Personal finance lessons we can learn from this millionaire janitor

To be a millionaire, you need to have a high-paying job or be a businessman.

At least that’s what we commonly hear.

But there are people who have quietly amassed wealth even with an ordinary job.

Enter Ronald Read.

I recently came across this retired gas station attendant and janitor who was worth nearly US$8 million (S$10.7 million) upon his death.

Morgan Housel’s “The Psychology of Money” featured the janitor-turned-philanthropist and I got intrigued by his story that I went to dig up further.

Ronald Read was born in 1921 in rural Vermont, US, to an impoverished farming family.

To travel to high school, he walked and hitchhiked daily, covering a distance of over 6 km.

He enlisted in the United States Army during World War II.

After getting an honourable discharge in 1945, Read returned to Vermont where he worked as a gas station attendant and mechanic for around 25 years.

[[nid:460787]]

Thereafter, he took on a part-time job at J. C. Penney sweeping floors, where he slogged for 17 years until 1997.

Read bought a two-bedroom house for US$12,000 when he was 38 and lived there with his wife and stepkids.

He died in 2014 at a ripe old age of 92.

That was when the world found out about his wealth.

In his will, the ex-janitor left US$2 million to his stepchildren and US$6 million to his local library and hospital.

An article from The Washington Post praised Read, saying:

Indeed, there are many personal finance lessons that we can draw from Read’s life. Here are some of them.

From what I gather, Read liked to live below his means, even though he had the money to splurge.

He drove a used 2007 Toyota Yaris. His lawyer recalled that despite his millionaire status, he would park his car at parking lots that didn’t have parking meters, even if that means a longer walk to get to.

He enjoyed inexpensive breakfast at the coffee shop in Brattleboro Memorial Hospital (the hospital he donated his wealth to) and he transitioned to a restaurant called Friendly’s once the coffee place closed down.

Even though Read’s denim jacket was falling apart, he would use a safety pin to fix it and continue wearing it.

There was once a diner at Friendly’s who though Read couldn’t afford to pay for his meal that the person paid on Read’s behalf.

My takeaway from the former janitor’s lifestyle is that frugality is something to embrace.

We may not necessarily have to go to the extreme of using safety pins to hold up our clothes, but living below our means goes a long way.

Someone who earns a high monthly salary of $20,000 but spends $20,001 will still have to live paycheque-to-paycheque.

Compare this to a person who earns $2,000 but uses a measured amount for everyday expenses and the rest for investing and emergency savings .

The person who doesn’t earn that much may actually end up doing better many years down the road.

Read invested in dividend-paying blue-chip stocks.

And he only bought companies that he understood, or as Warren Buffett would say, within his circle of competence.

Read avoided technology stocks as he didn’t understand them. This is an important point. Knowing the stocks to avoid is crucial to building long-term wealth.

We can sometimes be tempted to buy those hot Reddit stocks as everyone around us is buying them.

Or not getting on the cryptocurrency bandwagon may make us look like a dork.

However, it’s ok to miss out on those opportunities if we don’t understand those investments. There are many other ways to grow our money safely.

Some of Read’s past investments included AT&T Inc, Bank of America Corp, CVS Health Corp, Deere & Company, General Electric Company, and General Motors Company.

Whenever Read received dividend cheques, he used them to buy more shares, compounding his wealth further.

Here’s a snapshot of Read’s 10 biggest holdings upon his death:

| Company | Amount (in USD) |

|---|---|

| Wells Fargo | $510,900 |

| Procter & Gamble | $364,008 |

| Colgate-Palmolive | $252,104 |

| American Express | $199,034 |

| J.M. Smucker | $189,722 |

| Johnson & Johnson | $183,881 |

| VF Corp | $152,208 |

| McCormick | $145,055 |

| Raytheon | $142,970 |

| United Technologies | $140,880 |

Source: The Wall Street Journal

When he died, he owned at least 95 stocks that were spread across many industries like healthcare, telecommunications, banks, and consumer products.

