Robo-adviser vs financial adviser: Which is better?

I started out as an investment and personal finance clutz when I first joined Seedly.

But thankfully, with the guidance of the Seedly team and the help of some useful investment guides, I was able to kick start my investment journey during Black Monday 2020 .

However, as I continue to make investments and get better at personal finance.

I can’t help but wonder if I should engage someone more experienced, like a financial adviser , to help me manage my investment portfolio.

And more importantly, my finances as a whole.

Especially since I could potentially spend up to $397,056 by the age of 30 — that’s a lot of money I’ll need to put aside.

With more financial services becoming going digital, alternatives like robo-advisers have emerged in the investment scene .

This got me thinking, “Could robo-advisers one day replace financial advisers?”

After all, a study has noted that robots could potentially wipe out 20 million jobs by 2030 .

So.

Robo-advisers vs financial advisers, which is better? And which of the two should I choose?

As the name suggests, robo-advisers are robot advisers.

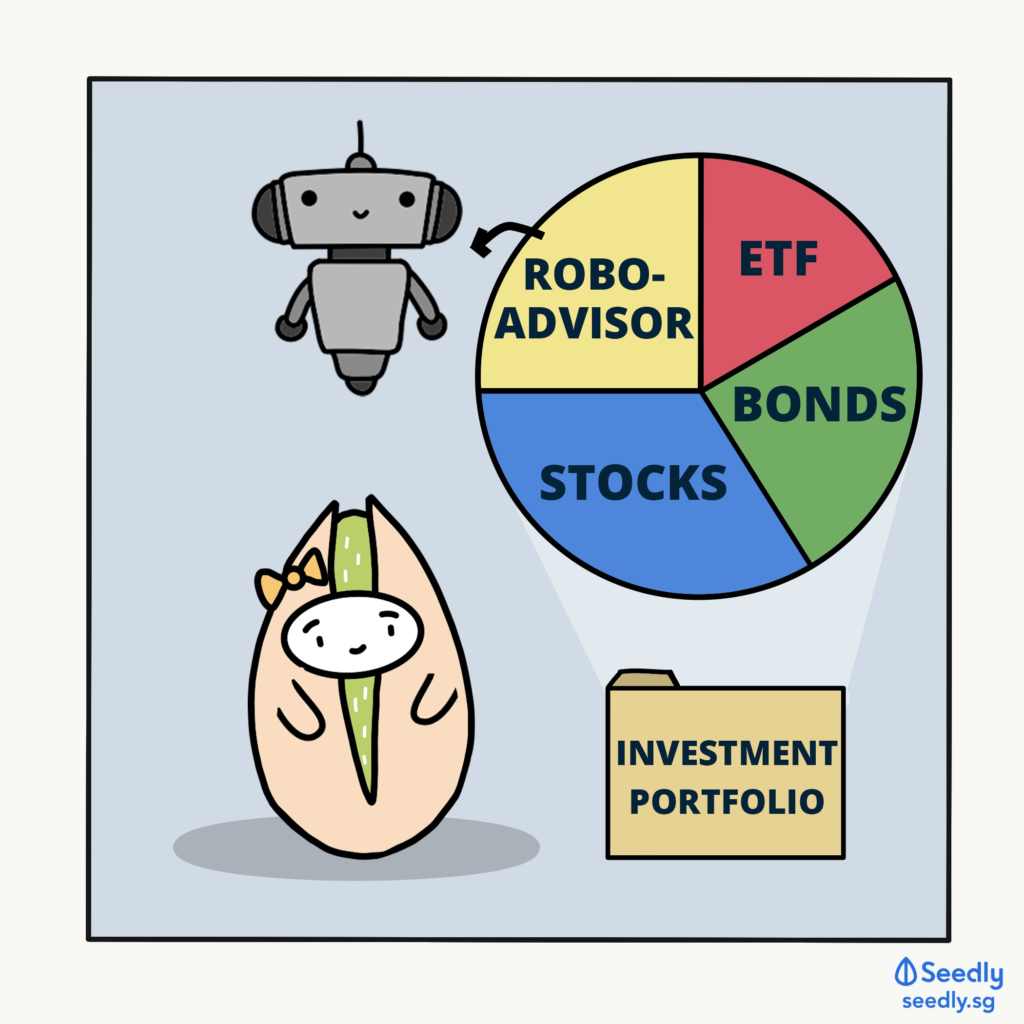

To be specific, they are digital platforms — driven by models and algorithms — that provide investment services with little to no human supervision.

They will help to build and manage your investment portfolio based on your risk profile and investment objectives.

It’s basically a low-cost financial product for investors with a passive investment strategy.

Since a lot of investors, like myself, don’t have a lot of capital, to begin with, this is what makes them increasingly popular today.

On the other hand, financial advisers are professionals who help you make decisions with regard to money matters, personal finances, and even investments.

