Stock market: Should you sell in May and go away?

You might have heard about the famous saying in the stock market that goes:

[embed]None[/embed]

With May fast approaching, are you wondering if you really should sell in May and take a break from the stock market?

We’ve got ya covered, mate!

The famous adage states that we should sell stocks at the start of the warm weather in May and reinvest only when the cold weather starts in November (the “summer” months).

Investors have a belief that when the warm weather begins, the lack of market participants (probably due to vacation breaks) can make for a lacklustre market period.

On the contrary, the months between Halloween and May Day (the “winter” months) produce better stock market results.

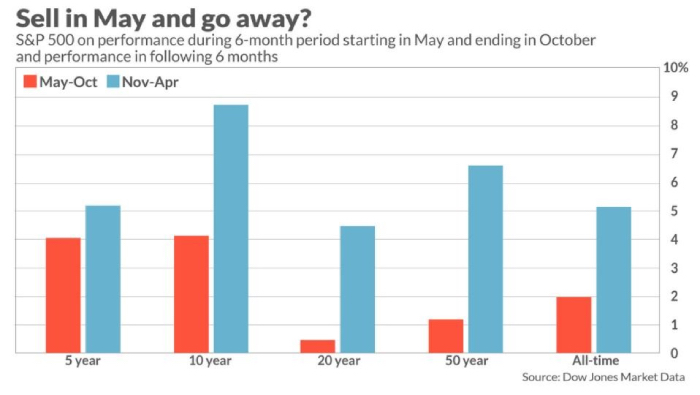

The chart below shows the “sell in May and go away” strategy seems to work, with the May-October period underperforming the November-April period for the S&P 500 index, which tracks around 500 of the top US companies in leading industries.

More recently, the index rose 28 per cent from end-Oct 2020 to late April 2021.

And it may look ripe for the market to take a breather over the next six months, tempting you to sell your stocks so you can buy back later at a lower price.

However, timing the market is never easy.

If investors had sold out in May last year, they would surely be kicking themselves.

[[nid:527639]]

The S&P 500 index gained around 16 per cent from May to Oct 2020.

We would never know what the upcoming month will be like, and likewise for all future Mays.

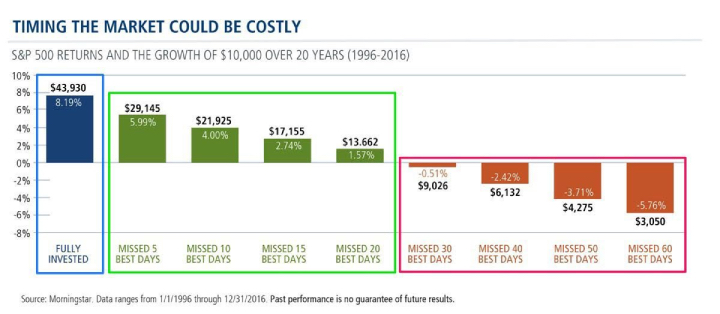

Research studies have shown time and again that being out of the market and missing the best market days can significantly reduce returns over the long run.

For instance, according to Morningstar, if an investor was fully invested from 1996 to 2016, $10,000 would have grown to a cool $44,000. On an annualised basis, that’s around eight per cent.

However, missing just five of the best days (out of the 20 years) would have brought down the annualised return to six per cent, or a huge difference of $14,785.

If the investor had missed out on the 10 best days, the average return would have halved to about $22,000.

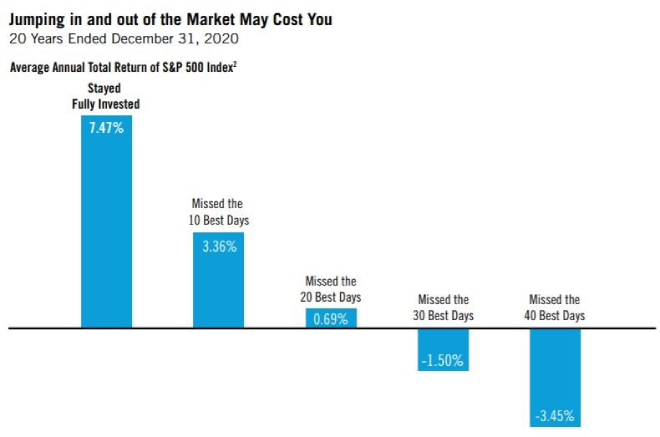

Another study that spanned from 2000 to 2020 and included the Covid-19-induced market crash showed similar results.

Instead of timing the market and dumping stocks when May comes around, we should ignore the old Wall Street adage and focus on the things that matter.

[[nid:526070]]

That is, the business behind a company’s share price.

The idea is to invest in fundamentally strong companies at reasonable valuations and hold them for long periods, no matter what the market does.

The stock market may fall from time to time, including during the “Sell in May and go away” period. But that’s just how the market behaves — it’s inherently volatile.

If the stock market indeed corrects in May and for the subsequent months that follow, it might actually be a great buying opportunity to position our portfolio for the long-term — just like what happened in March 2020.

This article was first published in Seedly.