HDB loan eligibility, interest rates and down payment (2022): A beginner's guide

If you're buying a HDB flat in Singapore, you often have the option of taking a HDB concessionary loan, better known as a HDB loan.

Before you apply for a HDB loan, read our ultimate guide to everything you need to know and all that it will cost you.

On Dec 16, 2021, the Singapore government introduced new property cooling measures which saw the HDB loan reduced from 90 per cent to 85 per cent.

From Sept 30, 2022, HDB loan was once again reduced to 80 per cent (this means you will have to pay more in down payment).

If you're thinking of applying for a BTO or buying a HDB, here's everything you need to know from your HDB loan eligibility to the interest rates and how much down payment you'll have to make.

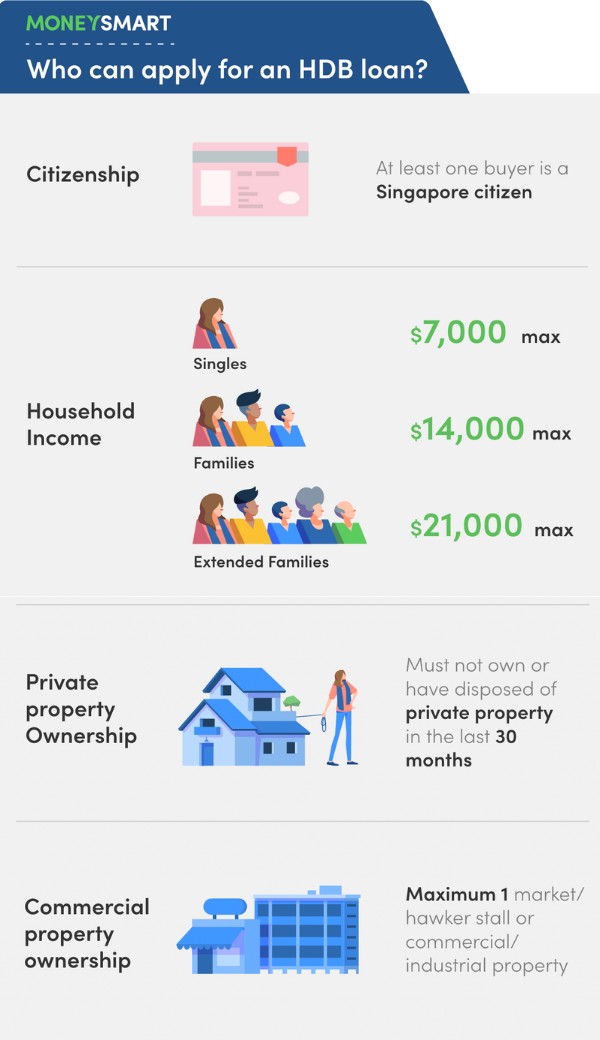

The first thing to ask yourself before you take up a HDB loan is whether you are eligible for the loan.

Here are the main eligibility conditions you need to meet if you're a first-time applicant for the HDB loan:

| HDB Loan Eligibility Conditions | |

|---|---|

| Citizenship | At least 1 buyer is a Singapore citizen |

| Household income | Maximum $14,000 for families, $21,000 for extended families, $7,000 for singles |

| Private property ownership | Must not own or have disposed of private property in the last 30 months |

| Commercial property ownership | Maximum 1 market/hawker stall or commercial/industrial property |

Note: If you own a market/hawker stall or commercial/industrial property, you have to be operating the business yourself and not earning income from any other sources.

If you meet all the above requirements, you should apply for the HDB Loan Eligibility letter (HLE). You need to do this before you book a new flat from HDB or obtain an Option to Purchase from a resale flat seller.

Fortunately, the HLE letter is valid for six months, so there's no excuse.

Applying for a HLE is an easy, straightforward process that you can do from HDB's website.

The HDB loan interest rate is currently 2.60 per cent. (It has remained at 2.60 per cent for several years.)

Why is this the main question on many Singaporeans' minds? Because it's pretty high.

In comparison, bank loan interest rates are lower. The bank loan interest rates are usually only valid for two to three years before you'll have to refinance your bank loan.

However, HDB loan interest rates have not changed at all and that kind of stability is often appreciated by homeowners.

Imagine not knowing ahead of time how much your monthly home loan repayment is going to be! You wouldn't know how much to set aside.

Those on a HDB loan know exactly what they're paying each month and it'll be the same today as it was five years ago.