Essentially, both have the same objective of helping people discover their financial needs and providing suitable recommendations to achieve their financial goals.

But, which of the two is better?

After reading through the discussions in the Seedly Community, here are a few key differences between the two:

Financial advisers typically charge anywhere between 2 per cent to 3 per cent (or sometimes more) of the value of your portfolio, while robo-advisers usually charge less than 1 per cent.

As an investor, you’ll want to keep these fees as low as possible.

Because in the long run, they’ll eventually eat into your returns.

The reason why robo-adviser fees are a fraction of the cost of a financial adviser is because (almost) everything is done by algorithms and computers.

This limits or minimises human intervention, so there isn’t as many man-hours or labour involved.

Overall, robo-advisers have the advantage here as they are a low-cost alternative to financial advisers.

And this is great news for undergraduates or fresh graduates like me who don’t have a lot of capital but wish to start investing early.

When you first sign up with a robo-adviser, you’ll need to complete an online questionnaire to create a profile which details your risk appetite and investment objectives.

Subsequently, the robo-adviser will recommend you a few investment portfolios that are tailored to your profile.

Think of it as taking a personality test in order to find a career path that suits you best.

On the other hand, a financial adviser will perform an in-depth financial assessment to understand stuff like:

This is where a financial adviser shines because an online questionnaire can only reveal so much.

Whereas a financial adviser is able to understand your unique circumstances and provide more personalised financial solutions to help you better reach your financial goals.

Robo-advisers make use of algorithms to automatically buy and sell assets.

Depending on the type of portfolio you are on, robo-advisers are able to react immediately to market changes.

This is a more efficient method as compared to a financial adviser where you would need to meet him or her in order to discuss and adjust your portfolio based on your objectives.

(You could speak over the phone as well, but I guess it’s always easier to discuss such matters in person!)

That being said, money is something that is extremely important for us to be able to achieve our aspirations and dreams.

Unlike robo-advisers, a financial adviser is able to show empathy which is something you might need when dealing with something as important as money.

With robo-advisers, you’ll usually build a passive, indexed portfolio.

All you need to do is fund your account, and let the algorithms do the work of rebalancing and adjusting your portfolio as required.

With a financial adviser, you can choose to be as active as you want.

You have greater investment flexibility and can actively adjust your investment portfolio to your liking.

Note: Adjusting your portfolio will incur fees (either through market commission, platform rates, and also your adviser’s fees) so even though you have the option to do it as often as you’d like, you should still try to limit it as much as possible to prevent fees from eating into your returns

The services offered by robo-advisers are usually limited to investments only.

You pick a portfolio, put money into your account, and the robo-adviser will invest it for you.

With financial advisers, they can also provide additional services such as insurance, tax planning, retirement planning and estate planning.

If you need help with investing with your CPF or Supplementary Retirement Scheme (SRS), they can also provide advice and guidance.

Basically, a financial adviser is more than just an investment manager.

The good ones also act as life coaches, educators, and planners to help you succeed in life.

Naturally, these value-added services are also why financial advisers cost more than robo-advisers.

Can’t decide between a robo-adviser or a financial adviser?

Well… you should really be making our decision based on your needs as an investor.

Given the low cost and barrier to entry, robo-advisers are arguably better for beginners who have less capital and less confidence about investing.

That being said, you should still understand what you’re getting into and not just blindly sign-up with a robo-adviser after reading this.

Alternatively, if you’re more experienced, then you might need more options in order to fulfil your investment objectives.

As such, a financial adviser is probably a better idea.

If you have a passive investment strategy, then a robo-adviser might be all you need.

However, if you’re a more active investor and would like to learn more about investment opportunities, then a financial adviser might be a better choice.

A good financial adviser should be able to answer your questions, give context, and provide recommendations.

In a way, having access to a mentor who can provide sound financial advice and information is extremely invaluable for someone who is just starting out.

If you don’t have time, a robo-adviser that automatically rebalances or adjusts your portfolio for you is a life-saver.

A financial adviser, however, requires frequent meetups to perform checks on your financial health and investments.

It’s not a bad thing.

But since it’s a more personalised service, it’s understandable that face-to-face interaction is needed to make sure that your interests are taken care of.

Ultimately, the biggest factors when deciding whether to go with a robo-adviser or a financial adviser would be how advanced you are as an investor, and what type of investor you are.

Personally, I believe that setting aside a part of our investment portfolio to invest in robo-advisers is something worth trying!

And while many of us would like to go only invest with the “best” robo-adviser …

The truth is there is no “best” robo-adviser .

Rather, it’s what suits us and our investment portfolio best.

As always, we should ALWAYS do our due diligence to find out more about a financial product before putting our money in.

After all, it is still OUR own money that we are investing with.

This article was first published in Seedly.