BTO flats in mature estates over 60% more expensive than those in non-mature ones but 'have been kept affordable'

SINGAPORE - The average selling price per square foot (psf) for Build-To-Order (BTO) flats in mature estates increased faster than those in non-mature estates in the last 10 years, according to figures provided by National Development Minister Desmond Lee on Monday.

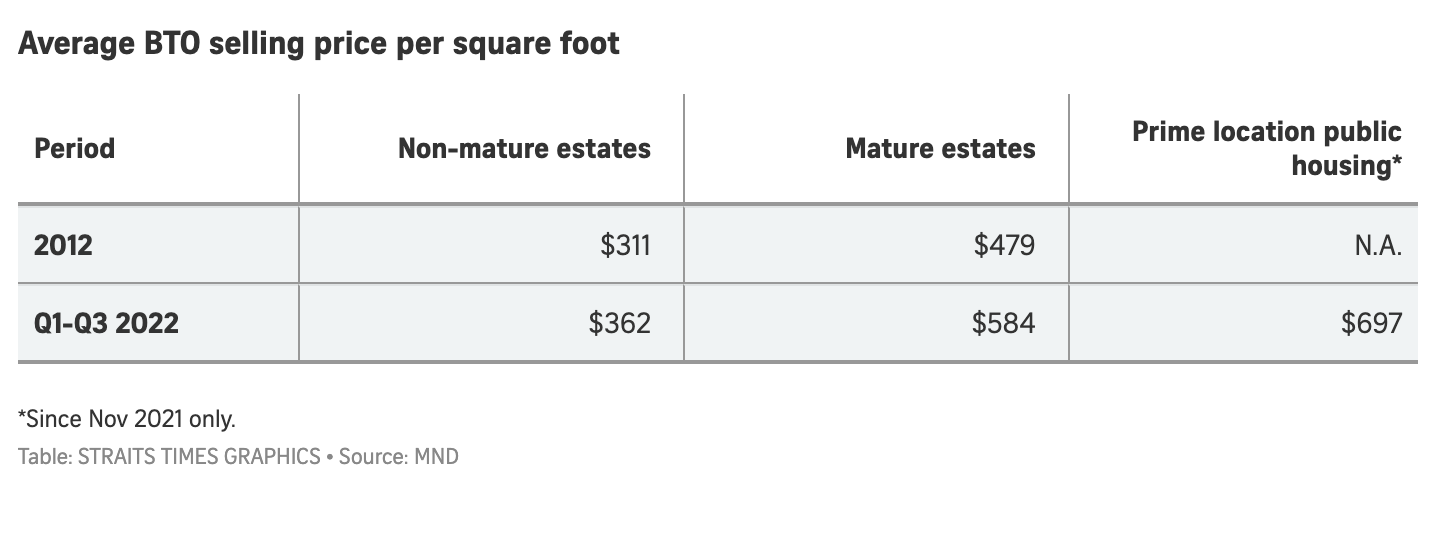

The psf price gap between BTO flats in mature and non-mature estates also widened between 2012 and the first nine months of 2022.

The average selling price psf for BTO flats in mature estates rose by 21.9 per cent to $584 in the first nine months of 2022, up from $479 in 2012. In the same period, the average selling price psf for BTO flats in non-mature estates increased 16.4 per cent from $311 in 2012 to $362 in 2022.

The average selling price psf for new flats under the prime location public housing (PLH) model was $697 in 2022. The Housing Board has launched six PLH projects since the scheme began in November 2021.

Mr Lee gave the figures in a written parliamentary reply to Progress Singapore Party Non-Constituency MP Leong Mun Wai.

The Government has kept BTO flat prices relatively stable by increasing subsidies, even as construction costs rose by about 30 per cent in the past two years, Mr Lee said.

He noted that the figures given do not account for housing grants given to eligible buyers. Mr Lee added that in the last 10 years, the median household income grew 26 per cent and housing grants were increased several times.

[[nid:601272]]

Professor Sing Tien Foo, director of the Institute of Real Estate and Urban Studies at the National University of Singapore, said the price increases in the last 10 years “have been kept affordable” at below 22 per cent, compared with the 30 per cent increase in construction costs in the last two years.

Different rates of increase in land costs in mature versus non-mature estates could have resulted in the variation of BTO flat prices, as the Government will need to provide more subsidies to defray the rising costs to keep prices within an affordable range, said Prof Sing.

ERA Realty’s head of research and consultancy Nicholas Mak said the figures show that the price gap between non-mature and mature estates has widened over the years.

In 2012, the selling price psf for BTO flats in mature estates was 54 per cent more expensive than those in non-mature estates.

The price gap has widened to 61.3 per cent in 2022, said Mr Mak.

“Looking at the figures, you can argue that the price psf for BTO flats in mature estates has increased quite substantially compared with those in non-mature estates,” said Mr Mak.

“As such, one can say that BTO prices in mature estates are becoming more expensive.”

“To be fair, it is not wrong for the Government to price BTO flats in mature estates higher – in a way, it is to be expected as the resale value of such flats are higher and you don’t want a case where flat owners benefit at the expense of taxpayers. But the question is: How much more?” said Mr Mak.

In his reply, Mr Lee also gave the total land costs that HDB paid to Singapore Land Authority, without elaborating on the total land area transacted.

In the 2021 financial year, HDB paid $2.6 billion for land in mature estates and $1.8 billion for that in non-mature estates.

In the 2012 financial year, the board paid $2.4 billion for land in mature estates and $2.4 billion for that in non-mature estates.

The amount includes the land cost for carparks, commercial properties and social communal facilities in BTO projects.

[[nid:603445]]

Apart from land costs, Mr Lee said HDB also incurs construction costs to build new flats. The total development cost, which includes construction and land costs, cannot be fully covered by the selling prices of flats, which results in a significant yearly deficit.

On Monday, Leader of the Opposition Pritam Singh pressed Second Minister for Finance and National Development Indranee Rajah for details of the development costs of new BTO flats and subsidies provided to buyers.

Ms Indranee said it was “not meaningful” to provide such information, as the affordability of flats is what matters to Singaporeans. She also noted that different locations have different pricing and subsidies applied to them, and giving the breakdown would lead to comparisons.

This article was first published in The Straits Times. Permission required for reproduction.