A value investor's guide to 'exploiting' the Singapore Savings Bond

‘You can park your money in Singapore Savings Bonds!’ I am sure you’ve heard something like that before.

As investors, we want to keep a war chest of cash that’s ready to be deployed in the stock market whenever opportunities emerge. At the same time, we want our money to not sit idly around because inflation is always eating away at its value.

The question is… is there a way to boost our returns while our money is waiting, and still have it readily available when we need it?

That’s where the Singapore Savings Bond (SSB) comes in.

First, it offers full capital protection, meaning to say you can’t lose your principal.

Second, it offers a competitive interest rate compared to the fixed deposit rates you’ll get at any of the three Singapore banks. The SSB interest rate can sometimes go as high as 2.5 per cent per annum.

Third, it is very liquid; you can sell it anytime you want, unlike fixed deposits which lock you in for period of time.

Besides high-yield savings accounts (which are also a great option), SSBs are a flexible way for investors to protect their capital against inflation while waiting for stock opportunities to emerge.

SSBs were launched in 2015 by the Monetary Authority of Singapore (MAS) to give investors a safe and flexible way to save for the long term.

[[nid:489645]]

Just as fixed deposits are backed by the banks you invest in, SSBs are backed by the Singapore government.

They are principal guaranteed and are considered to be a very safe form of investment (practically zero risk, unless you think Singapore might go bankrupt soon).

SSBs are available to Singaporeans 18 years and older, and each bond comes with a tenure of 10 years.

The beauty of the SSB is that there are no penalties levied for early redemption and investors can get their full money back — including any interest earned — anytime they want.

Any interest earned is also tax-exempted — just like your dividends. Plus, you only need a minimal sum of $500 to start investing in SSBs.

SSBs have a maturity period of 10 years. The interest you earn increases with each subsequent year.

At the end of 10 years, you would have earned an annual interest similar to that if you had invested in a 10-year Singapore Government Securities bond.

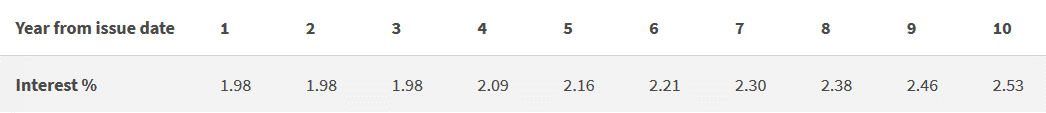

February 2019 Singapore Savings Bond interest rates.

Using the February 2019 SSB issuance as an example, you can see that the SSB interest rate starts out at 1.98per cent for the first year and goes up to 2.53per cent by the time the bond matures.

Interest is paid out every six months. So in the first year, for example, you will receive an interest payout of 0.99per cent (1.98per cent ÷ 2) in the sixth and twelfth months. Should you choose to redeem your SSB early, the interest earned will be pro-rated.

There are two ways to buy SSBs – either through cash or your SRS account.

We’ll be covering the cash option here since our sole purpose for parking our money in SSBs is to earn higher interest while waiting for potential stock opportunities.

Note that the headline interest rate stated is the compounded annualised return over a 10 years.

To check the interest you’ll receive every year, you’ll need to click ‘View Bond Details’. It should tell you how much interest you’ll receive annually over the 10-year period. (You can always check the current interest rates for the SSB on the MAS website.)

The application starts on the first business day of the month and closes on the fourth last business day of the month. If you wish to apply for that month’s SSB, you have to do it within this window.

Before you apply and invest in an SSB, you need to have a CDP securities account with direct crediting services activated. This will allow the interest earned from your SSB to be credited into your account – just like your dividends.

Once you have your CDP account , you can apply for SSBs at your nearest ATM from the three Singapore banks (DBS/POSB, UOB, OCBC). Alternatively, you can also apply to buy SSBs through Internet banking.

When successful, you will be notified via mail of the amount of SSBs allocated to you. You can also check your holdings online through the CDP Internet service or by calling +65 6535-7511.

The minimum amount to invest in the SSB is S$500, with subsequent multiples of $S500 up to a maximum of S$200,000 for each individual.

Bear in mind that there are a limited amount of bonds issued every month. So depending on the demand for SSBs during that month, you may or may not be allocated the full amount of your application.

There are no penalties for redeeming SSBs before their maturity. However, there is a $2 transaction fee for every redemption request.

The redemption process is pretty similar to the application process. You can do so via your nearest ATM or through Internet banking.

[[nid:487725]]

You can redeem SSBs in multiples of $500 up to the amount you’ve invested. The money will be credited to the bank account that is linked to your CDP.

One thing you need to note is that you will only receive your money by the second business day of the following month.

In other words, if you redeem your SSB this month thinking that you can use the proceeds to immediately fund a stock purchase, you won’t be able to do so since you will only get your cash on the second business day of the following month.

This can get a little tricky earlier in the month since you’d have to wait a few weeks before you can receive and then deploy the cash.

For this reason, I tend to keep some cash on hand in case I need to invest it immediately. But near to the end of the month, this becomes less of an issue.

The redemption period starts from the first business day of the month and closes on the fourth last business day of the month.

So if you want to receive your money the following month, you need to do so within the current month during the open window.

Singapore Savings Bonds tend to offer higher interest rates compared to what banks offer you. However, it is still important to check the SSB’s rates before you invest in them.

[[nid:489638]]

Due to the Covid-19 pandemic, Singapore is expected to experience an economic contraction. Thus, the interest rates offered for SSBs right now are rather low compared to the rates they used to offer.

Remember, the interest rates for SSB can fluctuate. So pick a rate that you are comfortable with before investing.

At the same time, you don’t have to allocate all your spare cash towards buying SSBs. You can always buy them in tranches based on how attractive the interest rates are for you in any particular month.

Lastly, in volatile times like these, I’d prefer to have more cash on hand to capitalize on any opportunities that arise than to have all my money parked in SSBs.

And when the market is expensive and opportunities are few, I would then allocate more of my cash back to SSBs to earn a relatively higher interest while waiting for new opportunities.