However, that's not to say the HDB loan interest rate will never change – it is always 0.1 per cent higher than the CPF Ordinary Account interest rate.

Currently, the CPF Ordinary Account interest rate cannot go lower than 2.50 per cent, so if the HDB loan interest rate changes, it can only increase, never decrease.

The HDB loan down payment used to be 10 per cent of the purchase price.

From Dec 16, 2021, Singapore's government stealthily increased the HDB loan down payment to 15 per cent at midnight. From Sept 30, 2022, the HDB loan down payment was once again increased to 20 per cent.

This came as part of a new wave of property cooling measures aimed at discouraging citizens from buying properties only to rent them out for passive income.

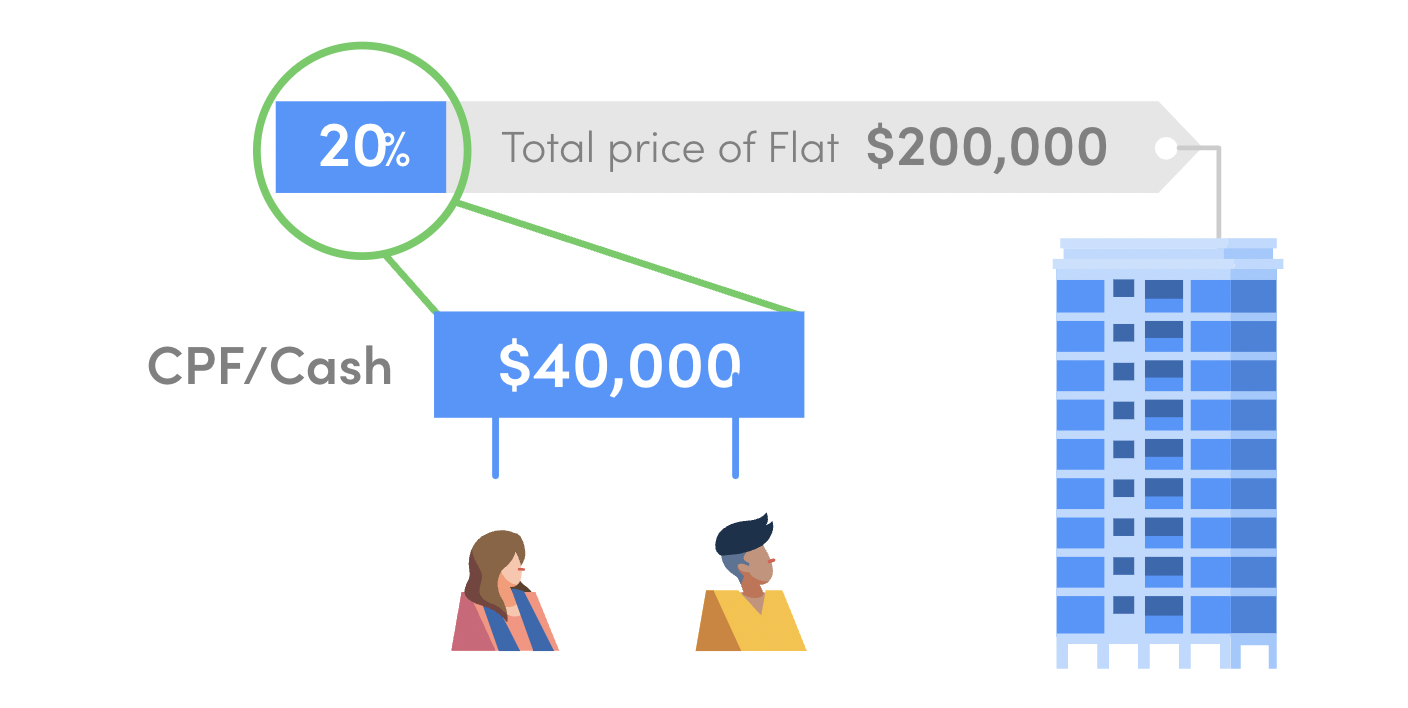

Besides the higher down payment required, everything else has remained the same. The HDB loan amount can be paid in cash or from your CPF Ordinary Account.

But 20 per cent is really no joke for some of us trying to make ends meet. Hence, this 20 per cent down payment should be a huge deciding factor whether you should take up a HDB loan.

