5 property asset progression risks upgraders should know to avoid financial setbacks

Picture this: You’re sitting down with a property agent, discussing your long-term financial goals. You mention your desire to build your wealth through property investment, and the agent’s eyes light up.

Before you know it, they’re selling you the property asset progression story – how buying and selling properties can lead to huge returns and financial freedom.

It’s a seductive pitch and one that many people fall for. But as someone who’s seen both the highs and the lows of the Singapore property market, I can tell you that the reality is far more complex.

Yes, property asset progression can be a lucrative way to build your wealth, but it’s not without its risks.

As always, the devil is in the details. While the concept of property progression is simple; the execution carries more risks than you might think. These are the main stumbling blocks:

After you sell your home, you need to pay back all the CPF monies used, with the accrued 2.5 per cent interest. It’s possible that, after discharging the existing loan and refunding your CPF, you will end up with nothing left in hard cash.

For example, this means that if you sell your flat for $500,000, but have to refund $515,000* to your CPF account, you may be left with no cash after the sale.

This is problematic for progression, as you must pay an absolute minimum of five per cent of your next home in cash. Negative cash sales can end up stalling your upgrade for anywhere between months to a few years, depending on how quickly you can save up the minimum cash down.

However, it’s also important to note that this scenario may not apply to everyone. Many people use their CPF to service their mortgage and preserve cash for saving or investing. Even if you do encounter a negative cash sale situation, it doesn’t necessarily mean you’re in a dire financial position.

*So long as you sell at market value, you don’t need to pay back the extra $15,000. It just means you refund the full $500,000 into CPF.

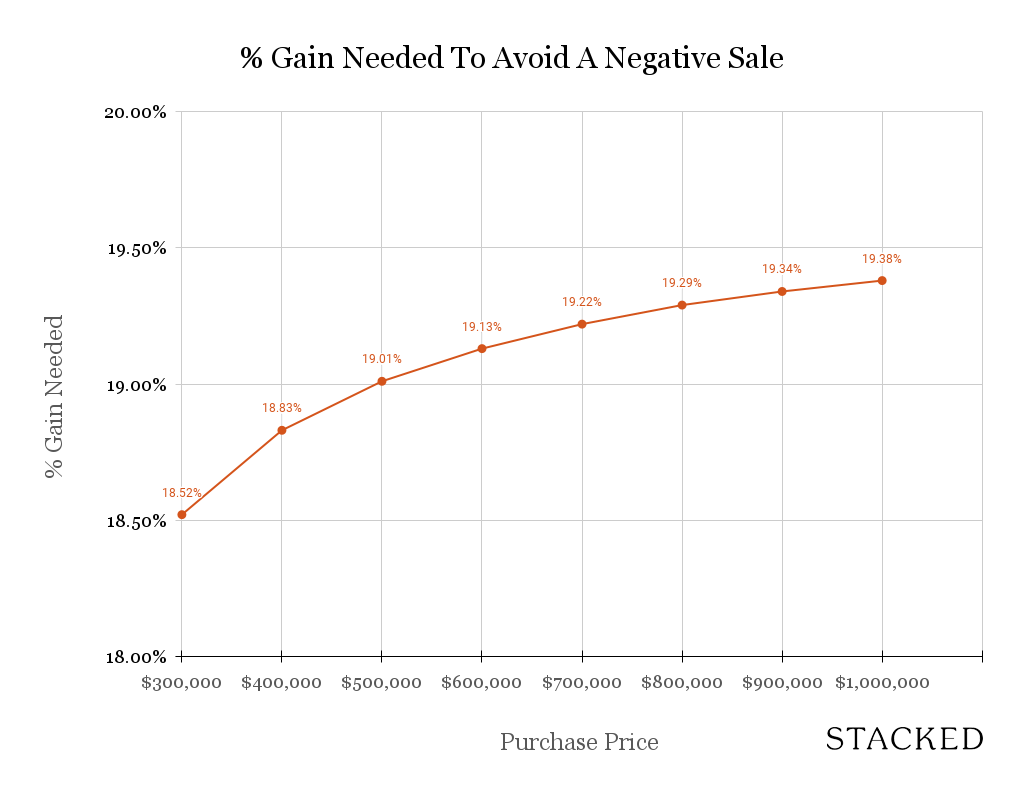

We have a detailed explanation of negative cash sales in this article, and here are the estimated gains you’ll need to minimally attain in order to avoid such a situation:

