Definitive guide to using your CPF to repay your home loan installments for HDB flats and private property

Times are tough.

Singapore is staring at an upcoming recession, with the Singapore Government projecting Gross Domestic Product (GDP) to fall 4 per cent to 7 per cent this year.

Unemployment is also rising.

In the first quarter of 2020, data from the Ministry of Manpower (MOM) indicates that Singapore’s overall unemployment rate has risen from the previous quarter, increasing from 2.3 to 2.4 per cent.

This 2.4 per cent rate is the highest Singapore has experienced since the 2009 global financial crisis, due in part to the fallout from Covid-19.

[[nid:446200]]

I would think that most of us would be affected financially or know someone who has been financially affected during this difficult time.

And it’s times like this when debt like your home loan can weigh heavily on your finances and affect your cash flow.

In Singapore, the Median Gross Monthly Income from work , inclusive of CPF contributions of full-time employed residents is at $4,563 . Out of this amount, $1,232 goes to your Central Provident Fund (CPF).

As such, it may be enticing to use CPF to repay our mortgage loan instead of using cash as most of us would be contributing to our CPF on a monthly basis anyway.

But before you do so, here is what you need to consider!

| Type of Loan | Property Type | Withdrawal Cap | Additional Requirements |

|---|---|---|---|

| HDB | HDB BTO Flat | No caps | Maximum allowed amount from OA |

| HDB Resale Flat | Valuation Limit (VL) | Can withdraw above VL up to HDB loan amount if CPF BRS is met | |

| Bank | BTO Flat | Resale Flat | Private Property | Valuation Limit + Withdrawal Limit (WL)(120per cent of VL) |

Can withdraw above VL up to the WL if CPF BRS is met |

Key points to take note of:

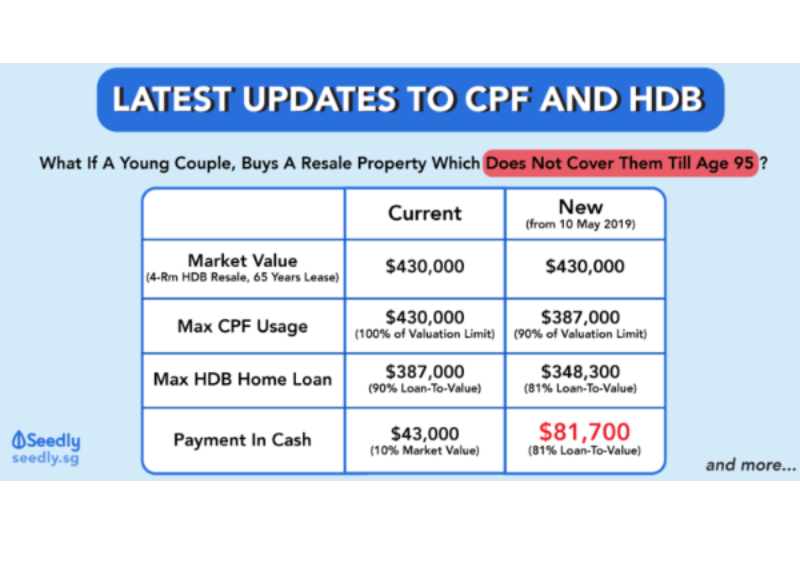

Before we begin, it is important for you to know about the May 2019 updates to CPF usage and HDB housing loans.

Regardless of whatever type of loan you take up, the first criteria for you to use your CPF Ordinary Account (OA) funds for housing , is that NO CPF can be used if the property’s remaining lease is less than 20 years .

Also, the amount you can borrow for the HDB loan depends on whether the remaining lease can cover the youngest buyer until age 95 and beyond.

If the property’s lease can cover the youngest buyer till 95 years and beyond, buyers can loan up to the full loan-to-value (LTV) limit of 90 per cent

However, if the property cannot cover the youngest buyer till 95 years and beyond, the loan-to-value (LTV) limit will be pro-rated based on the number of years that the remaining lease can cover the youngest buyer to age 95.

On top of cash, you can use your CPF Ordinary Account (OA) funds to service the home loan for your property.

Do note that you have to be insured under the CPF Home Protection Scheme if you are using your CPF savings to service the housing loan for your HDB flat.

This is regardless of whether you are using:

Depending on which type of property you bought, either the Valuation Limit or the Withdrawal Limit cap applies when you want to withdraw your CPF to repay your monthly HDB home loan instalments.

