Is Frasers Hospitality Trust considered a steal at its share price of $0.49?

Frasers Hospitality Trust is the first global hotel and serviced residence trust to be listed on the Singapore stock exchange in 2014.

At the time of writing, Frasers Hospitality Trust’s share price (technically known as unit price for REIT s and trusts) stands at $0.49.

At that unit price, the trust looks undervalued since its price-to-book (PB) ratio is below 1x.

However, is Frasers Hospitality Trust cheap for a reason or is there an attractive investment opportunity for long-term investors?

Let’s explore using my 10-step guide to pick the best Singapore REITs .

As a summary, here are the 10 steps I use to pick the best Singapore REITs:

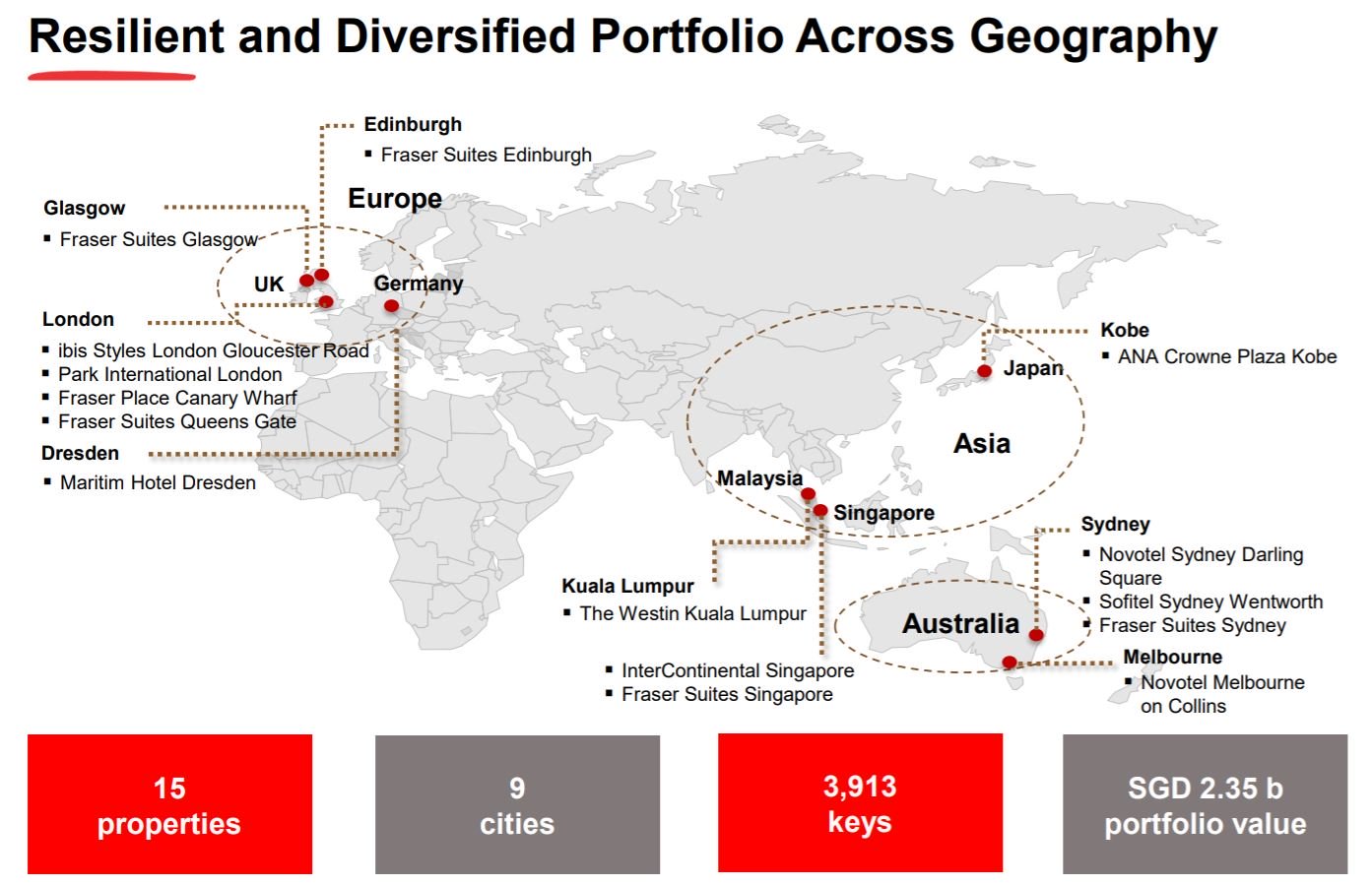

Frasers Hospitality Trust provides investors exposure to one of the largest international hospitality portfolios.

Its portfolio consists of nine hotels and six serviced residences located in prime locations in nine main cities in Asia, Australia and Europe.

In Singapore, Frasers Hospitality Trust owns InterContinental Singapore and Fraser Suites Singapore.

Frasers Hospitality Trust is a stapled group comprising Frasers Hospitality Real Estate Investment Trust and Frasers Hospitality Business Trust.

A “stapled group” means that if an investor buys units in Frasers Hospitality Trust, the investor would own both the Frasers Hospitality Real Estate Investment Trust — a REIT — and Frasers Hospitality Business Trust — a business trust.

Frasers Hospitality Trust’s sponsor is Frasers Property Ltd, a large Singapore-listed property developer and investor. As of November 22, 2019, Frasers Property held a 24 per cent stake in Frasers Hospitality Trust.

Check for: Increasing gross revenue and NPI

Frasers Hospitality Trust has a financial year that ends on September 30 each year.

