Neo Group Limited - evaluating a food catering solutions company using 4 financial metrics

Neo Group Limited (“Neo Group”) is a homegrown, integrated food solutions provider. Established since 1992, the Group is one of the most recognized brand names in Singapore.

The Group has been named the number one events caterer in Singapore and provides one-stop food and catering solutions.

The Group supplies a large variety of quality food and buffets appealing to various market segments through its multi-brand strategy.

Neo Group's strong portfolio of over 20 brands includes Neo Garden Catering, Deli Hub Catering, Orange Clove Catering, Best Catering, Chilli Manis Catering, Lavish Dine Catering, How's Catering, Gourmetz, Kim Paradise, Umisushi, DoDo fish ball, Joo Chiat Kim Choo traditional rice dumplings, amongst others.

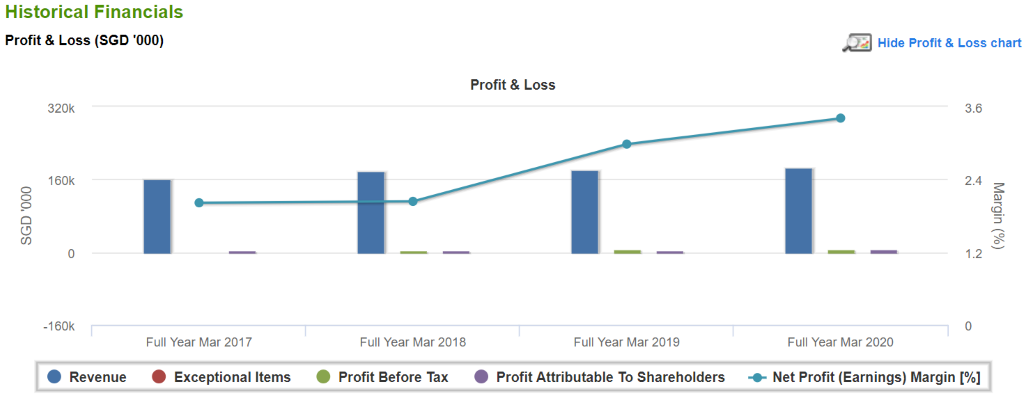

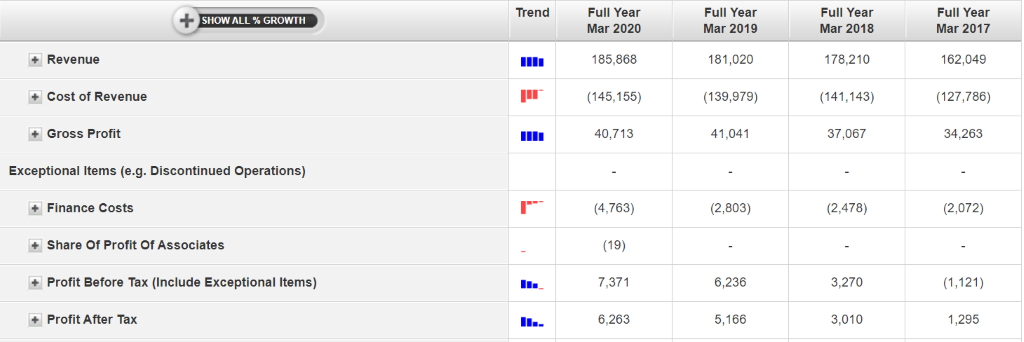

For FY2020, Neo Group’s revenue inched up 2.7 per cent to $185.8 million as compared to FY2019’s revenue of $181.0 million.

The growth can be attributed to the Food Catering business, and partially offset by a decrease in Food Retail business.

Food Catering business remains the biggest contributor towards the Group’s revenue with a weightage of 49.8 per cent.

Despite an increase in expenses in FY2020, Neo Group’s profit after tax registered a 21.2 per cent increase to $6.2 million on a year-on-year basis.

This is largely due to the adoption of SFRS(I) 16 Leases which Neo Group did not record any operating lease expenses in FY2020 as compared to $7.3 million in expenses in FY2019.

