MediShield Life premiums may rise by up to 35% under proposed changes

SINGAPORE - The benefits offered by MediShield Life are set to be widened from next year, to cover more and larger hospital bills, with proposed yearly claim limits raised from $100,000 to $150,000.

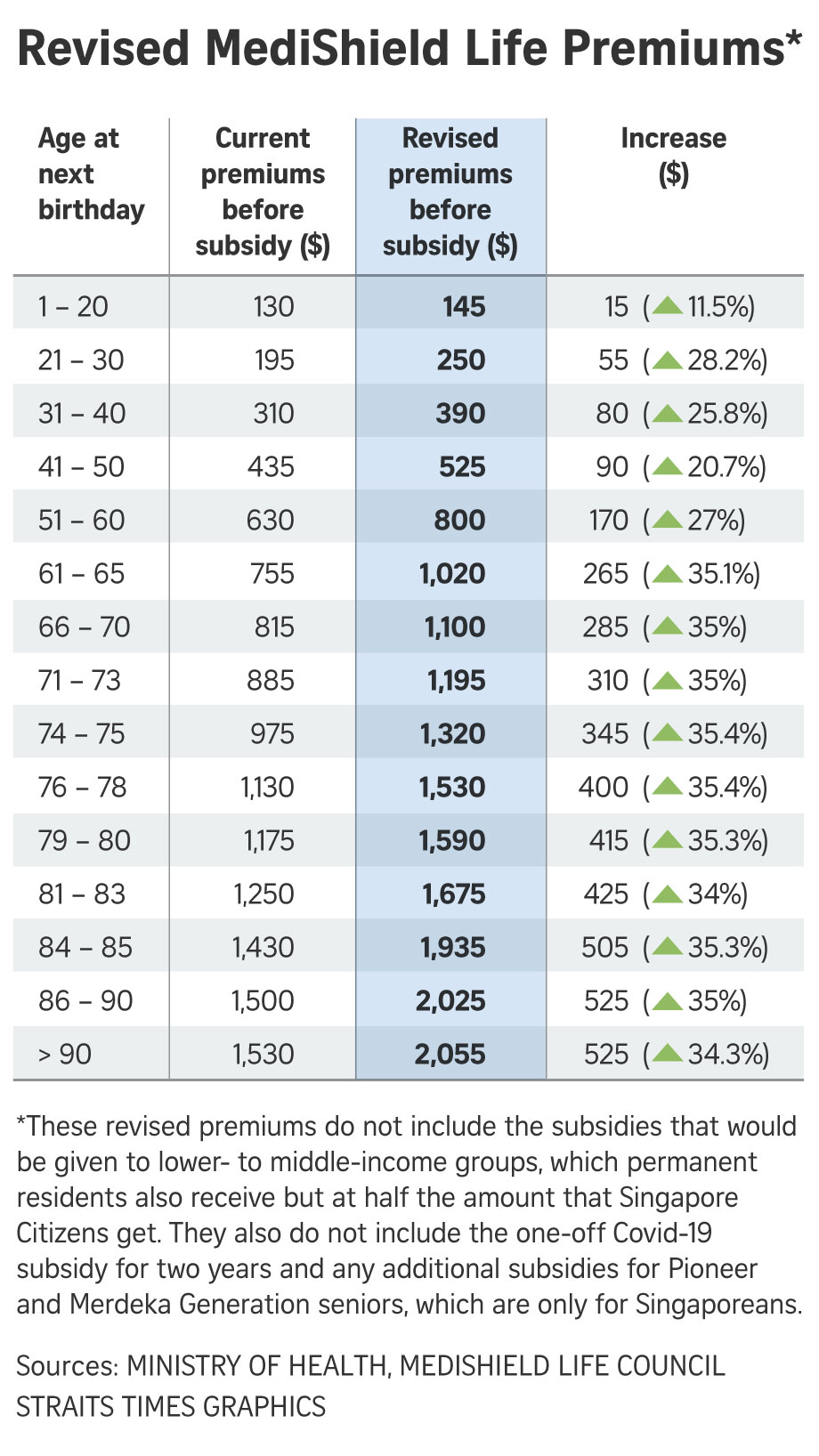

To pay for these additional benefits and rising healthcare costs, premiums are expected to go up next year by as much as 35 per cent.

This will be the first increase in premiums for the compulsory health insurance since its launch five years ago. At the upper end, the proposed hike will exceed $500 a year.

But given the difficult times Singaporeans are facing now, Health Minister Gan Kim Yong said the Government will soften the impact of the premium increase with a special Covid-19 subsidy for the first two years.

In the first year, all Singaporeans will get a 70 per cent subsidy on the increase. This goes down to 30 per cent in the second year. This will cost the Government $360 million.

This is on top of the existing subsidies of 15 to 50 per cent given to middle- and lower-income groups, and 40 to 60 per cent for Pioneers. The Merdeka Generation receives additional subsidies of 5 to 10 per cent.

In all, the subsidies for the next three years will amount to $2.2 billion.

The proposed higher premiums will allow for better benefits, including:

[embed]https://www.youtube.com/watch?v=lRT3PWhvLhs[/embed]

However, the cap on claims for people treated at private hospitals will be reduced from 35 per cent of the bill to 25 per cent. Based on recent bills, 35 per cent of private hospital care amounts to far higher sums than bills incurred by subsidised patients.

The change in pro-ration does not impact people getting private care at public hospitals. They continue to get 35 per cent of their bills paid by MediShield Life.

The new claim limits should bring MediShield Life back in line with its original mandate to cover 90 per cent of subsidised bills beyond the initial deductible. It was revealed last year that only 80 per cent of subsidised bills were fully covered.

The MediShield Life Council said: "MediShield Life claim limits should be refreshed to cover nine in 10 subsidised bills, and should be reviewed more regularly to ensure that they offer adequate protection in light of inflation and medical advancements."

These proposed changes are expected to get rolling sometime in the first quarter of next year. Meanwhile, the council is seeking people's views on these "preliminary recommendations", with a public consultation held till Oct 20.

Details on the preliminary recommendations can be viewed, and feedback submitted at this website.

Council chairman Fang Ai Lian said: "We have to periodically review and update the scheme benefits and premiums to keep pace with evolving medical practice, healthcare cost inflation and actual claims experience, so that it continues to provide assurance for Singaporeans, while remaining sustainable."

From now, reviews will be carried out every three years.

Dr Tan Wu Meng, head of the Government Parliamentary Committee for Health, supports the changes, although he said some of the premium increases are "significant".

He told The Straits Times: "The revised policy year claim limit and the ICU claim limits are consistent with supporting Singaporeans through catastrophic illness."

As for the removal of some exclusions from MediShield Life, Dr Tan said: "This would also be a key statement about inclusivity and the tone we want in our society."

This article was first published in The Straits Times. Permission required for reproduction.