CPF LIFE vs Retirement Sum Scheme: What's the difference?

This article was first published on November 13, 2019 and updated to reflect changes to the maximum payout age under the CPF Retirement Sum Scheme from 95 to 90.

This will apply to all CPF members who turn 65 from July 1, 2020. For older CPF members who have already started receiving Retirement Sum Scheme payouts, this rule has already taken effect from Jan 1, 2020 and you should have received a letter from CPF detailing how the changes affect your payouts.

On the back of rising life expectancy in Singapore, the CPF Lifelong Income For the Elderly (LIFE) was introduced in 2009. Since then, the average life expectancy of Singaporeans has increased to 83.6 years today from 81.4 years.

CPF LIFE replaced the Retirement Sum Scheme as the default CPF payout scheme for Singaporeans in our retirement.

While younger Singaporeans and PRs will find themselves on the CPF LIFE scheme when they turn 55, the Retirement Sum Scheme is currently the main retirement payout plan for those born before 1958.

In future, there will remain pockets of the population who will be on the Retirement Sum Scheme, either because they were already on it before CPF LIFE was introduced, or find that they still qualify for it.

There are three main groups of people who will find the Retirement Sum Scheme still relevant to them today.

As mentioned, the first group are those who were already receiving payouts from the Retirement Sum Scheme before CPF LIFE was introduced in 2009. Of course, when CPF LIFE was launched, they had the option to switch to the new scheme.

Those who didn't are still on the Retirement Sum Scheme today. These members can still decide to switch to CPF LIFE at any time before they turn 80.

The second group of people are those who were born before 1958, but have not yet begun their Retirement Sum Scheme withdrawals.

This is because CPF LIFE was launched with an auto-inclusion criteria that required only those born in 1958 or after to mandatorily join the CPF LIFE scheme, if they are able to.

This second group of people who were born before 1958 can choose to remain on the Retirement Sum Scheme or switch over to CPF LIFE.

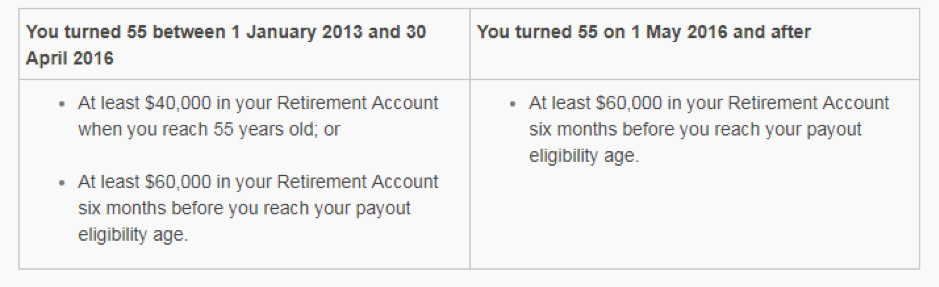

The third group is those who fail to meet the CPF LIFE auto-inclusion criteria as stated on the CPF website:

- You are a Singaporean Citizen or Permanent Resident born in 1958 or after; and

- Have at least $60,000 in your Retirement Account six months before you reach your payout eligibility age (PEA)

Those most likely to be unable to meet the auto-inclusion criteria for CPF LIFE would include housewives and those unable to work, as well as freelancers, self-employed and business owners in certain instances.

Do note that while these groups of people will not automatically be on CPF LIFE, they still retain the option of joining CPF LIFE if they want to.

Before going into the differences between CPF LIFE and the Retirement Sum Scheme, let's first understand how they are similar.

While the payout eligibility age was increased from 62 to 65 in 2007, around the same time as the introduction of CPF LIFE, it should not be seen as a difference between the two schemes.

This is because the change affected everyone, including those who remained and those who will enter the Retirement Sum Scheme going forward.

[[nid:489348]]

Both CPF LIFE and the Retirement Sum Scheme are meant to sustain us in our retirement by providing monthly payouts derived from our CPF account balances.

