Citibank Cash Back Card review 2022: Get up to 8% cash rebate on everyday spending categories

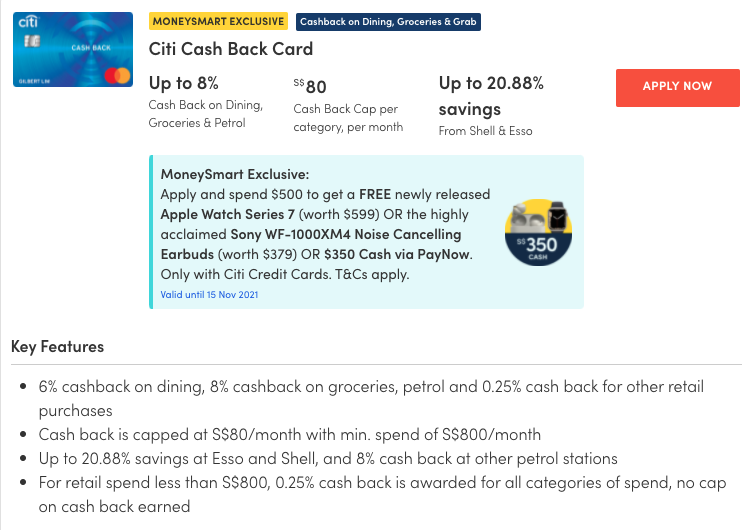

The Citibank Cash Back Card is one of the most eye-catching cashback cards in Singapore, promising up to eight per cent cash rebate (huat ah!) on everyday spending categories.

In contrast, the average cashback card offers only three per cent to five per cent rebates at best, which can leave you feeling a tad underwhelmed.

Let's take a closer look at the Citi Cash Back Card and see if it's as good as it sounds.

Note: The Citi Cash Back Card T&Cs were updated on Dec 9, 2020. This article reflects the new T&Cs.

| Citi Cash Back Card | |

| Annual fee & waiver | $192.60 (waived for one year) |

| Supplementary annual fee | $96.30 (waived for one year for first two supp cards) |

| Interest-free period | 25 days |

| Annual interest rate | 26.90 per cent |

| Late payment fee | $100 |

| Minimum monthly repayment | One per cent or $50, whichever is higher |

| Foreign currency transaction fee | 3.25 per cent |

| Cash advance transaction fee | Six per cent or $15, whichever is higher |

| Overlimit fee | $40 |

| Minimum income | $30,000 (Singaporean) / $42,000 (non-Singaporean) |

| Card association | Mastercard |

| Wireless payment | Mastercard PayPass, Samsung Pay, Citi Pay |

The Citibank Cash Back Card is an everyday cashback card for the average Singaporean that covers most of our daily spending categories i.e. food and transport.

It gives you a very impressive eight per cent cashback on groceries and petrol and six per cent cashback on dining, which represents the bulk of a typical Singaporean family's spending. Here's a breakdown of the categories:

| Spending category | Cashback |

| Groceries (all supermarkets, Redmart) | Eight per cent |

| Petrol (all stations, but bonus savings up to 20.88per cent at Esso & Shell) | Eight per cent |

| Dining (restaurants, cafes) | Six per cent |

| All other spendings | 0.25 per cent |

Citibank did a great job updating this credit card in Dec 2020. The main changes are:

Yes, they've lowered the dining cashback slightly, but it's a fair trade-off in exchange for the lower minimum spend and more relaxed cashback cap.

No more split caps = no need to track your spending to the dollar anymore!

The Citi Cash Back Card appears to cover most of the essentials of Singaporean middle-class life.

It works great for anyone who:

The $800/month minimum spend might be a tad high, but it should be no problem if you're the breadwinner of a family or a couple sharing their household expenses on one card.

For singles, this requirement may be a bit high unless you dine out a lot. Note that bars and nightspots do not count as dining.

However, note that recurring expenses like utilities are also not covered, nor are online purchases and offline shopping. You'll probably need a backup credit card for those categories.

If you're new to Citibank cards, sign up through MoneySmart by Dec 13 to get $300 cash via PayNow upon your first swipe.

Plus, stand a chance to win an Apple Watch Series 6 or a Samsung Watch 3.

Save on your food delivery expenses as well from these two merchants. Valid until Nov 30, 2021.

| Merchant | Customer | Promo code | Deal |

| Deliveroo | New | CITINEW21 | $4 off first three orders with minimum spend of $20 |

| Deliveroo | Existing | CITI8NOV | $8 off with a minimum spend of $40 |

| Foodpanda | New | CITINC21 | $8 off first order with a minimum spend of $15 |

| Foodpanda | Existing | CITI21NOV | $6 off with a minimum spend of $30 |

| Foodpanda | Existing | CITI21NOV10 | $10 off with a minimum spend of $60 |

For more food delivery codes, bookmark our more comprehensive post.

The Citibank Cash Back Card is one of the best credit cards on the market for steady, predictable household expenses. That said, it does have plenty of competition.

Here are some all-purpose credit cards that might also suit your lifestyle:

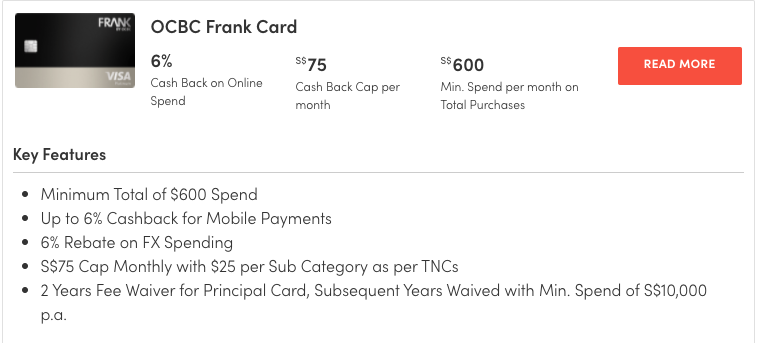

Despite a lower minimum spend of $600, the OCBC FRANK Card gives you the market-leading six per cent cashback on online spending and mobile payments.

Unfortunately this credit card suffers from the dreaded split cap of $25 per category, meaning you'll need to track your expenses.

The UOB ONE Card doesn't restrict your spending to specific categories, so it covers things like recurring bill payments. But you'll need to spend consistently every month, or you might lose your whole quarter's rebates.

If you're mainly interested in cashback on dining, the UOB YOLO Card may be a better choice with eight per cent cashback on weekends for dining and entertainment.

It also gives you three per cent on online fashion, and the minimum spend and cashback caps are the same as the Citi Cash Back Card.

Still, if you happen to be a good fit for the Citibank Cash Back Card, it's pretty damn impossible to find a better deal out there.

As a bonus, you'll get up to $350 in cash if you're new to Citi and sign up through MoneySmart by Nov 30, 2021: