Fresh Card had a super generous bonus cashback promotion (think five-plus-five per cent cashback), but those days are gone.

READ ALSO: DBS Altitude card review 2021: The air miles card for fresh grads and young working adults

To get decent discounts on your favourite online merchants like Lazada and Expedia, you'll have to look through the DBS Lifestyle app or dig through the DBS credit card promotions page.

You can also expect hassle-free rides when you take the bus and train with your DBS Live Fresh Card. Never bother about topping up the value in your EZ link card again. Actually, you won't even need it anymore.

Get up to 28 per cent cashback with promo code "MORECASH" upon signup via digibank or Myinfo. Available through Jan 31, 2022.

Almost all the banks in Singapore are fighting over millennial dollars - after all, young Singaporeans have zero brand loyalty (how many credit cards do you have?) and can be easily persuaded to part with what little money we have.

So as expected, the DBS Live Fresh Card has some serious competition. Let's see how it stacks up against the others:

Another credit card obviously targeting the same demographic as the DBS Live Fresh Card, the UOB EVOL Card offers a more attractive eight per cent cashback for weekend dining and entertainment categories, but with the same cashback cap of $60.

For young people who go out a lot, this is a lot more versatile offline. You won't have to patronise only outlets with Visa payWave. That means you can go to all the indie cafes and dive bars you want.

I never gave CIMB much thought until I came across this credit card. It gives you an amazing ten per cent cashback when you spend on online spending, groceries, beauty and wellness services, as well as pet shops and veterinary services.

The drawbacks are its horribly tedious minimum spend requirement of $800 a month and the cap of $100 per statement for the ten per cent cashback.

Although this is a rewards credit card, it's a viable alternative to the DBS Live Fresh Card for someone with the same spending profile.

You get up to UNI$10 per $5 spend on online shopping and entertainment, as well as making contactless payment. You can also earn SMART$ rebate at over 300 participating outlets and use it to offset your next purchase.

I think the UOB Preferred Platinum Visa Card is a near-perfect alternative to the DBS Live Fresh.

Sure, you earn rewards instead of cashback, but which millennial would turn down air miles, right?

READ ALSO: Saving savvy: The best free budgeting apps in Singapore to manage your spending

This article was first published in MoneySmart.