As the life expectancy of Singaporeans increase, we may expect the retirement age and the payout eligibility age to increase as well.

Both schemes also require us to set aside a retirement sum in our Retirement Account (RA). When we turn 55, our combined CPF Ordinary Account (OA) and Special Account (SA) balances will be funnelled into the newly created RA.

For those who turn 55 in 2019, the Full Retirement Sum (FRS) will be $176,000. If we have more than the FRS in our OA and SA, we can either choose to withdraw the remaining sum or contribute more to our RA up to the Enhanced Retirement Sum.

Even if we are not able to contribute the FRS, we can still choose to withdraw a maximum of $5,000 from our Retirement Account balances at 55.

In both schemes, we can start receiving our monthly payouts from age payout eligibility age, which is currently 65, to tide us through our retirement.

As you may have worked out, anyone aiming to accumulate the Full Retirement Sum in their Retirement Account will automatically be enrolled in CPF LIFE.

Currently, the only way for younger Singaporeans and PRs to enter the Retirement Sum Scheme is to fail to meet the CPF LIFE auto-inclusion criteria. Even then, you can still opt to join CPF LIFE.

As a recap, here's the CPF LIFE auto-inclusion criteria:

In our Retirement Account, our balances compound at 4 per cent per annum (p.a.), with the first $60,000 earning an additional 1 per cent p.a. in interest, and the first $30,000 earning an extra additional 1 per cent p.a.

When we reach our payout eligibility age of 65, we can start receiving monthly payouts from either schemes. We can also choose to defer our payouts until we reach a maximum of 70 years old.

After understanding the similarities, we can better understand the five differences between the CPF LIFE Scheme and the Retirement Sum Scheme.

However, do note that some of the differences no longer apply to the majority of those who enter the Retirement Sum Scheme today, as they would not have sufficient balances in their RA. If they did have sufficient balances, they would have been automatically put on the CPF LIFE scheme.

The biggest difference comes from how we receive our monthly payouts under the two schemes.

Under the Retirement Sum Scheme, we receive payouts from our Retirement Account balances. We will still be able to monitor and track our funds within our Retirement Account.

Under CPF LIFE, once we start receiving our monthly payouts, it means we have contributed our funds to CPF LIFE.

For many of us, this means our funds no longer sit within our Retirement Account, and we receive our monthly payouts from the CPF LIFE scheme, which we have contributed to.

[Note: On CPF LIFE, only those on the Basic Plan continue withdrawing their funds from the Retirement Account, while paying a premium to CPF LIFE to withdraw from the scheme should they live beyond what their Retirement Account can distribute.]

On both the CPF LIFE scheme and Retirement Sum Scheme, the withdrawal age commences at 65. However, as explained above, this wasn't always the case as the withdrawal age on the old Retirement Sum Scheme was 62 in 2007.

[[nid:487266]]

On both CPF LIFE and the Retirement Sum Scheme, the maximum age we are able to defer our monthly payouts to is when we turn 70.

Again, this was not always the case as there was no limit to how long we could defer our monthly payouts on the Retirement Sum Scheme in the past.

In other words, opting to stay on the Retirement Sum Scheme, instead of opting to join CPF LIFE doesn't allow you to make your withdrawals any earlier or later.

This isn't really a difference between the two schemes as the policies could have been affected even if CPF LIFE never existed.

On the Retirement Sum Scheme, we were able to purchase property with our Retirement Account balances up to the Basic Retirement Sum, or half of the Full Retirement Sum.

We were able to do this at any point we wished, primarily because our funds still reside in our Retirement Account as opposed to within the CPF LIFE scheme.

On CPF LIFE, our balances in our Retirement Account is contributed into CPF LIFE, typically when we turn 65. While we can continue using our Retirement Account balances to purchase a property until that point, this flexibility is gone once our Retirement Account funds is contributed into CPF LIFE.

Both funds that are contributed to CPF LIFE or kept in Retirement Sum Scheme earn interest from the government. However, the interest returns are paid to us in a slightly different method.