Assuming you are buying a flat under the Fiance/Fiancee Scheme. If you and your partner check your CPF Ordinary Account and you only have $30,000 combined in there, then you should probably look for a HDB flat that costs no more than $150,000.

Choosing a more expensive flat means you will need to pay the rest of down payment by cash.

It's always a good idea to find out how much down payment you can afford to pay before choosing a flat. That's because you can compromise on renovation or furniture costs when buying a flat, but you can never compromise on the down payment, unless you win first prize in Toto.

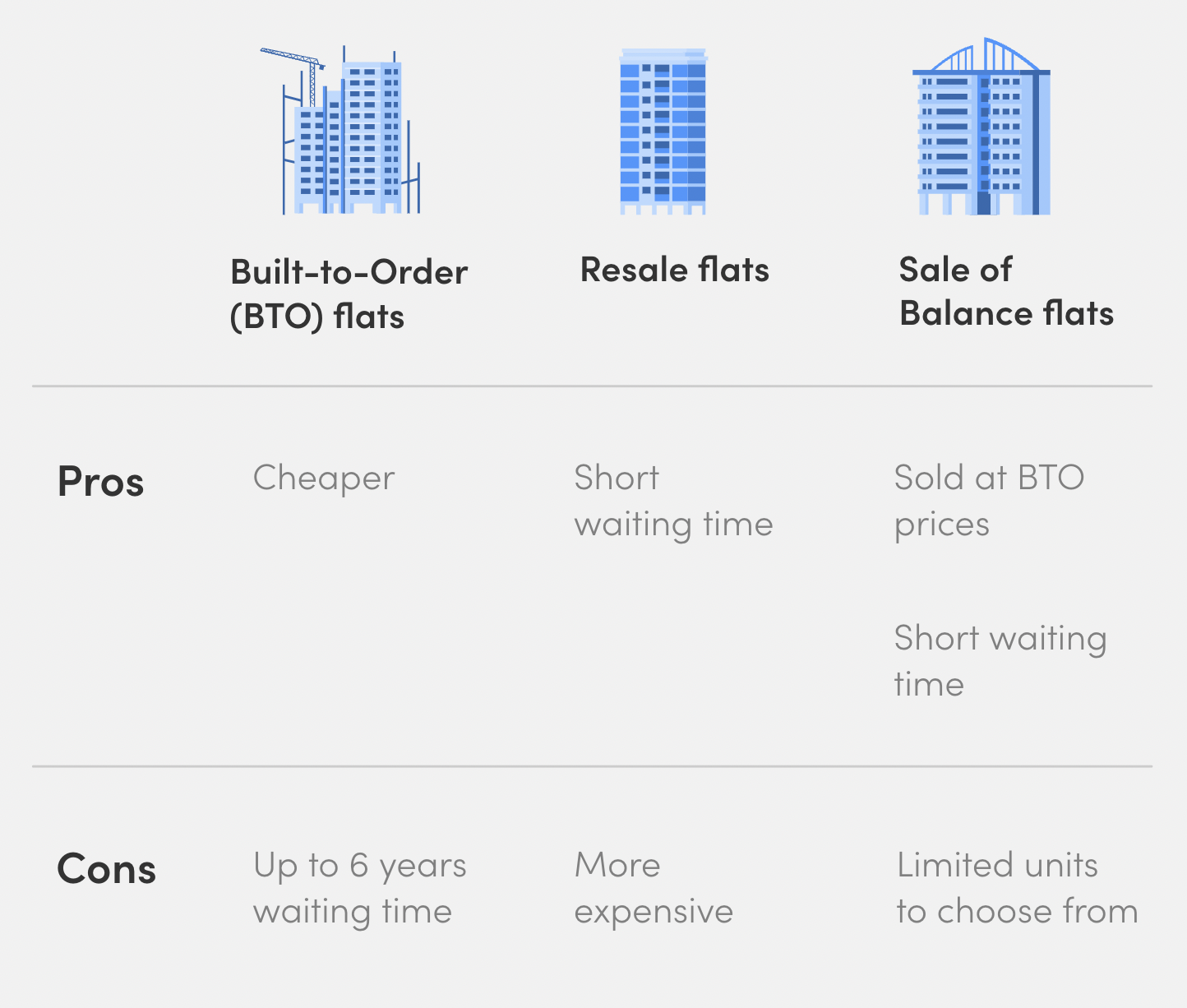

Your first decision when choosing a HDB flat to buy is between a new HDB flat (aka a Build-To-Order flat, or BTO) or a resale HDB flat.

