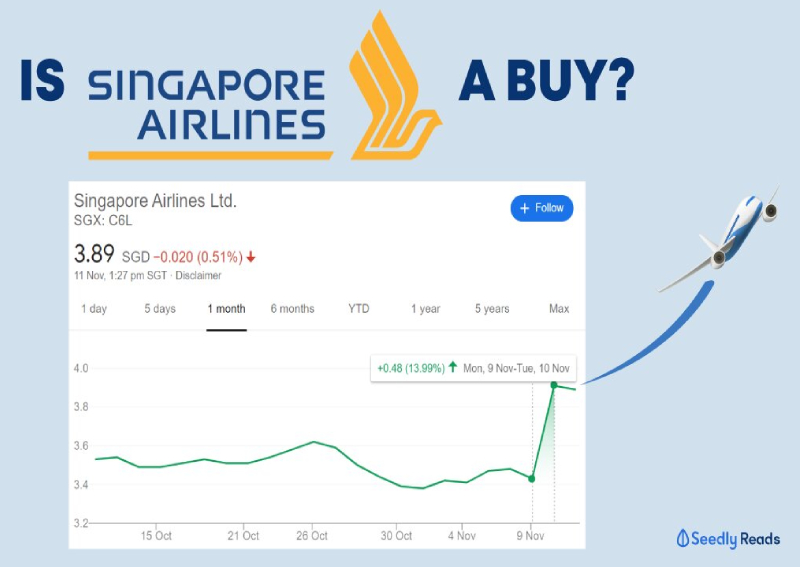

SIA share price soared 14% after possible vaccine news: Is the airline stock a buy?

The Singapore stock market rose to levels not seen since early-June this year as investors cheered the news of a potential vaccine defeating the coronavirus pandemic.

On Nov 10, Singapore’s stock market benchmark, the Straits Times Index (STI) surged 3.7 per cent, or 95.6 points, to 2,705.

The biggest winner of the STI that day was Singapore’s flag carrier, Singapore Airlines (or SIA for short), which increased by 14 per cent to $3.91.

It would have been a welcome respite for investors as the airline has been beyond battered by the Covid-19 pandemic.

I’m hoping the promising Covid-19 vaccine by Pfizer and BioNTech, which is touted to be over 90 per cent effective, puts an end to the virus that has made 2020 a year to forget.

But even if the vaccine, or other vaccines, are safe for mass use, does it make Singapore Airlines an automatic buy?

Or are there better opportunities out there for us to put our money into?

Let’s find out.

We’ll explore the company’s investment worth by understanding the following:

Earlier in March this year, Singapore Airlines announced that it “will be cutting 96 per cent of the capacity that had been originally scheduled up to end-April”, calling the current situation the “greatest challenge” that it “has faced in its existence”.

[[nid:488626]]

However, things are looking slightly better now.

Last month, SIA said that it will continue to increase flights gradually, reaching about 15 per cent of its usual passenger capacity by the end of this year.

Moreover, news just dropped that the Singapore-Hong Kong air travel bubble will start on Nov 22 with one flight a day to each city, gradually increasing to two flights per day from Dec 7. SIA will be the chosen airline from Singapore.

If the vaccine really proves effective, people would be able to globe-trot freely once again, and SIA’s business would eventually recover.

But whether the airlines can continue doing well over the long run is another question altogether, since the long-term economics for airline stocks don’t look great.

The airline industry is notorious for being a competitive one. Unlike luxury goods, there’s very little brand loyalty when it comes to flying on a particular airline.

I, for one, usually go for the low-cost option if my trip is just within Asia, which is mostly the case. There are lots of options to choose from for me — Scoot, Jetstar, AirAsia, and so on.

Nowadays, with the advent of price-comparison sites like Skyscanner, I can make my life easier by sieving out the lowest price to fly from one place to another.

[[nid:507508]]

(Yes, I don’t mind the inconvenience of having nothing to nibble on for just a few hours.)

As an investor, I shun buying companies that are price-takers.

