5 common financing issues for HDB upgraders and how to solve them

Ever since 2019, HDB upgraders have made up the bulk of private home buyers.

A combination of rising demand, with record-high resale flat prices, has further made the past two years seem like an ideal time for those seeking condo ownership. However, an upgrade may not be as simple as "just sell and then buy". Here are some common financing issues that upgraders may face:

This could happen if you purchase the condo unit, before you’ve discharged the loan on your HDB flat.

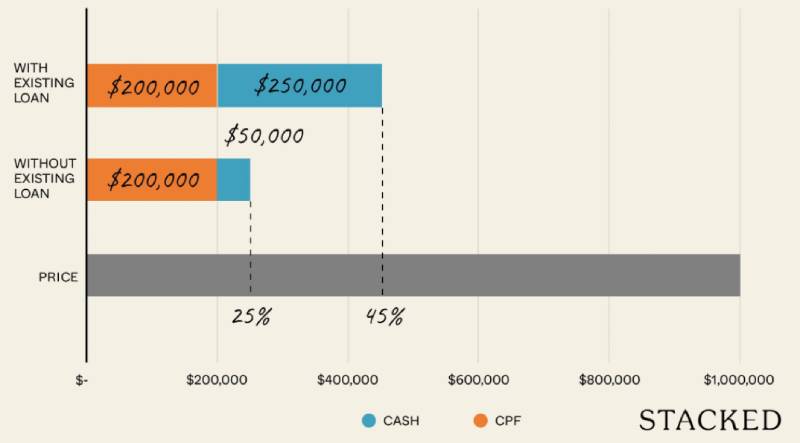

Under normal circumstances, the maximum Loan To Value (LTV) ratio for a condo is 75 per cent of the price or value, whichever is lower. However, if you have another outstanding home loan at the time of application, the LTV will fall to just 45 per cent. In addition, the minimum cash down will be increased from the first five per cent, to the first 25 per cent.

For example, if you purchase a $1 million condo unit after discharging your previous home loan, your minimum down payment would be $250,000, of which $50,000 has must be in cash (the rest can be in any combination of cash or CPF).

However, if you still have an outstanding home loan, the minimum down payment rises to $550,000, of which $250,000 must be in cash.

One way around this is to try and explain to your lender that you’re in the process of selling your former home. If you can provide the documentary proof needed (e.g., your buyer has signed the Option To Purchase), you can sometimes be given the normal LTV limits.

Otherwise, the only real way around this is to discharge your former home loan first, and buy the new condo afterward.

A bridging loan can be used to cover part of the costs for your new property, while you await sale proceeds from your flat. Be clear on these two points regarding bridging loans:

Most realtors or mortgage brokers will only advise the use of bridging loans under specific scenarios; such as if the buyer for your flat pulled out at the last moment, but you still want to hold on to a condo unit you’ve found.

Due to the significant interest repayments, HDB upgraders should not freely use bridging loans, unless the situation really calls for it.

If you find yourself requiring such a loan, use a mortgage broker to find the bank with the cheapest possible rates — don’t just take the very first option you find.

To quickly summarise: You may find that, upon discharging your home loan and refunding your CPF, you have no sale proceeds left.

This leaves you unable to pay the minimum cash down for your next home, as bank loans always require you to pay at least the first five per cent in cash.

HDB upgraders must bear in mind that negative cash sales can happen even when buying Executive Condominiums (ECs). This is because there are no HDB loans for ECs; you must use a bank loan.

The only real way to deal with this is to be conscious of your CPF usage. It’s good to check exactly how much you need to refund when you sell your flat, and make sure you’ll still have sufficient cash left over.

Note that for some cases, the longer you service your home loan with CPF, the more likely you are to see a negative sale. If you want to upgrade at some point, we suggest paying for your flat with a combination of cash and CPF.

Many HDB upgraders are in their mid-40’s or older. For this group of buyers, keep in mind that your maximum loan tenure is shorter.

[[nid:565991]]

In conjunction with the lowered Total Debt Servicing Ratio (TDSR) of 55 per cent*, this might necessitate a higher cash outlay.

For example, if you’re 45 years old when you upgrade, the maximum loan tenure (to get full financing) is only 20 years, not 25 years. This is because your LTV would fall from 75 per cent to 55 per cent, if your loan tenure plus your age would exceed the retirement age of 65.

Shortening the loan tenure will increase the monthly loan repayments, potentially causing it to breach the TDSR. For example:

If you have a $1 million loan at 1.3 per cent, for 25 years, the monthly loan repayment is about $3,900.

If you reduce the loan tenure to 20 years, the monthly loan repayment rises to about $4,700.

Assuming an income of $8,000 per month, your TDSR cap would be $4,400. So by shortening the loan tenure, you’ve also busted the TDSR limit.

There is a solution to this, and that’s to borrow less (i.e., make a bigger down payment). As such, older HDB upgraders may need to crunch the numbers, and save up for a bigger cash outlay.

*TDSR was lowered from 60 per cent to 55 per cent in the December 2021 cooling measures.

For some couples, all the credit usage is placed on a card under one person’s name. This results in one spouse sometimes having zero credit history. So when the credit report gets pulled up, the lender will only see a grade of "Cx". This means there is insufficient data to assign any credit score.

This can be a bit disconcerting, as couples may wonder why their creditworthiness is 'bad' when they’ve paid everything on time, and share only one credit card. The good news is that this is a minor issue; just get the co-owner to use their own credit card as a mode of payment only, for around 12 months before loan application.

By mode of payment, we mean charging purchases to the card but always paying it back in full, thus incurring no interest. Don’t let roll over debt accrue on the card, as that can worsen credit scores as well.

A bigger problem is if, over the years, your co-owner has run into issues such as defaults, constant delinquent payments, or bankruptcy. Note that for bankruptcies, there may be a waiting time of five to seven years before they can apply for a home loan, even after receiving the official letter of discharge.

This is a spanner in the works when it comes to upgrading; as it means you may have to take on the mortgage without a co-borrower. That means being able to meet the TDSR single-handedly, and possibly a higher down payment; whether you can do this is highly dependent on the sale proceeds of your flat.

Otherwise, you might consider approaching a non-banking financial institution for a home loan. We do know of cases where even recently discharged bankrupts have been able to get home loans; but we would do this only as a last resort, as the interest rate charged can be much higher than the bank.

In any case, we suggest talking to a mortgage broker first, who may be able to help you negotiate with various lenders.

READ ALSO: 6 factors to look out for when buying a 40-year-old resale flat

This article was first published in Stackedhomes.