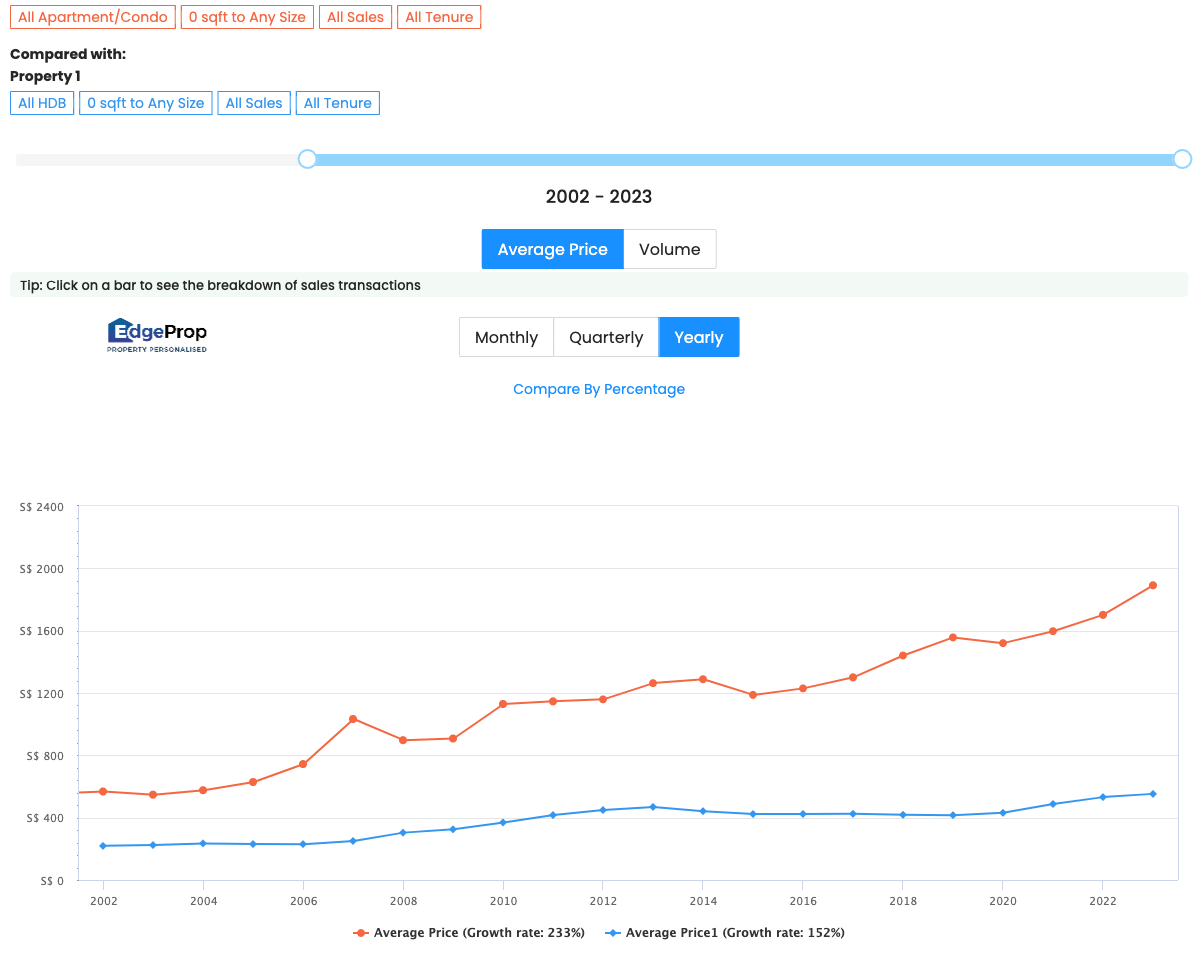

This usually refers to the price gap between HDB flats and condos, but it can also refer to the price gap between ECs and private condos, or private condos and landed housing (depending on the kind of upgrade you want to make).

There is a risk that, if private property prices rise too high, your resale flat may not provide sufficient funds to make the upgrade. This is another reason resale flats are preferred to BTO flats – while you pay more, you can also sell sooner, thus reducing the risk of an increasing price gap.

That said, this is also a common scare tactic used by some agents to make you buy; so don’t base your entire decision on this alone (the price gap fluctuates, and it may narrow in the future too).

If each spouse has a separate mortgage, you need to consider the impact if one of you cannot work, or face diminished income/retrenchment.

There’s a possibility that you’ll have to liquidate one of the two properties, and it may be the larger one. This means an end to rental income; and in some cases, it even means a complete reset (i.e., both spouses sell their properties and have to move back to a flat).

For this reason, we’d recommend the “sell one, buy two” approach only if both spouses can buy well within their means; and if both have stable incomes.

This is especially so in this high-interest rate environment and uncertain economic situation. While rental rates are at a high right now, we’ve already seen signs on the ground that this may be peaking.