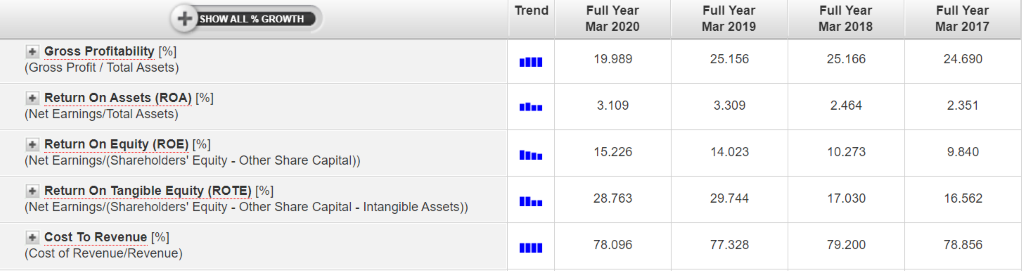

Neo Group’s Return on Equity (“ROE”) has been on an upward trend since FY2017. For FY2019, ROE came in at 15.2 per cent, which is a 1.2 percentage points improvement as compared to FY2018’s ROE of 14.0 per cent.

This shows that the management is deploying the Group’s equity in an efficient manner to generate profits.

Despite the strong ROE performance, Neo Group’s cost to revenue has been on the high side of more than 75 per cent for the past 4 financial years.

This probably means that the company has not been able to achieve economics of scale despite the increased revenue over the same period.

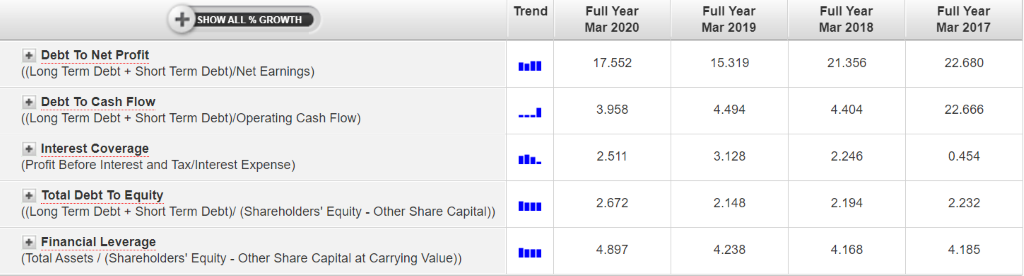

Neo Group’s total debt to equity has been on a rising trend since FY2017, growing from 2.23 times in FY2017 to 2.67 times in FY2020.

Investors should take note as this shows that the Group is utilising a huge amount of debt to finance and expand its business operations.

Moreover, with the high debt level, interest coverage ratio is under pressure. For FY2020, interest coverage ratio stands at 2.5 times and that is 19.3 per cent lower compared against FY2019’s ratio of 3.1 times.

This shows that its profit on hand could only cover 2.5 times of its finance cost and therefore any severe drop in profit level could result in the Group being unable to meet its interest obligations.

Despite recording a higher earnings per share (“EPS”) for FY2019 and FY2020, Neo Group’s dividend per share has dropped by 50 per cent to 0.5 Singapore cents per share for both periods mentioned above.

The fall in dividends also resulted a sharp drop in the Group’s dividend payout ratio. FY2017 and FY2018’s payout ratio amounts to more than 40 per cent while FY2019 and FY2020’s payout ratio amounts to about 11-13 per cent.

This signals that the Group is looking to preserve its cash on hand for further expansion and growth despite the strong growth in revenue and profit for the Group for FY2019 and FY2020.

Neo Group has registered a strong growth in its FY2020 net profits amid the adoption of SFRS(I) 16 Leases and achieved a decent return on equity ratio in the past 4 years.

However, investors should also pay attention to the high debt level and weaker interest coverage ratios.

In its latest corporate development, Neo Group has announced the proposed diversification of the Group’s business to include property development, property investment and management.

[[nid:495746]]

For a quick background, Neo Group will be setting up a joint venture with Boldtek Holdings Limited to carry out the business as mentioned above.

Boldtek Holdings is listed on the Catalist Bourse and have business interests in general building, precast manufacturing, and properties development and investment in Singapore and/or Malaysia.

Neo Group has mentioned that the rationale for this diversification is to allow the Group to have additional revenue streams while reducing reliance on its existing food catering business.

Neo Group also highlighted that it is part of the Group's corporate strategy to provide shareholders with diversified returns and long-term growth.

This article was first published in Investor-One.