Price-takers tend to have low net profit margins since they can’t command a high price for their goods. I prefer to invest in companies with net profit margins of more than 20 per cent (or the price-makers).

In SIA’s instance, its net profit margin is clearly low. For its financial year ended March 31 2019 (FY2018/19), it posted revenue of $16.3 billion while its net profit was $682.7 million.

(I’m not using FY2019/20 results as SIA went into a net loss due to the pandemic.)

Dividing net profit by revenue, we get a net profit margin of just 4 per cent, which ain’t gonna fly for me.

On top of its low profit margin, SIA has to regularly use up cash to upkeep its young fleet of aircraft since it’s committed to operating a modern fleet.

As of March 31 2020, the combined average fleet age of the SIA group was five years and 11 months.

What this means is that almost every six years, the free cash flow that can be returned to shareholders as dividends or be used to reinvest into its business for growth has to be used to purchase new planes instead.

The capital outlay is humongous too; planes don’t come cheap, ya know?

For FY2019/20, around 97 per cent of SIA’s capital spending of some $5.1 billion was on aircraft, spares and spare engines.

Let’s look at the table below to understand SIA’s free cash flow situation over the last six years:

| FY2014/15 | FY2015/16 | FY2016/17 | FY2017/18 | FY2018/19 | FY2019/20 | |

|---|---|---|---|---|---|---|

| Cash generated from operations (S$' million) |

2,193.9 | 2,929.9 | 2,583.4 | 2,745.6 | 2,827.4 | 2,751.7 |

| Capital expenditure (S$' million) |

2,600.2 | 2,909.0 | 3,944.7 | 5,209.5 | 5,562.3 | 5,103.5 |

| Free cash flow (S$' million) |

-406.3 | 20.9 | -1,361.3 | -2,463.9 | -2,734.9 | -2,351.8 |

In general, we can see that its free cash flow has been becoming increasingly negative from FY2014/15 to FY2019/20, with only one slight positive year.

Investors have to remember that it’s from free cash flow that companies reinvest to grow their business, buy back their shares, pay dividends, or pare down debt.

Add the lack of free cash flow to the fact that SIA has more debt than cash on its balance sheet, the business prospects are indeed not great. I prefer companies to have more cash than debt as they are more likely to withstand harsh economic conditions.

[[nid:507339]]

As of March 31 2019, SIA’s balance sheet had $2.9 billion in cash but $6.7 billion in total borrowings. The figures translate to a net debt position of $3.8 billion, almost six times that of FY2018/19’s net profit of $682.7 million.

But earlier this year, SIA shored up its balance sheet by raising funds through shareholders to the tune of $8.8 billion.

It also raised additional money of around $2.5 million through aircraft secured financing, credit lines, and short-term unsecured loan.

With that, as of the latest quarter ended Sept 30 2020, the airline’s total borrowings was $9.5 billion, and its cash balance was higher at $7.1 billion.

To conserve cash, the airline’s dividends were cut too, from 30 Singapore cents in FY2018/19 to just 8 cents in FY2019/20.

For the first half of FY2020/21, SIA didn’t declare any dividends (a year back, it declared 8 cents in dividend).

Even though SIA’s balance sheet is slightly stronger now than before, the fact remains that it’s operating in a price-sensitive industry without much pricing power.

And could it be a matter of time before SIA faces the same old problem of having a weakening balance sheet? Only time will tell…

With all due respect, Singapore Airlines has been doing a fabulous job as a national carrier amid the pandemic. It has been instrumental in getting Singaporeans evacuated back home when countries shuttered their borders.

I know for sure as one of my loved ones was stuck in India and our government and SIA worked closely with our foreign counterparts to get her back, together with over 600 other people.

But as an investment, I’ve got my reservations.

Famed investor Warren Buffett once said that he judges businesses on their ability to raise prices (emphases are mine):

“The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.”

SIA’s operating in an industry that’s very sensitive to price increases and that doesn’t make for good long-term investment. Therefore, there are better opportunities out there to invest in.

This article was first published in Seedly. All content is displayed for general information purposes only and does not constitute professional financial advice.