If individual stock-picking intimidates you, you can also look into exchange-traded funds (ETFs) or robo advisors. The key is to only buy investments that you understand.

Who said easy-to-understand “boring” companies like Colgate-Palmolive don’t make good investments?

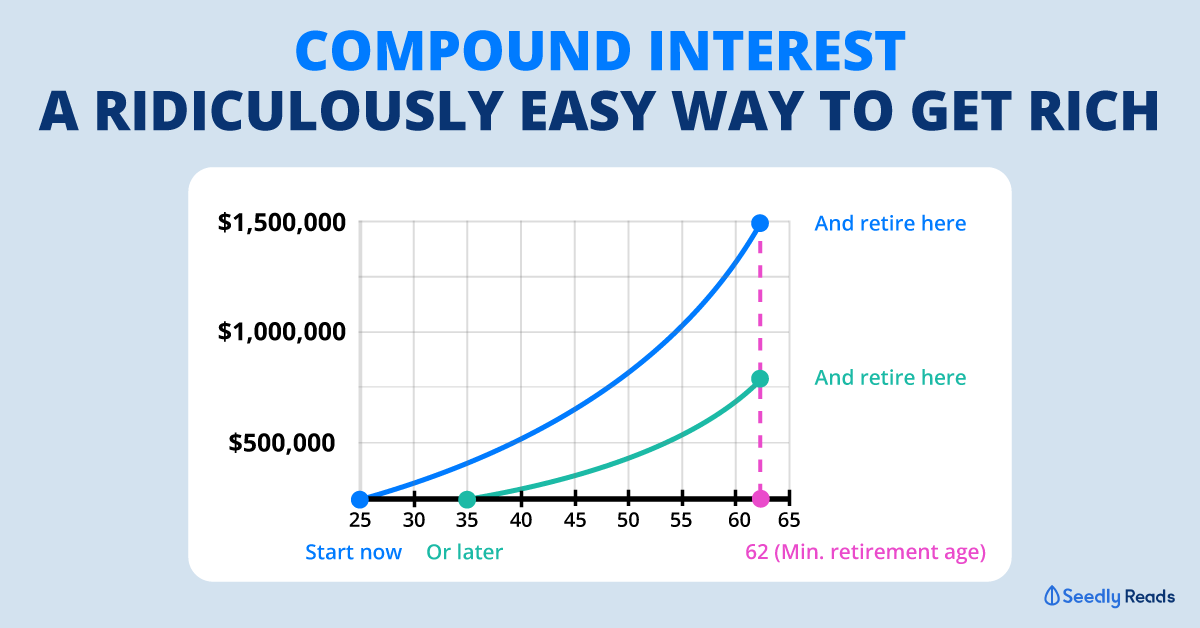

Read is an investor for the long-term. He understood compounding takes time to play out.

We too can understand the power of compound interest by looking at its formula:

As seen, the longer the period, n, the more compounding can occur, creating a larger ending amount, FV.

Read has shown that investing for the really long term can really pay off.

[embed]https://twitter.com/RonaldRead18/status/1331228933086437377[/embed]

On the contrary, jumping in and out of stocks based on trending news will do no good for our portfolio. As American economist Paul Samuelson once said:

"Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas."

Read was an avid learner.

He read The Wall Street Journal and Barron’s and visited the public library near him to be updated on his stocks.

Many successful people attest to reading. Apparently, famed investor Warren Buffett reads hundreds of pages each day.

You may not have the patience to sit through 500 pages of a book every day, but 10 minutes of reading each day goes a long way. Knowledge compounds as well.

If you are new to the investing world, here are 10 books every beginner investor should read.

Read didn't always have winning stocks.

His portfolio included shares of Lehman Brothers, the infamous company that went bankrupt in 2008.

However, the collapse didn't affect his returns much since his portfolio was diversified.

The lesson here is that we will make mistakes with our investments.

But the winners should more than take care of the losers in a well-constructed portfolio containing high-quality companies.

This article was first published in Seedly.