Here, let’s understand more about how the trust has performed from FY2015 to FY2019. Do note that FY2015 spanned from July 14, 2014 (listing date) to September 30, 2015.

| FY2015 | FY2016 | FY2017 | FY2018 | FY2019 | Compound Annual Growth Rate (CAGR) from FY2016 to FY2019 | |

|---|---|---|---|---|---|---|

| Gross Revenue ($' million) |

128.7 | 123.6 | 158.7 | 155.9 | 149.8 | 6.6 per cent |

| Net property income ($' million) |

105.7 | 104.2 | 120.2 | 117.0 | 111.7 | 2.3 per cent |

Excluding FY2015, Frasers Hospitality Trust’s gross revenue and NPI have increased at an annualised rate of 6.6 per cent and 2.3 per cent, respectively, over the years.

For FY2019, both gross revenue and NPI fell largely due to foreign exchange impact and weaker performances from the trust’s Australia and Malaysia portfolios.

Verdict: Pass

Check for: Increasing DPU

Next, let’s find out how Frasers Hospitality Trust’s distribution per stapled security (DPS; similar to DPU for REITs) has performed.

| FY2015 | FY2016 | FY2017 | FY2018 | FY2019 | CAGR from FY2016 to FY2019 | |

|---|---|---|---|---|---|---|

| DPS (Singapore cents) | 7.56 | 5.23 | 5.05 | 4.76 | 4.41 | -5.5 per cent |

Over the past four years, Frasers Hospitality Trust’s DPS has been falling, which is not a good sign.

For the second quarter of FY2020, DPS fell further by 68 per cent year-on-year to 0.3137 Singapore cents mainly on the back of lower travel demand from the Covid-19 pandemic.

Verdict: Fail

Check for: Property yield of between 5 per cent and 9 per cent

Frasers Hospitality Trust had an NPI of $111.7 million and a portfolio valuation of $2.3 billion for FY2019, giving a property yield of 4.8 per cent.

Frasers Hospitality Trust fails this criterion too.

Verdict: Fail

Check for: Gearing ratio below 40 per cent

As of March 31, 2020, Frasers Hospitality Trust had a healthy gearing ratio of 36 per cent, which is below my limit of 40 per cent.

Verdict: Pass

Check for: Interest coverage ratio above five times

Frasers Hospitality Trust had an interest cover of 4.1 times as of end-March 2020, which doesn’t meet my criterion.

Verdict: Fail

Check for: Healthy portfolio occupancy rate

Frasers Hospitality Trust’s Australia portfolio brings in the bulk of gross revenue for the trust. Therefore, we will focus on this geography for our portfolio occupancy rate check.

[[nid:494179]]

For the second quarter of FY2020, the Australia portfolio had an occupancy rate of 72.4 per cent, down from 88.2 per cent a year ago, due to the Covid-19 pandemic.

However, the latest rate was much higher than the occupancy rates of the property portfolios in other countries.

Australia latest portfolio’s occupancy rate of 72.4 per cent is also not far off the average occupancy of hotels, resorts, and serviced apartments in the country of around 75 per cent at end-2019 (latest data unavailable).

This somewhat shows the resiliency of Frasers Hospitality Trust’s Australia portfolio.

Considering the above, I’m giving this criterion a pass.

Verdict: Pass

Check for: Positive rental reversions

Frasers Hospitality Trust’s properties are under master leases.

As of September 30, 2019, the weighted average lease expiry (excluding a master lease for Novotel Melbourne on Collins) was 14.3 years.

In my opinion, the rental reversion criterion is not applicable to Frasers Hospitality Trust since there’s no option to renew leases on an ongoing basis with the potential for rental reversion, unlike many other REITs.

Verdict: Not Applicable

One of the ways for Frasers Hospitality Trust to grow is through acquisitions, as seen below:

On that front, Frasers Hospitality Trust’s sponsor, as well as strategic partner TCC Group Investments, have granted the right of first refusal (ROFR) to a pipeline of hospitality assets for the trust to acquire.

The ROFR arrangement ensures that the sponsor and strategic partner offer the properties to Frasers Hospitality Trust for purchase consideration first before any other company.

With a strong balance sheet, Frasers Hospitality Trust has the potential to lever up to acquire those properties.

Verdict: Pass

Check for: Acceptable price-to-book ratio

At Frasers Hospitality Trust’s current unit price of $0.49, it has a PB ratio of 0.69x, which looks undervalued since it’s below 1x.

Verdict: Pass

Check for: Distribution yield to be above 5 per cent

At Frasers Hospitality Trust’s current unit price of $0.49 and based on FY2019 DPS, its distribution yield will be 9 per cent.

[[nid:492054]]

However, the high yield is not sustainable with the headwinds from Covid-19.

In the first half of FY2020, DPS was 1.6438 Singapore cents. Frasers Hospitality Trust will be retaining a large portion of that and will be distributing only 0.3287 Singapore cents per stapled security for the period.

Annualising that amount, we arrive at FY2020 projected DPS of 0.6574 cents (assuming the retained portion is not given out in the current financial year).

At Frasers Hospitality Trust’s unit price of $0.49, its projected distribution yield then falls to just 1.3 per cent.

Verdict: Fail

Frasers Hospitality Trust has a final score of 5/9.

After analysing the hospitality trust, in my opinion, Frasers Hospitality Trust looks cheap for a reason.

Despite its low PB ratio, I’m not attracted to the trust due to its falling DPS, low property yield, and unattractive distribution yield.

Therefore, I’ll skip investing in Frasers Hospitality Trust.

This article was first published in Seedly. All content is displayed for general information purposes only and does not constitute professional financial advice.