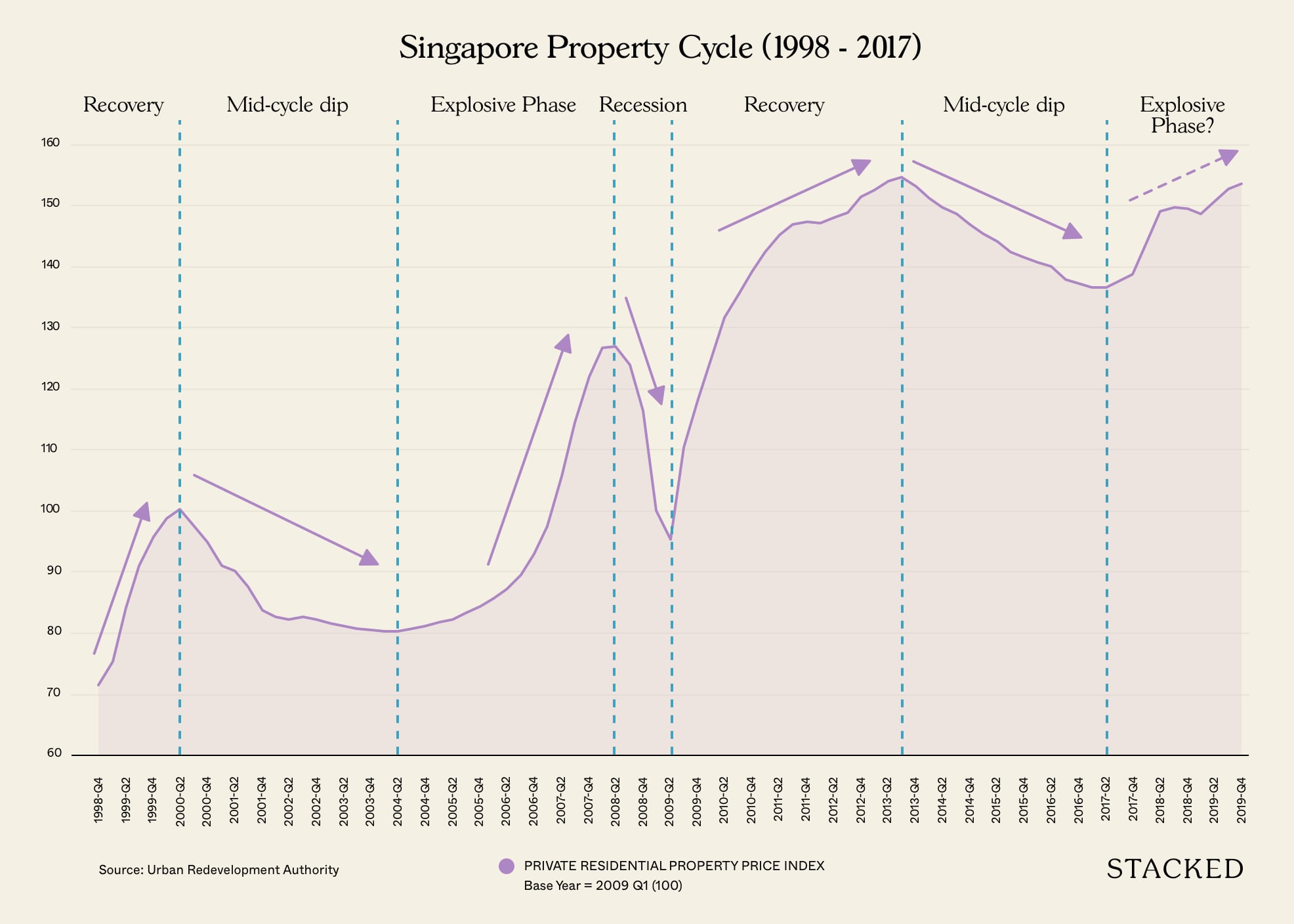

The property market doesn’t always behave in line with our plans. Resale flat prices may crash just at the time you’re trying to upgrade to a condo; or you may be one of the unlucky few who – just at the time you need to sell for retirement – are faced with a massive property downturn.

None of this is within your control, nor can you accurately predict it. The only solution is to have patience and holding power. You should be prepared to hold on to your property longer than expected, as you’ll want to ride out the downturn and sell at a better time.

It’s a tricky thing to try and time the market, and we know of some people who assumed the worst when the pandemic hit and sold off their investment property thinking that the market would surely drop. In fact, even experts frequently get this wrong (here are some property predictions over the last few years that have not panned out).

Beware of buying “out of sequence”. For example, if you choose to start with a one-bedder shoebox unit, you cannot easily switch to an HDB flat (you can’t buy an HDB flat while you own a private property, so you need to sell first, and the timing may not be ideal).

Likewise, some properties may be tougher to resell than others.

A two-bedder EC unit may not, for instance, sell as well as a family-sized four-bedder (as families are the main buyers of ECs). This could hamper your subsequent upgrade to private property, or at least, delay your timeline longer than you might think.

Remember, buying and selling property isn’t like trading your phone in at a mobile shop. There are a lot more nuances, and timing issues to be aware of.

ALSO READ: 7 qualities you want in a property for asset progression

This article was first published in Stackedhomes.