There are several factors to consider in this decision, always keeping in mind the down payment.

| Type of HDB flats | Advantages | Disadvantages |

|---|---|---|

| Built-to-Order (BTO) flats | Cheaper | Waiting time of up to six years |

| Resale flats | Short waiting time | More expensive |

| Sale of Balance Flats |

Sold at BTO prices Short waiting time |

Limited units to choose from |

HDB BTO flats are usually significantly cheaper than resale flats. A four-room BTO flat in Sengkang can cost as little as $400,000, while a four-room resale flat in the same area can cost around $850,000.

So if you're planning to get a HDB loan, you're looking at a down payment of $80,000 vs $170,000. That's a pretty significant difference.

However, you will need to ballot for a HDB BTO flat, usually competing with twice as many applicants as there are available units.

Assuming you're lucky enough to get a BTO, you then have to wait as long as six years for the flat to be ready. Trust me, a lot of fights, quarrels, break ups and babies can happen in six years.

With Covid-19 wrecking havoc in our lives, the waiting time for some BTO projects have been further delayed.

Resale flats, on the other hand, can be snapped up in a matter of days, once negotiations with the seller are complete.

However, an in-between option was released by HDB – the Sale of Balance Flats. These are units that are either unsold or sold, and returned to HDB for whatever reason.

They are often significantly cheaper than a resale flat and you don't need to wait for years before moving in, unlike a HDB BTO.

Of course, the main disadvantage is you are given limited options to choose from – that is, in an entire block there may only be one or two units you can buy.

Once you've decided on the type of HDB flat, your next decision is the location and size of the HDB flat.

Again, how much of a down payment you can afford should help you with your decision. Here's a full guide to HDB down payment for you to map out your finances.

Location matters when it comes to cost. In Singapore, housing estates are divided into mature and non-mature, with mature estates being at least 20 years old.

Mature estates usually come with lots of convenient amenities like schools, medical facilities, supermarkets and so on. Thus, flats in mature estates will be significantly more expensive than those in non-mature estates.

For example, a four-room resale flat in Bukit Batok (a non-mature estate) can cost around $748,888, while a three-room resale flat in nearby Clementi (a mature estate) can cost around $838,888.

Of course, it also goes without saying that size does matter as well. A larger flat will cost you more than a smaller one, sometimes as much as two times the price!

For example, a three-room resale flat in Bedok can cost around $385,000 while a five-room resale flat in Bedok can set you back by $765,000.

Other than the main cost of the flat, there are other costs involved. Many of these costs are regardless of whether you're taking a HDB loan or a bank loan.

| Item | Amount | Payment mode |

|---|---|---|

| Online application for HDB flat | $10 | Credit or debit card |

| Option fee | Up to $2,000, depending on flat size | NETS |

| Stamp duty | Based on selling price, e.g. $4,200 for $300,000 flat | Cash or CPF |

| Legal fees | At least $257, depending on selling price | Cash or CPF |

| Down payment | 20% of purchase price | Cash or CPF |

| Survey fees | Up to $375, depending on flat size | Cash or CPF |

| Home Protection Scheme annual premium | Varies depending on buyer and loan type | CPF |

| Fire Insurance Scheme 5-year premium | Up to $7.50, depending on flat size | Cheque |

Note that the option fee will be refunded to you if you complete the flat purchase, but forfeited if you do not. Think of it like a deposit.

Here are the cost and fees of buying a resale HDB flat. Again, many of these costs are incurred, regardless of whether you're taking a HDB loan or a bank loan.

| Item | Amount | Payment mode |

|---|---|---|

| Resale application admin fee | Up to $80 | Credit or debit card or GIRO |

| Request for Value processing fee | $120 | Credit or debit card or GIRO |

| Stamp duty | Based on selling price e.g. $4,200 for $300,000 flat | Cash or CPF |

| Legal fees | At least $257, depending on selling price | Cash or CPF or NETS |

| Down payment | 20% or 25% of purchase price | Cash or CPF |

| Home Protection Scheme annual premium | Varies depending on buyer and loan type | CPF |

| Fire Insurance Scheme 5-year premium | Up to $7.50, depending on flat size | Cheque |

Do note that for the legal fees, it depends on whether to you wish to have HDB's lawyers acting for you or not. Either way, you will need to pay conveyancing fees, stamp duty, registration and miscellaneous.

This article was first published in MoneySmart.