New property cooling measures: Singapore hikes additional buyer's stamp duty, doubles foreigner rate to 60%

The Singapore government stepped up additional buyer stamp duty (ABSD) rates for residential properties, in a fresh round of cooling measures aimed at curbing investment demand.

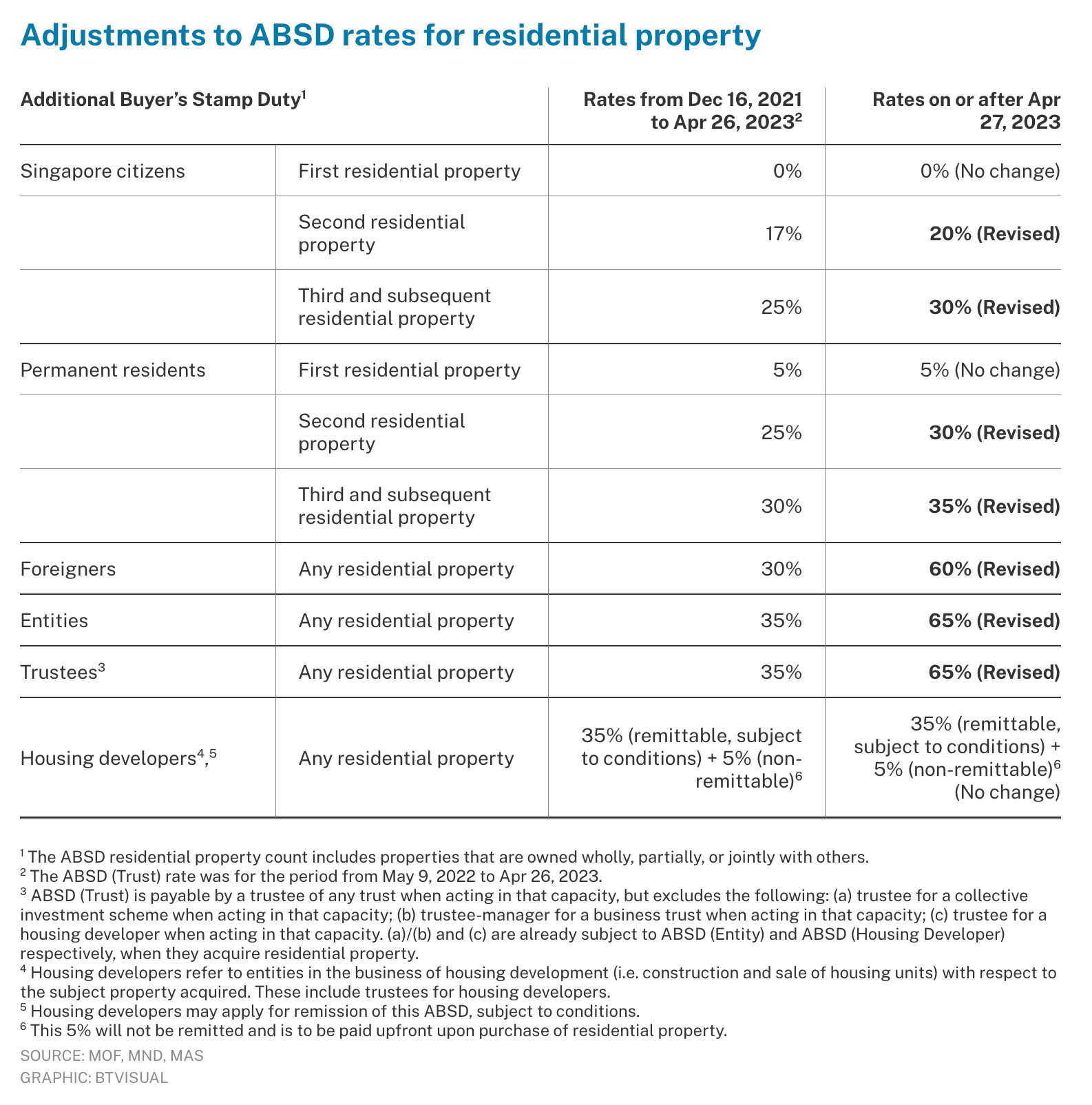

For Singapore citizens, ABSD for the purchase of their second property will be raised to 20 per cent from 17 per cent and to 30 per cent from 25 per cent for their third and subsequent properties. Singapore permanent residents (PR) will see ABSD raised from 25 per cent to 30 per cent on their second property and from 30 per cent to 35 per cent for their third and subsequent properties.

Foreigners bear the brunt of the increases, with ABSD on any property purchase doubled from 30 per cent to 60 per cent. A 65 per cent rate will apply to residential properties bought by entities or in trust, up from 35 per cent. The new rates take effect on April 27.

The new measures are expected to impact about 10 per cent of all residential property transactions, and are meant "to pre-emptively manage investment demand", said a joint press statement from the Ministry of Finance, Ministry of National Development and the Monetary Authority of Singapore.

Previous measures in December 2021 and September 2022 have had a moderating effect, the statement said. "However, in Q1 2023, property prices showed renewed signs of acceleration amid resilient demand. Demand from locals purchasing homes for owner-occupation has been especially strong, and there has also been renewed interest from local and foreign investors in our residential property market."

Official data shows private home prices rose 3.2 per cent in the first quarter of 2023 on lower sales volume. This follows a 0.4 per cent increase in Q4 of last year.

ABSD was introduced in December 2011, as one of several property market cooling measures. Rates were hiked in 2013, 2018 and 2021.

This round of property cooling measures follows the last round in September 2022, when borrowing limits for all property loans were tightened through tweaks to the benchmark interest rate used to calculate total debt servicing ratio. A 15-month waiting period was also introduced for private property sellers before they can buy a HDB resale flat.

Some 30 new residential projects are slated to be launched this year, with several waiting in the wings to be marketed in the next few weeks. Some are now expected to be pushed back as the latest ABSD hikes will likely hit sentiment hard, coming in the wake of higher interest rates that have already eroded gains.

Some exemptions still apply, such as for married couples with one Singapore citizen spouse who jointly buy a second property - they can apply for a refund subject to selling their first property within six months of the purchase of the second property. The ABSD increases also do not affect HDB and executive condominium purchases from developers with upfront remission if the spouse is a Singapore citizen.

There is a transitional provision where the ABSD rates on or before April 26 will apply to transactions that fulfil all three of the conditions below:

The ABSD revisions are expected to help moderate demand as the government ramps up supply to alleviate the tight housing market. The supply of private housing on the Confirmed List has been raised to 4,100 units in H1 2023 from 3,500 units in H2 2022.

On the public housing front, over 23,000 flats were launched in 2022 and up to 23,000 flats are expected to be launched in 2023. The government said it is prepared to launch up to 100,000 new flats between 2021 and 2025, maintaining a steady pipeline to cater to the demand.

Pandemic-related delays have pushed back property completions, but the government expects that housing supply coming on the market will be significant enough to cater to demand. There will be about 40,000 public and private residential property completions in 2023 and about 100,000 units to be completed by 2025.

"The measures above have been calibrated to moderate housing demand while prioritising owner-occupation, and provide sufficient housing supply. The government will continue to adjust our policies as necessary to ensure that they remain relevant, and promote a sustainable property market," said the ministries in the press statement.

This article was first published in The Business Times. Permission required for reproduction.