For example, if the purchase price of a property is $400,000 and its valuation is $430,000, the Valuation Limit will be $400,000 and the Withdrawal Limit is $480,000.

According to CPF, there are no limits to the amount of CPF OA funds you can use for loan repayment for BTO flats.

For resale flats, the amount of CPF OA funds you can use for loan repayment is capped at the Valuation Limit without needing to meet the Basic Retirement Sum (BRS).

However, if you want to withdraw more than that you will need to meet the BRS. Do note that the amount you can withdraw is capped to the housing loan amount .

If you are below 55, the current Basic Retirement Sum (BRS) of $90,500 in both your CPF Special Account (SA) and CPF Ordinary Account (OA) applies.

If you are above 55, you can only withdraw any amount from these three sources, capped at the housing loan amount if you can meet the BRS:

Generally, if you are aged 55 or above, you can only use your CPF OA and Retirement Account (“RA”) savings in excess of your Basic Retirement Sum (“BRS”) to buy a Studio Apartment or short-lease 2-room Flexi flat with a lease of between 15 years and 45 years from HDB.

On the other hand, if you have taken up a bank home loan for a new HDB BTO flat/Resale flat or a bank home loan for private property , you can only borrow 75 per cent of the home’s selling price.

[[nid:492653]]

In addition, a 25 per cent down payment is required . Of which 5 per cent needs to be in cash while 20 per cent can be paid using your CPF OA . You also have the option of paying the 25 per cent down payment in cash.

For the bank loans for your HDB flat and private property , you can use your CPF OA to service your monthly home loan instalments.

Do note that this withdrawal limit takes into account the principal amount of the mortgage as well as their interest that you pay.

You can withdraw up to the Valuation Limit without meeting BRS .

You will only need to meet BRS if you want to withdraw beyond the Valuation Limit. However, the amount you can withdraw is capped within the Withdrawal Limit which is 120 per cent of the Valuation Limit.

If you are below 55, the current Basic Retirement Sum (BRS) of $90,500 in both your CPF Special Account (SA) and CPF Ordinary Account (OA) applies.

If you are above 55, you can only withdraw any amount from these three sources, capped at the Withdrawal Limit if you can meet the BRS:

If you still have funds left over from buying your first property and subsequent properties, you can use CPF to service your home loan instalments.

However, there are a few caveats.

You will need to have met the BRS if you have at least one property bought using CPF or the property that you are buying can cover you till age 95.

If you do not meet this requirement, you will need to have met the current Full Retirement Sum (FRS) of $181,000 if you do not have any property that can cover you till age 95.

If you are below 55, the current Basic Retirement Sum (BRS) of $90,500 in both your CPF Special Account (SA) and CPF Ordinary Account (OA) applies.

If you are above 55, you can only withdraw any amount from these three sources, capped at the housing loan amount if you can meet the requirements listed above:

Do note that the maximum amount of CPF that can be used for your multiple properties is dependent on whether the remaining lease of the multiple properties can cover the youngest owner using CPF till the of age 95

As every case is different, you can use the CPF housing limits calculator to estimate how much CPF you can use for your property. You should also contact CPF or a trusted financial advisor before you make this decision as well.

Once you have hit the limit for the amount of CPF savings you used for the home loan instalments, you will have to pay the remaining of your monthly instalments in cash.

Now that you know more about how much CPF OA you can use for your monthly home loan instalments, here are a couple of considerations you have to take into account.

Once you have exhausted the funds in your CPF OA on the home loan instalments, do note that you will have to pay the rest of the instalments in cash.

[[nid:495010]]

Another important thing to consider is CPF’s requirement that you repay any CPF funds used or received to finance a property when you sell your current property.

The amount you have to pay back consists of the principal amount you ‘borrowed’ as well as the accrued interest.

In other words, you will have to pay back interest on the principal amount based on the current CPF-OA interest rate of 2.5 per cent!

Think of it as a reverse interest ; the longer the money is out of the account, the more the accrued interest you’ll have to ‘payback’ into your CPF OA when you sell your property.

Singaporeans have a love-hate relationship with their Central Provident Fund (CPF) . But, you have to admit that the interest rate of 2.5 per cent for the OA and 4 per cent for the SA is nothing to sneeze at.

So much so that there is even a 1M65 movement, which teaches you how to get $1 Million at 65 using your CPF.

By taking out money from your CPF to pay back your mortgage, you incur opportunity cost, as the money could be in your CPF accounts earning that sweet sweet compound interest.

This article was first published in Seedly.