How to invest in a recession or bear market (2020 edition)

It is during these recessions where there might be some of the best opportunities in the stock market. It is often a great time to invest, for those brave enough. How to invest in a recession or bear market could potentially be the million-dollar question that you have got to ask.

I have asked this question before in my previous article: When to buy stocks in a recession. The ideal time to pick a bottom. What constitutes a recession and are we already in one?

A recession is often characterised by two consecutive quarters of negative GDP growth rate. At that point in my writing just a week ago, I highlighted that the Bloomberg Recession Tracker calculated the odds of a recession at 53 per cent.

In the latest update on April 8, the probability of a recession happening over the next 12 months is now 100 per cent. According to Bloomberg, a US recession is imminent.

The current economic downturn is undoubtedly going to be a painful one for many. Businesses around the world are shuttered with citizens being issued stay-home mandates that could last much longer than most politicians would expect. Many businesses might never recover from this recession.

As scary as this recession might be, one should not be expecting the end of the world due to Covid-19. At some stage, the global economy will recover.

The Great Recession of 2008 seemed like the end of the world to many investors, with the stock market cratering more than 50 per cent from peak to trough.

Yet, it presented a buying opportunity as stocks staged a strong recovery over the next decade which came to become the longest bull market in our history.

The 2020 recession can again create great buying opportunities for investors. Quality blue-chip stocks or stocks with a high level of recurring revenue typically trades at a premium.

The only opportunity to purchases these stocks with any level of margin of safety is during a recession or bear market.

The best companies with a strong balance sheet have the highest probability of surviving the recession, potentially gaining market share when their cash-strapped peers collapsed under the weight of their debt burden.

Identifying these stocks and investing in them when their prices are beaten down “unfairly” could see an investor reaping strong returns in the years ahead.

So what is the best course of action for a typical investor who is now facing a bear market recession? Should one continue to invest in a bear market?

Although I did look to “call” a market bottom in my previous article, using historical recession data, the truth is that historical performance is never representative of what the future might behold and “this time around, it might be different”.

[[nid:480006]]

What a typical investor might consider doing at this stage is to look at his/her portfolio and determine if a rebalancing might be in order.

Ideally, if you were allocated well going into this bear market, with a portfolio that is well diversified across stocks, long-term government bonds, real estate and commodities such as Gold as a hedge, you likely have nothing much to worry about.

For example, if one structures a portfolio like the NAOF portfolio which I recommended in this article for Singaporean investors, the drawdown will be less painful.

Instead of feeling the full wrath of the YTD equity market decline of 22 per cent, this portfolio is “only” down 9.9 per cent (before expenses).

However, after an 11-year bull market, most investors are probably stocks-heavy. That has got to be painful.

Look to rebalance your portfolio. This could mean getting more defensive or getting more aggressive, depending on how you are currently invested.

If you entered this bear market with a sizeable allocation of long-term bonds, now might be the time to start shifting that into stocks in a strategic manner.

Given how interest rates are where they are, which is at ZERO, I can’t see how bonds can appreciate much from hereon.

Use this bear market discount as an opportunity to get more aggressive in stocks.

However, if you are heavy in stocks coming into this bear market, then now might be an opportunity for you to take this “rebound” and sell out some of your weak positions, those stocks that will probably not see the light of the day after this recession.

Lighten up your stock position and move them into cash as you wait for the right moment to pounce on the right stock.

I have earlier highlighted that a recession or bear market presents an opportunity to invest in some high-quality blue-chip names that have been beaten down.

Make a list of stocks that you have always wanted to buy but hesitated due to their premium pricing. Have their prices corrected to an attractive level where value is finally emerging? If so, then start to purchase strategically.

[[nid:485346]]

Billionaire investor Howard Marks told CNBC in a recent interview: “I never believe that I know when’s the bottom, but I know things have gotten a lot cheaper and it’s reasonable to do some buying. If it goes lower, do more buying.”

In my last article, I used historical recession data to show that the IDEAL entry time to enter in this bear market might be when prices have corrected by 50 per cent. However, that is not to say that you should only enter at the 50 per cent drawdown level.

The table below illustrates historical recessions and the peak to trough performance of the market. On average, the max peak to trough decline is 33 per cent and the duration from the start of the recession to the trough is typically 10 months.

Start putting capital to work when you think stocks are at a decently cheap level and get aggressive when the market has corrected 50 per cent or more. History shows that by then, the trough is near.

If you only choose to invest at the 50 per cent drawdown level, then you might risk missing the boat entirely.

I am not going into details of individual stock counters in this article but just to highlight the strategy that I am looking to deploy ahead.

Growth stocks have taken center-stage in the recently ended bull-market. If a recession is to occur, many of these stocks cannot grow because organisations are cutting down on their expenses and hence not willing to spend. Many of these growth stocks, particularly those with a weak balance sheet might well go belly-up.

There are of course some exceptions which I will talk about later.

ALSO READ: Here's how to pick strong dividend companies that can survive recessions

But in general, the idea is to focus on companies with strong fundamentals, those with good business models that ensure enduring growth even in a recession.

Yes, there might be some minor near-term earnings hiccups, but these companies are in the best position to weather a pandemic crisis like the current one and emerge a much bigger entity from it.

For example, we have Walmart, a traditional retailer that has transform itself and has proven to be extremely resilient in the current market downturn due to its strong positioning as the go-to big box store for all your daily necessities.

It also helps that Walmart is increasing its e-commerce presence and adding digital capabilities inside its stores. Significant acquisitions and partnerships done over the years now makes Walmart’s e-commerce strategy a strong contender against Amazon.

In times of a crisis like this current one where revenue might be significantly impacted, a strong balance sheet becomes extremely critical.

Companies with inadequate cash or a truckload of debt lack the financial flexibility to navigate the economic disruption.

[[nid:484076]]

While not necessarily requiring a net cash position, companies who are moderately geared (below 0.5x net debt to equity) might also fall under this category, especially if this is coupled with strong cash-generating ability.

Such stocks should generate consistent free cash flow where additional capital can be used for dividend payments and share buybacks.

Ideally, these stocks are blue-chip names that have a fantastic record of paying dividends consistently as well as doing share buyback, not from borrowings but free cash flow.

Ultimately, the goal is to identify stocks that have been beaten down alongside the market but has the potential to emerge stronger out of the crisis.

To do that, it needs to have a solid balance sheet and a good cash generation profile to capitalise on opportunities in this crisis.

These are stocks that likely falls under the “growth” category as they are definitely not “cheap” from a valuation standpoint but their products are radically changing the world. Examples are artificial Intelligence, 5G, cloud, Big Data, etc.

Stocks from these categories are unlikely to be categorised as value, likely falling in the growth category.

While they might seem expensive on a PER basis, these stocks also possess the same traits which I highlighted earlier on a company fundamental: ie, enduring business model, strong balance sheet and cash-generating abilities.

[[nid:468118]]

A key differentiating factor between a potential “winner” and a “loser” is that these game-changers, while having products/services that are revolutionary and often disruptive, also spot a healthy balance sheet with strong cash-generating abilities (Think Amazon and Microsoft).

Some of these smaller companies which have yet to generate much earnings might be unloved and sold off during a recession or bear market.

However, as long as they have a robust business model which is unlikely to be significantly impaired in this downturn as well as a strong balance sheet and cash-generating abilities to tide them over this period where access to capital might be limited, these are game-changing companies that will not only survive but will emerge out of this crisis as a multi-bagger winner.

On the other hand, growth stocks which does not generate much cash could find themselves in serious trouble when funding liquidity dries up alongside their deteriorating top-line.

So now that the probability of a recession over the next 12 months is a certainty, what should we expect of the stock market?

The market entered into a bear market territory in record time back in March and we are currently witnessing a rebound back into bull market territory, again in record time.

Unless this recession that we are about to witness is a mild one, characterised by a V-shape economic recovery, it just does not justify the start of a new bull market, at least for now.

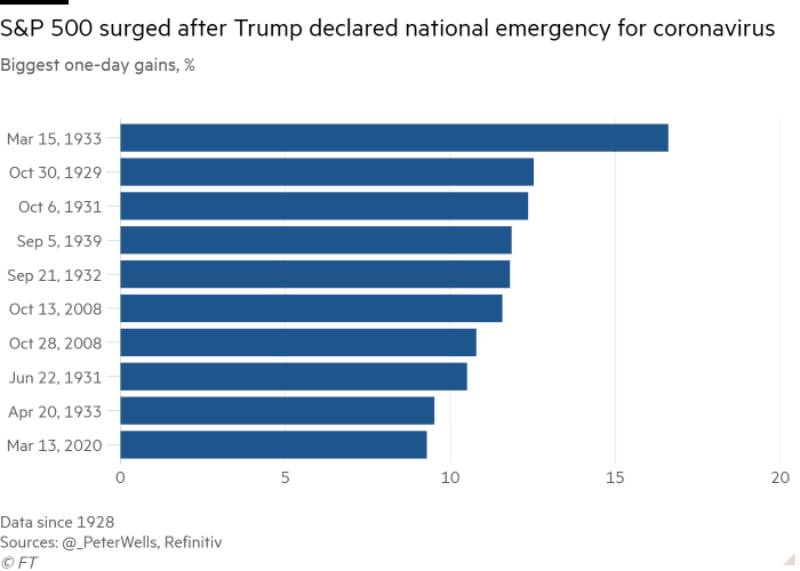

It is not unusual to see big positive swings in a bear market. Of the top 10 biggest daily gains in index history, almost all took place during bear markets.

It is easy to see why the biggest down days happen during a bear market. Investors panic and start dumping their investments. Buyers disappear. Consequently, prices drop like a rock and cash becomes king. Sounds familiar already?

What happens next? Short sellers have to close their positions in an illiquid market, thus driving up prices. Investors who felt they missed the boat, or FOMO (fear of missing out) start piling on and all of a sudden, we might be back in bull market territory again.

The key takeaway: Volatility is going to be the rule of the day. Our current scenario might seem like blue skies ahead, but I will not be too hasty in concluding that these positive spikes in the market represent that the bottom is already in.

The earning season is kicking off and it is likely going to be an ugly one. I sense that companies will take this opportunity to “kitchen sink”, putting the blame on the coronavirus for such drastic actions. This will not just be for 1Q20 but likely for the entire 2020, in a bid to start “afresh” in 2021.

Hence, I believe there will likely be huge downward revisions to the market 2020 earnings forecast after this earnings season is done, which could herald a new wave of market selling.

Well, some say that the market might already be looking at 2021 earnings and with the US fed being the lender and purchaser of last resort, the only direction for stocks from hereon is UP.

ALSO READ: 5 things to consider before you invest during this Covid-19 crash

Whether the market is going to hit a new low or whether it is going to be blue skies ahead, there is always a time to invest in this recession or bear market, particularly in solid companies with strong fundamentals and a resilient business model.

I will start to get aggressive when the market drops 50 per cent from its peak. However, before that, I will already be having my list of blue-chip stocks to own when the opportunity presents itself.

This article was first published in New Academy of Finance. All content is displayed for general information purposes only and does not constitute professional financial advice.