The difference is that on the Retirement Sum Scheme, the interest is paid into our Retirement Account Balances.

[[nid:493749]]

On CPF LIFE, funds that are contributed to the scheme earns an interest that is paid to the Lifelong Income Fund, which is meant to continue giving monthly payouts to those who live longer.

One important point to note is that while we do not receive the interest payments on funds contributed to CPF LIFE directly, our financial futures are secured, especially if we live beyond how long our funds would have lasted.

Secondly, if we pass on early, our beneficiaries will not be taking out from the CPF LIFE scheme less than what we have put in, minus the payouts we have received under CPF LIFE.

We can understand this from the article on CPF LIFE "benefit illustration" that we researched below.

Another important difference between the two retirement schemes is that CPF LIFE offers the security and peace of mind that regardless of how long we live, we will continue receiving our monthly payouts.

The fact is that Singaporeans have one of the longest life expectancies in the world. According to government statistics, 1 in 3 Singaporeans aged 65 today will live beyond 90, and there are also close to 1,200 centenarians in Singapore today, compared to just 50 in 1990.

On the Retirement Sum Scheme, our monthly payouts only last until our Retirement Account balances are exhausted. Based on the RA interest rate of 4 per cent, our funds are typically meant to last up to age 85.

However, as we earn an additional 1 per cent p.a. on the first $60,000 and an extra additional 1 per cent p.a. on our first $30,000, payouts under the Retirement Sum Scheme may last until about the age of 90*.

[* UPDATE: The government announced that all CPF members under the Retirement Sum Scheme who turn 65 from July 1, 2020 will come under the new payout rules, which spreads payouts to age 90, rather than 95, which will result in higher payouts for members each month.

The CPF Board will send out a letter to all RSS members who are receiving payouts as of Jan 1, 2020 to inform them whether they will be affected by the changes.

Around one-third of members currently on the Retirement Sum Scheme will receive a higher monthly payout as a result.]

It seems like the CPF LIFE is really, really forward-thinking as it provides payouts for life unlike the Retirement Sum Scheme which has a limited duration.

Of course, we also have to note that CPF LIFE was introduced in 2009, while the extra additional 1 per cent on the first $30,000 of our Retirement Account balances was introduced only in 2016.

On both the CPF LIFE and Retirement Sum Scheme, members can expect to receive a similar payout.

| Amount in 2020 | Monthly Payouts From age 65 | ||

| CPF LIFE (Standard Plan) | Retirement Sum Scheme | ||

| Basic Retirement Sum (BRS) | $90,500 | $750 – $810 | $750 – $810 |

| Full Retirement Sum (FRS) | $181,000 | $1,390 – $1,490 | $1,390 – $1,490 |

| Enhanced Retirement Sum (ERS) | $271,500 | $2,030 – $2,180 | $2,030 – $2,180 |

We need to ensure that our retirement plans are not solely reliant on our CPF funds.

While it provides a good safety net, we can see that there have been adjustments to the scheme in the past, and there is nothing to say that in 30 years, when some of us may be retiring, the scheme will still look the same as it does today.

Of course, we're not saying it will disappear altogether! What we're saying is that we need to ensure that we have supplementary plans to secure a comfortable retirement for us and our spouse.

Regardless of whether you were an older Singaporean on the Retirement Sum Scheme or a younger Singaporean who will join the CPF LIFE scheme, we can see that the government is trying to tweak the schemes not to "shift the goal posts" but rather offer greater security in retirement solutions for Singaporeans.

CPF LIFE or Retirement Sum Scheme payouts are also meant to provide a basic retirement for Singaporeans and PRs.

The majority of us are living beyond this basic retirement level and will need to put in place other sources of retirement income in order to continue our current standard of living.

Choosing the right ETF is crucial to your investment success. Distilled from over 2,000 ETFs available on FSMOne.com, the 2020 edition of the ETF Focus List brings you the best in class ETFs that will help you invest globally and profitably. Click here to find out more!

This article was first published in Dollars and Sense.